By Alliance Bernstein via Iris.xyz.

Earning income without taking excessive risk is a balancing act—and it can be hard to pull off in the late stages of a credit cycle. A credit barbell strategy can help investors stay on their feet.

A credit barbell combines high-yield corporate bonds and other credit assets with high-quality government debt. Because the returns of these two asset types are usually negatively correlated, pairing them can be a good way to generate income while limiting downside risk.

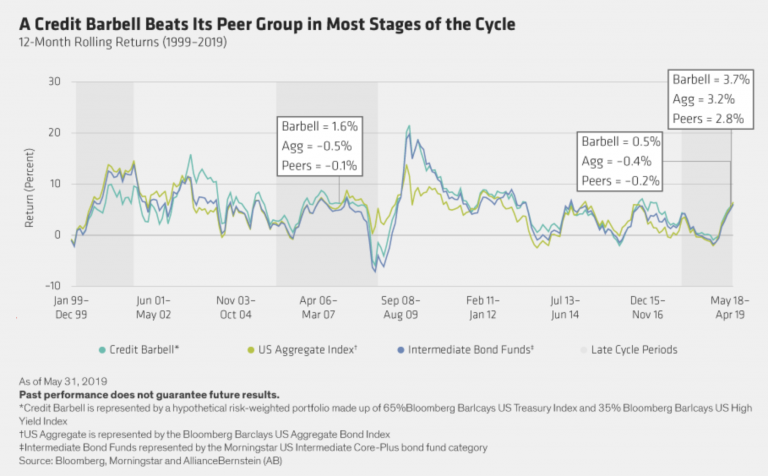

As the display shows, a generic risk-weighted barbell consisting of 65% US Treasuries and 35% US high-yield bonds would have held up well in most market cycles over the last 20 years, often besting the Bloomberg Barclays US Aggregate Bond Index and its peer group in the Morningstar Intermediate Core-Plus category.

That’s especially important during the later stages of a cycle, when the risks associated with income-oriented strategies increase. In some cases, a barbell has produced superior returns in such circumstances. In others, it has delivered downside protection.

Pinpointing the start and end of the late cycle period is difficult. For this display, we defined it as coterminous with the last three Federal Reserve interest-rate hiking cycles. For example, on June 30, 2018—more than two years into the Fed’s recent tightening campaign and with Treasury yields having risen sharply—12-month rolling returns for a generic barbell strategy would have been 0.5%. Its peers and the Aggregate delivered negative returns in that period.

Read the full article at Iris.xyz.