U.S. ISM survey supports the hawkish expectations for the Federal Reserve. EM activity gauges were more mixed, but pointing to emerging opportunities in EM debt.

U.S. Policy Normalization

Sell-side analysts seem to have a lot of fun coming up with new terms to describe the state of the global economy. The latest one is “growthflation” – a combination of solid growth and elevated inflation. “Growthflation” should (at least in theory) justify a more hawkish policy stance in developed markets (DM) – including nearly 5 full rate hikes in the U.S., currently implied by the Fed Funds Futures. January’s ISM survey in the U.S. definitely looked “growthflationary” – the ISM Manufacturing Index stayed well in expansion zone (57.6), while the ISM Prices Paid Index surged to 76.1.

Emerging Markets Growth Outlook

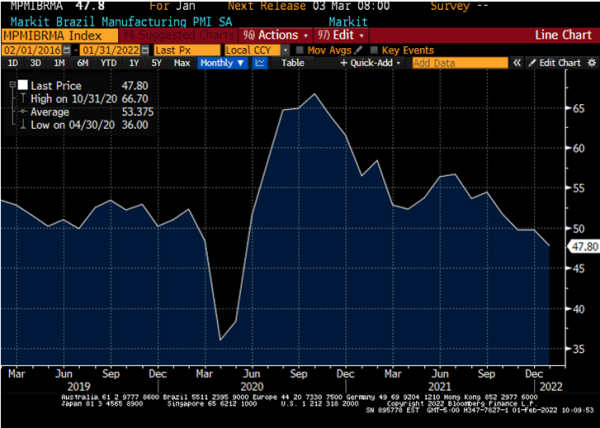

Domestic activity surveys in emerging markets (EM) were more mixed. There were some notable “ouchies”. Brazil’s manufacturing PMI (Purchasing Managers Index) slipped further into contraction zone (47.8), reinforcing near-term growth concerns. The flipside is that Brazil’s interest rates are very high, the central bank is way ahead of the curve, and there is a good chance of sizable disinflation in H2 – this can create interesting opportunities in local debt going forward. Turkey’s PMI weakened noticeably to 50.5 – the key question here is if the weakness persists, can this be used as a pretext for further easing? Hungary’s PMI collapse was spectacular (from 65.5 to 50.7) and odd, given that its Central European peers did OK. There might be some technical factors at play as the non-seasonally adjusted PMI actually improved in January, but weaker domestic orders (against the backdrop of frontloaded rate hikes) is a potential yellow flag for growth.

EM Rate Hikes Frontloading

The rest of EMEA did quite well. The Czech manufacturing PMI and Q4 GDP looked very strong, fully justifying aggressive policy tightening, with 70bps more expected in the next 3 months. The Russian PMI showed more signs of life than expected (rising to 51.8), and South Africa’s PMI stayed well in expansion zone (57.1). One concern stemming from South Africa’s stronger growth rebound (=stronger revenue collection) is that it might delay spending reform, which is required to improve the long-term fiscal trajectory. Elsewhere in LATAM, Colombia’s manufacturing PMI was very healthy (52.6), leaving plenty of room for the central bank to reinforce its hawkish message after delivering a larger than expected rate hike last week. Stay tuned!

Chart at a Glance: Brazil’s Activity Gauges Point to Strong Growth Headwinds

Source: Bloomberg LP

Originally published by VanEck on February 1, 2022.

For more news, information, and strategy, visit the Beyond Basic Beta Channel.