Economic growth slowed last spring, but don’t panic: The decade-long expansion has lost some momentum, but there’s little reason to think it is about to stall out.

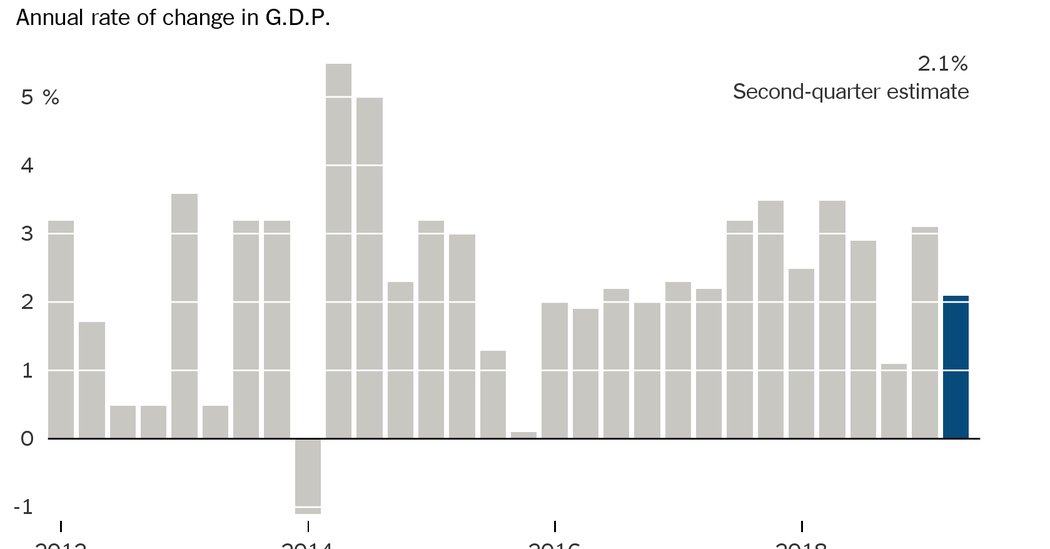

Gross domestic product, the broadest measure of goods and services produced in the economy, rose at a 2.1 percent annual rate in the second quarter, the Commerce Department said Friday. That represents a significant deceleration from the 3.1 percent growth rate in the first quarter.

But the big swings in the quarterly data are almost certainly exaggerated. The larger trend shows that the economy has cooled since last year, when tax cuts and government spending gave growth a temporary jolt. But the strong job market and robust consumer spending are keeping the recovery on track, even as trade tensions and a slowing global economy are threatening to knock it off course.

“It’s a good economy, but it’s got fragilities in it,” said Diane Swonk, chief economist for the accounting firm Grant Thornton. “You’d expect to feel more euphoria and more underlying strength, and instead what we’re seeing is fault lines.”

Last year’s surge in growth also turns out to have been smaller than initially believed. The Commerce Department on Friday revised G.D.P. data back to 2014, an annual process that incorporates data not available when the initial estimates were released. The revisions included a downgrade to growth in mid-2018.

Consumers carry the economy.

Growth in the first quarter looked good on the surface, but the underlying details were much weaker. The pattern reversed in the second quarter. Final demand — a measure of underlying growth that strips out some of the most volatile components — actually accelerated.

The biggest factor: consumer spending, which accounts for more than two-thirds of the American economy. Stock market volatility, a prolonged government shutdown and harsh winter weather all contributed to weak spending early in the year. But consumer spending roared back in the spring, rising at a 4.3 percent rate. Government spending, which picked up in the second quarter after being depressed by the shutdown, also helped lift growth.

Unfortunately, other parts of the economy look much weaker. Business investment declined and exports slumped as manufacturers, in particular, were battered by tariffs and slowing demand from overseas. If that continues, it could slow hiring or even lead to layoffs, which would hurt consumer spending as well.

“There’s nothing that I can point to about the consumer and say I’m worried,” said Ellen Zentner, chief United States economist for Morgan Stanley. “But how long can business investment remain this sluggish without spilling over into jobs and the consumer?”

The housing market continued its recent struggle. Residential fixed investment, which includes housing construction, declined for the sixth consecutive quarter.

A historic milestone.

The second quarter of this year was the 10th anniversary of the end of the Great Recession. Assuming another downturn hasn’t already begun, this is now the longest expansion on record.

There are some signs that the record run could be nearing its end. Some forecasting models, particularly those based on the market for government bonds, have been flashing warning signs, and surveys show that economists think the risk of a recession in 2020 has been gradually rising.

“Obviously, the headwinds are increasing,” said Joe Brusuelas, chief economist for RSM, a financial consulting firm. Europe is close to a recession or perhaps already in one. A trade deal with China looks to be months away at best. A flare-up in the trade war could be enough to cause a recession, he said.

On the other hand, this week’s budget deal between the Trump administration and Congress eased the risk of another government shutdown or a standoff over the debt ceiling. And if the United States and China were to reach a deal this fall, that could give the expansion a new life, Mr. Brusuelas said.

“Once that uncertainty is off the table, you’ll see a release of demand,” he said.

The view from Washington.

Friday’s report is one of the last major pieces of economic data before next week’s Federal Reserve Board meeting, when policymakers are widely expected to cut interest rates in an effort to stimulate the economy.

The report is unlikely change the Fed’s mind. But it could affect how policymakers think about the need for further cuts later this year — something investors have been anticipating but that Fed officials have yet to commit to.

The strong details in Friday’s report might weaken the case for further cuts. The Fed has been paying particular attention to inflation, which had been running below its 2 percent target. But the central bank’s preferred measure of inflation picked up in the second quarter.