The Federal Reserve has announced a 0.25% interest rate increase in its March meeting, with six more planned at each monthly meeting, aiming for 1.9% by the end of the year, reported CNBC.

The Fed has also said that it plans to begin balance sheet reductions in the coming months, looking to shed some of the nearly $9 trillion it currently carries, over $4 trillion of which have been picked up since the onset of the pandemic, according to the Federal Reserve website.

Additionally, the Committee has raised inflation expectations for the year, with the personal consumption price index minus energy and food to grow 4.1% this year, up from the 2.7% estimate in December. Core PCE over the next two years is anticipated to be 2.7% and then 2.3% before eventually settling at 2%.

“We are attentive to the risks of further upward pressure on inflation and inflation expectations,” Fed Chairman Jerome Powell said at his post-meeting news conference. “The committee is determined to take the measures necessary to restore price stability. The U.S. economy is very strong and well-positioned to handle tighter monetary policy.”

What Inflation Means for Portfolios and Stocks

While inflation can negatively impact markets, Doug Ewing, JD, CFP, RICP at the Nationwide Retirement Institute, explains in a Nationwide blog post that there has been no clear correlation drawn by economists between economists inflation and actual market returns. Inflation in the past has created the opportunity for both positive and negative market returns, but the return potential of markets is often a more nuanced story that combines a variety of factors.

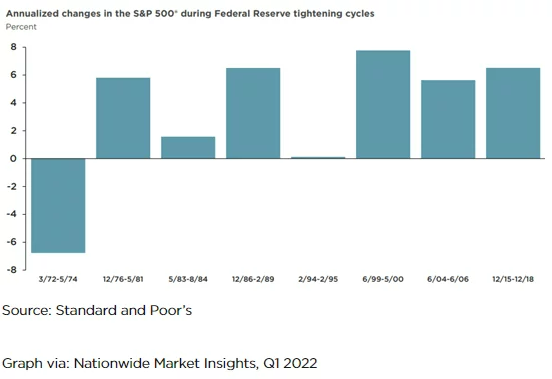

Fed tightening in response to inflation can have real, negative effects on some fixed-income investments, but in periods of Fed tightening in the past, equities have often performed positively overall.

Content continues below advertisement

Image source: Nationwide Blog

Inflation does have real effects in creating market volatility and creates difficulty in identifying the value of companies currently because of its erosion effect on the U.S. dollar value. Higher prices for inventory, materials, and labor can all affect a company’s earnings, resulting in stock price fluctuations and volatility.

“When we experience significant volatility early in retirement, specifically negative market returns, it can impact the potential longevity of our retirement portfolios. This is sometimes referred to as a ‘sequence of returns’ risk,” explained Ewing.

Nationwide offers a variety of actively managed ETFs for advisors that cater to a range of investment exposures and strategies for those seeking retirement income options for their clients as part of their bigger retirement planning pictures.

For more news, information, and strategy, visit the Retirement Income Channel.