Inflationary pressures and investor sentiment have seen markets fluctuating since the beginning of the year, with concerns around rising interest rates and now geopolitical tensions sending the major indexes plummeting. The S&P 500 has officially entered into correction territory as of this week, and while it is still too early to tell how severe sanctions will be on Russia, one of the biggest oil suppliers for many parts of the world, stocks could fall further if sanctions prevent export from Russia.

The S&P 500 has fallen below the 4,222 dip that saw investors scooping up stocks in January, but the buy-ins now aren’t doing anything to lift the market, reports Barron’s. Frank Cappelleri, chief market technician at Instinet, believes that the index could fall an additional 13% to 3,620 as long as it remains below that 4,222 threshold.

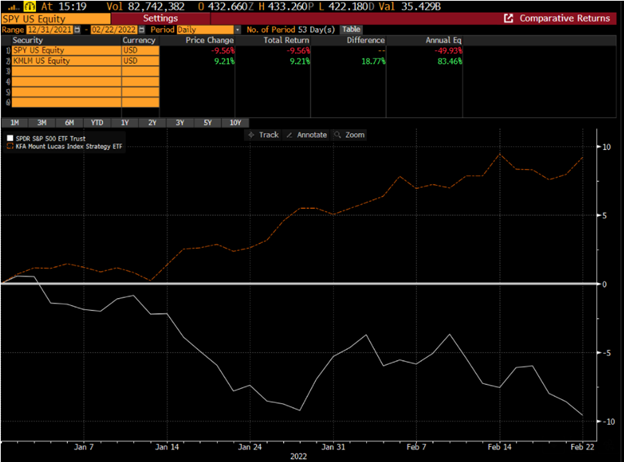

Image Source: Courtesy of Mt. Lucas

Managed futures are an often-overlooked area by advisors because of their lack of familiarity with how managed futures work, but advisors should consider the space given the current volatility. The MLM Index EV (15V) is currently up 10.3% YTD while major indexes and sectors are all down. The index seeks to offer moderate returns during lower volatility, and to continue returns during rapid market movements and volatility, both up and down, without reducing exposure.

“Managed futures is properly viewed as insurance against macro volatility. Granted, it does not have the contractual nature of true insurance, but it has the same positive skew. When managed futures pays off, like this year, rebalance – rebuild the house. Use those gains to buy cheap stocks. Pump the volatility of your portfolio elements,” writes Mt. Lucas in a blog.

Futures markets carry risk potentials in the long and short, and during times of volatility, investor capital is necessary to help absorb the risks. Investors receive premiums in exchange for providing the capital that allows companies to lower their risk, a premium that is paid during times of extreme market movement, offering a potential return stream when other investments may not.

During times of increasing volatility, an investor will want more managed futures exposure because of its ability to diversify a portfolio, according to Mt. Lucas. While it can sometimes come at a cost as a drawdown once volatility settles, during high volatility and rapid market movements, better returns can allow for continued exposure to the investments that are skewed negatively and provide space to rebound once markets and portfolios have a chance to recover.

“Managed futures checklist: Keep the cost down. Maximize positive skew. Rebalance aggressively,” Mt. Lucas explains.

Content continues below advertisement

Investing in Managed Futures With KMLM

The KFA Mount Lucas Index Strategy ETF (KMLM) from KFAFunds, a KraneShares company, offers investment with managed futures.

KMLM’s benchmark is the KFA MLM Index, and the fund invests in commodity currency as well as global fixed income futures contracts. The underlying index uses a trend-following methodology and is a modified version of the MLM Index, which measures a portfolio containing currency, commodity, and global fixed income futures.

The index weights the three different futures contracts types by their relative historical volatility, and within each type of futures contract, the underlying markets are equal dollar-weighted. Futures contracts will be rolled forward on a market-by-market basis as they near expiration.

The index evaluates the trading signals of markets every day, rebalances on the first day of each month, invests in securities with maturities of up to 12 months, and expects to invest in ETFs to gain exposure to debt instruments.

KMLM carries an expense ratio of 0.90%.

For more news, information, and strategy, visit the China Insights Channel.