One of the leading providers of independent investment research, Morningstar, Inc (MORN) released reports on their mutual fund and ETF flows for July 2019.

According to the report, overall, the totals were the worst outflows for US equity funds since June 2018. Active US equity funds amounted to 23.5 billion in outflows, while passive US equity funds saw 6.6 billion in inflows.

The long-term funds collected $26.7 billion in July, a drop from $46.1 billion in June. Net flows went overwhelmingly to taxable-bond, municipal-bond, and money market funds.

Speaking of money mark funds, they took in a hefty $75.7 billion. The group has collected $202 billion over the past three months, which is the strongest three-month stretch in at least ten years.

Falling rates have ran with a massive amount of money going into bond funds. Since October 2018, the yield on the 10-year Treasury bond has dropped from 3.2% to 2.0% as of July 2019. This has powered strong returns.

Additionally, as a product of better results on credit-oriented strategies, as the report explains, “More baby boomers are seeking safety and income in retirement, funneling money into bond funds.”

With that in mind, taxable-bond funds absorbed $40.2 billion in July inflows, the group’s highest showing since January 2018. Multisector and high-yield bond funds also had healthy inflows of $3.4 and $4.2 billion.

July was also the best month for active taxable-bond funds since October 2012. At $27 billion, they’ve collected more than double the inflows for passive taxable-bond funds, reflecting the popularity of credit-oriented strategies.

The report states continued positive momentum for municipal-bond funds, with a new $10.2 billion coming to the group. At this rate, 2019 could end up being a record year for municipal-bond inflows.

On the other hand, passive municipal demand is growing. Organic growth for passive offerings was 22.5% for the trailing 12 months through July, where the group collected $7.2 billion.

In regards to international-equity funds, there was a lot of similarity with their domestic counterparts, with nearly $4 billion of outflows. The core-oriented foreign large-blend category saw significant inflows at $3.5 billion. Meanwhile, allocation and sector-equity funds have been walloped by outflows, losing $66 billion and $51 billion, respectively.

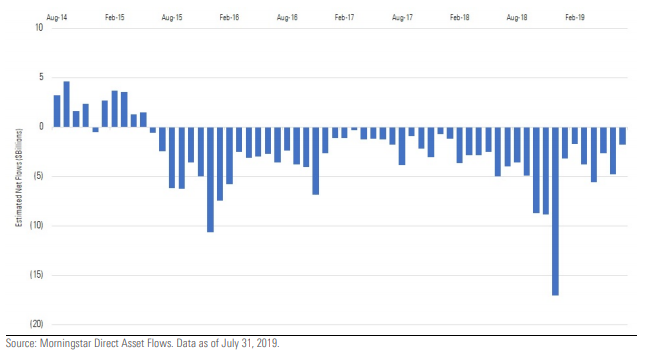

For allocation funds, this trend may be more an abstract threat. The group has had outflows every month since June 2015. There may be no place for them with the popularity of target-date funds and other managed portfolio types.

With $2.5 billion in inflows, commodities was the only non-bond group pressing forward. This comes thanks to gold prices rallying, allowing commodities precious-metals funds to take most of that money. Equity precious-metals funds did not have the same benefit, with flat flows in July, and nearly $3 billion in outflows YTD. However, it still has higher average YTD returns: 24.1% vs. 11.8%

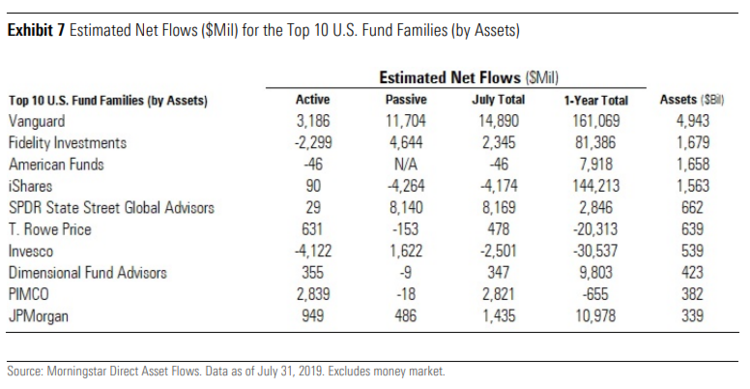

Finally, Vanguard rebounded in July, leading all the fund families with $14.9 billion in estimated inflows. Vanguard Total Bond Market II Index (VTBIX) and Vanguard Total Bond Market Index (VBMFX) stood strongest with inflows of $3.2 billion and $2.4 billion.

Also performing well was state Street. They led with $8.2 billion in inflows, led by SPDR S&P 500 ETF’s (SPY) $4.1 billion in inflows, and SPDR Gold Shares’ (GLD) $1.3 billion. Meanwhile, iShares had nearly $4.2 billion in outflows. Following a strong June, iShares Russell 1000 Value ETF IWD and iShares Russell 1000 Growth ETF IWF had a loss of $4.9 billion and $3.9 billion to outflows in July.

For more market trends, visit ETFdb.com.