One of the reasons we founded RBA in 2009 was we thought the US market was entering, perhaps, the biggest bull market of our careers. However, our bullish view at the time was far from consensus.

Skepticism regarding potential returns in the US was understandable because emerging markets had significantly outperformed for a decade, and investors’ attention was squarely focused on those markets’ relative strength. From 2000 to 2010, emerging markets appreciated more than 16%/year, whereas commodities returned only about 6%/year and NASDAQ returned a paltry 1.6%/year. (See Chart 1).

Because emerging markets had so significantly outperformed the US, investors widely assumed the core of any global equity portfolio should be in the emerging markets. Our preference for US stocks was, to say the least, highly unusual.

Content continues below advertisement

Chart 1: Performance of Nasdaq, MSCI Emerging Markets & Commodities: 12/31/2000 – 12/31/2010

Source: Bloomberg Finance L.P. For Index descriptors, see “Index Descriptions” at end of document.

Investors naturally extrapolated emerging markets’ outperformance after 2010, but the global economy and global financial markets were in the early stages of a major paradigm shift in which performance reversed and US equities significantly outperformed. From 2010 to present, NASDAQ returned more than 17%/year versus only about 3%/year for emerging markets and -1.5%/year for commodities. (See Chart 2).

Chart 2: Performance of Nasdaq, MSCI Emerging Markets & Commodities: 12/31/2010 – 03/24/2022

Source: Bloomberg Finance L.P. For Index descriptors, see “Index Descriptions” at end of document.

Investors appear to again be looking backward when constructing portfolios. During the 2009-2014 period, investors preferred emerging markets based on past performance. Today, investors’ preference for growth stocks seems to again be based on past performance rather than an objective assessment of future economic and profit fundamentals. As were emerging markets stocks in 2010, US growth stocks today are widely considered a core portfolio holding.

However, the global financial markets may be in the early stages of another paradigm shift, which seems likely to emphasize “pro-inflation” assets. Most investors probably consider it inconceivable that the financial markets could change so dramatically from the past decade. However, leadership reflects macro fundamentals, and the macro fundamentals are indeed changing. It would be highly unusual that the old leadership suited to a specific economic regime would be the same leadership in a totally different global economy.

The “new paradigm” is all about reduced globalization and inflation

Globalization has historically expanded and contracted like an accordion, and it appears as though globalization has started to contract. The first indication that globalization was contracting was the uncertainty surrounding US tariffs and trade regulations. Today, the combination of global supply chain disruptions and the Russia/Ukraine war are furthering the contraction.

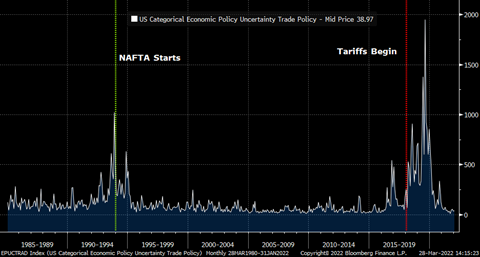

Chart 3 looks at trade “uncertainty,” and we’ve highlighted two events. The first is the uncertainty surrounding NAFTA at the beginning of the modern period of globalization. The second is the initiation of US tariffs on foreign produced goods, which we believe was the beginning of the contraction. These data have yet to be updated for the war in Europe but seems reasonable to assume the war and the associated trade and financial restrictions will significantly add to uncertainty regarding both trade and the overall global economy.

Chart 3: US Categorical Economic Policy Uncertainty Trade Policy 12/31/1984 – 1/31/2022

Source: Bloomberg Finance L.P.

The US’s secular disinflationary trend and its associated investment themes were largely the symptoms of expanding globalization. If the globalization accordion is indeed contracting, then one should expect investment themes to change as well.

Globalization altered the global economy exactly as economic textbooks said it would: a more open global economy allowed production to move where it was most efficient. One could argue whether all countries competed fairly or not, but the ever-increasing US trade deficit clearly demonstrates the US was not the most efficient producer of goods (See Chart 4).

Chart 4: US Trade in Goods Balance 6/30/1988 – 2/28/2022

Source: Bloomberg Finance L.P.

Few considered the bulging trade deficit a problem because increased global competition and more efficient production imparted deflationary pressures on the US economy. Economists frequently stated that the US was “importing deflation” because import prices were rising more slowly than the overall US Consumer Price Index (See Chart 5).

Chart 5: US Import Price Index less US CPI 12/31/2011 – 02/28/2022

Source: Bloomberg Finance L.P.

Charts 3, 4, and 5 taken together suggest that a meaningful change is occurring in the US economy. The trade deficit continues to expand, but import prices are now rising faster than those in the overall US economy. In other words, the US is now importing inflation, which is a significant difference from the trends of the past decade.

Chart 5’s impact is visible in Chart 6, which examines US inflation in (1) pre-globalization period, (2) in the period of expanding globalization between NAFTA and the pandemic/war, and (3) during the most recent period. In very rough terms, globalization seems to have reduced secular inflation by about 2 percentage points.

Chart 6: US Inflation & Globalization 3/31/1960 – 2/28/2022

Source: Bloomberg Finance L.P.

The over/under on secular inflation

Although investors are currently focusing on the recent surge and higher-than-expected near-term inflation, longer-term investors need to focus on whether forecasts for secular inflation accurately portray the changing environment.

Most forecasts of secular inflation range between 2% and 3.5% (see Chart 7), so investors might want to assume that forecasts between 2% and 3.5% are already discounted into asset prices. That somewhat forces investors to position portfolios for secular inflation either higher than 3.5% or lower than 2%.

We believe the changes in the global economy warrant taking the “over” on secular inflation.

Chart 7: Inflation Forecasts 12/31/2011 – 3/28/2022

Source: Bloomberg Finance L.P.

The New Paradigm

A new paradigm within the global economy calls for a new paradigm of investing. We think the predominate theme will be a move away from long-duration assets, i.e., those assets for which valuations are highly dependent on lower long-term interest rates. Long-duration assets would include Growth, Technology, innovation and disruption themes, cryptocurrencies, residential real estate, and longer-term fixed-income.

Long-duration assets continue to disproportionately dominate most investors’ portfolios despite the building evidence that changes in the macroeconomy are drastically increasing the risk of secularly higher long-term interest rates.

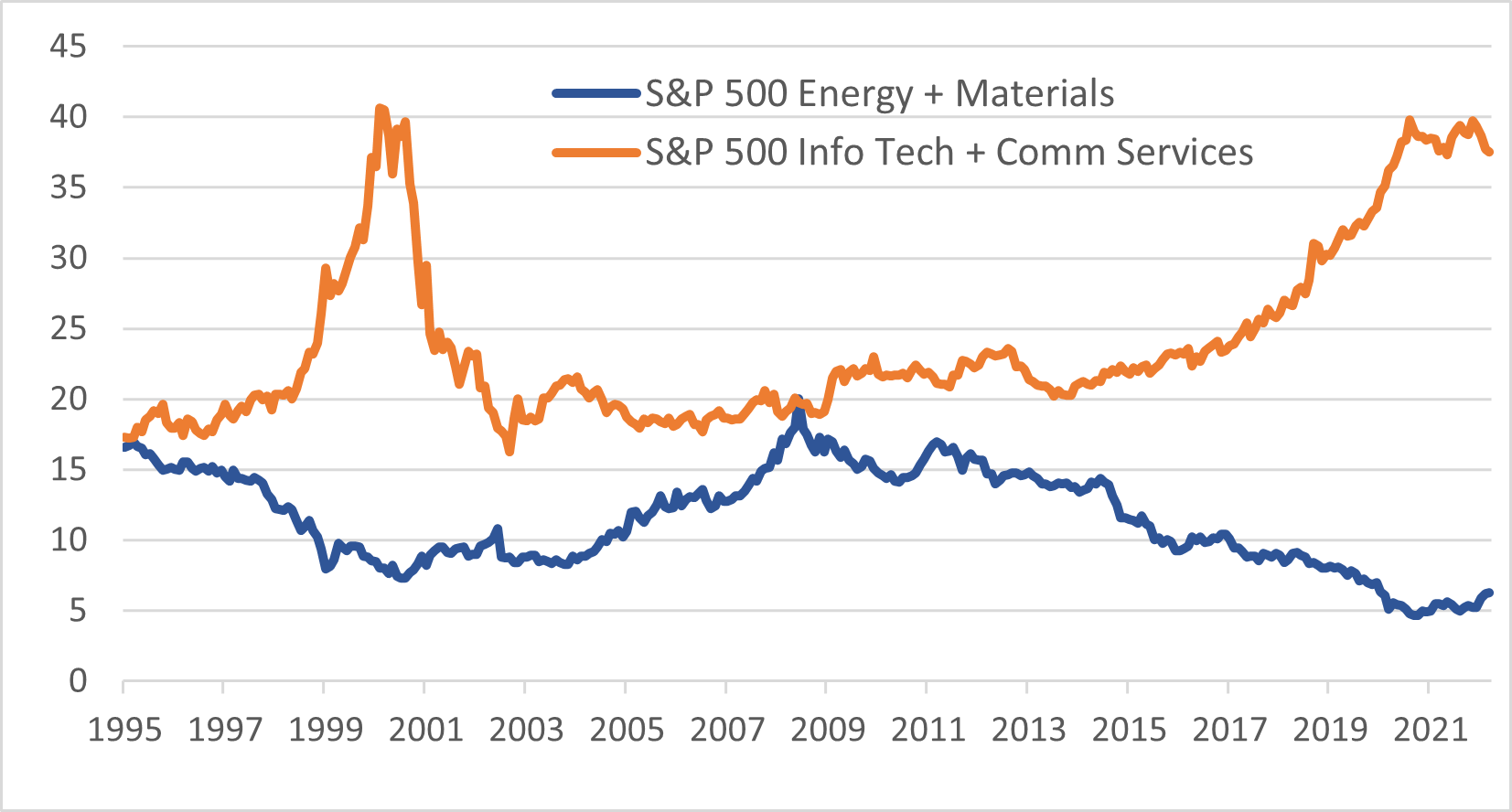

The performance of sectors like Technology and Communication Services are highly dependent on long-term interest rates because of the longer time horizons built into those stocks’ valuations. On the other hand, sectors like Energy and Materials tend to outperform during of periods of inflation and rising interest rates because their businesses strengthen during periods when interest rates increase.

Chart 8 highlights how significantly investors are positioned in so-called “long-duration” sectors. The chart shows the proportion of the S&P 500® market capitalization made up of Technology and Communication stocks versus that made up of Energy and Materials stocks. Today seems more extreme than in 2000 after which Energy and Materials significantly outperformed for a decade.

Chart 8: S&P 500® Sector Weights: Energy & Materials vs. Information Technology & Communications Services 1/31/1995 – 3/29/2022

Source: Richard Bernstein Advisors LLC, Bloomberg Finance L.P. For Index descriptors, see “Index Descriptions” at end of document.

An awakening for bond investors too

Because of the near 40-year bull market in bonds, many investors believe long duration fixed-income should be a significant core portfolio holding. However, if secular inflation does end up being higher than investors currently expect, fixed-income investing could become significantly more challenging.

Chart 9 shows the risk/return combinations by decade for long-term government bonds. Better performance is depicted in the chart by points lying “northwest” because that represents higher returns with lower risk. The risk/return statistics for the past four decades did indeed reflect higher returns and lower risk.

If secular inflation does surprise, then it might be more appropriate to expect future periods to resemble the 1950s, 1960s, and 1970s. During those periods, fixed-income investing provided lower returns and higher risk. In fact, fixed-income investors actually lost money during about 1/3rd of the years during this thirty-year period.

Chart 9: Risk Return of Long-Term Government Bonds by Decade

Source: Richard Bernstein Advisors LLC, SBBI® Yearbook. For Index descriptors, see “Index Descriptions” at end of document.

A recession would sideline but likely not kill the secular inflation story

Inflation is simply a period during which demand outstrips supply and prices rise. Both the 1970s inflation and today’s inflation have been fueled by curtailed supply. In the absence of the ability to meaningfully increase supply, central banks must curb demand to stymie inflation.

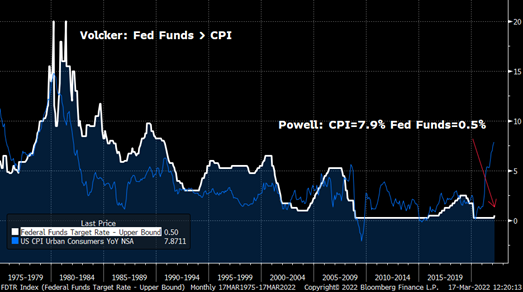

Paul Volcker was the Fed Chair during the early-1980s and he showed the only way a central bank can kill rampant inflation is by raising rates to such restrictive levels as to cause a significant recession. Today’s Fed seems much more timid and less likely to quickly raise rates and depress consumption.

Chart 10 shows the difference between the Volcker Fed and today’s Fed. Volcker kept the Fed Funds rate above the inflation rate, i.e., the real Fed Funds rate was exceptionally high. By comparison, today’s real Fed Funds rate is historically negative.

This does not mean a recession is impossible. Rather, it merely suggests the Fed is still very supportive of nominal growth and is unlikely to force the economy into recession anytime soon.

Chart 10: US Inflation and The Fed 3/31/1975 – 2/28/2022

Source: Bloomberg Finance L.P.

If the global economy is changing, then portfolios should accordingly change

The global economy seems to be significantly changing, yet investors remain very hesitant to alter their basic portfolio strategies. As they did around 2010, investors are using the old leadership as their portfolios’ core. We think this could be a mistake.

Investors have done a “180” on sentiment during the past decade. It took investors more than 5 years to finally realize the US was in a major bull market and now they are so strongly convinced of US leadership that they believe the most speculative US stocks should comprise the core of their portfolios.

Pro-inflation assets are universally underweighted. Pensions, endowments, foundations, family offices, high net worth, institutional investors, and individual investors are all underweight the asset classes that might benefit from higher inflation.

We see longer-term opportunities in Energy, Materials, Industrials, commodities, commodity-related countries, gold, and some real assets. If history repeats, these sectors will be consensus core holdings in about five years.

We believe this is the story for the next decade. A profits or economic recession would temporarily mute the success of these sectors, but would be unlikely to end the story. The era of secular disinflation is over and portfolios need to change.

INDEX DESCRIPTIONS:

The following descriptions, while believed to be accurate, are in some cases abbreviated versions of more detailed or comprehensive definitions available from the sponsors or originators of the respective indices. Anyone interested in such further details is free to consult each such sponsor’s or originator’s website.

The past performance of an index is not a guarantee of future results.

Each index reflects an unmanaged universe of securities without any deduction for advisory fees or other expenses that would reduce actual returns, as well as the reinvestment of all income and dividends. An actual investment in the securities included in the index would require an investor to incur transaction costs, which would lower the performance results. Indices are not actively managed and investors cannot invest directly in the indices.

S&P 500®: S&P 500® Index: The S&P 500® Index is an unmanaged, capitalization-weighted index designed to measure the performance of the broad US economy through changes in the aggregate market value of 500 stocks representing all major industries.

Nasdaq: The Nasdaq Composite Index: The NASDAQ Composite Index is a broad-based market-capitalization-weighted index of stocks that includes all domestic and international based common type stocks listed on The NASDAQ Stock Market.

Commodities: The Bloomberg Commodity Total Return index. The Bloomberg Commodity Total Return index is composed of futures contracts and reflects the returns on a fully collateralized investment in the BCOM. This combines the returns of the BCOM with the returns on cash collateral invested in 13 week (3 Month) U.S. Treasury Bills.

Sector/Industries: Sector/industry references in this report are in accordance with the Global Industry Classification Standard (GICS®) developed by MSCI Barra and Standard & Poor’s.

LT Government Bonds: The SBBI® Long-Term Government Bonds Index: From 1926 to 1976 the series uses data from the Center for Research in Security Prices (CRSP) at the University of Chicago Booth School of Business. From 1997 on the series are constructed using data from The Wall Street Journal. For more detail see the current SBBI® Yearbook’s description of the basic series.