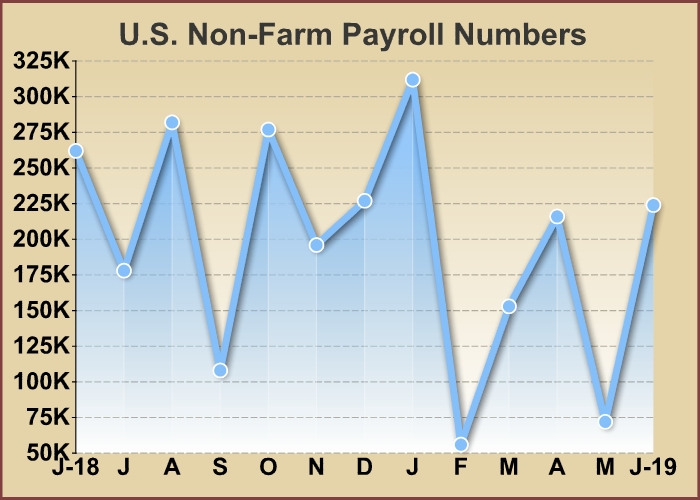

After reporting disappointing job growth in the previous month, the Labor Department released a report on Friday showing U.S. employment jumped by much more than expected in the month of June.

The report said employment surged up by 224,000 jobs in June after edging up by a downwardly revised 72,000 jobs in May.

Economists had expected employment to increase by about 160,000 jobs compared to the addition of 75,000 jobs originally reported for the previous month.

The Labor Department said the stronger than expected job growth reflected significant job gains in professional and business services, healthcare, and transportation and warehousing.

Government employment also rebounded by 33,000 jobs in June after falling by 11,000 jobs in May, while the report also showed notable increases in manufacturing and construction jobs.

Andrew Hunter, Senior U.S. Economist at Capital Economics, said the strong jobs data would seem to “make a mockery” of market expected the Federal Reserve will cut interest rates by up to 50 basis points later this month.

“Employment growth is still trending gradually lower but, with the stock market setting new records and trade talks back on (for now at least), the data support our view that Fed officials are more likely to wait until September before loosening policy,” Hunter said.

Despite the stronger than expected job growth, the unemployment rate inched up to 3.7 percent in June from 3.6 percent in May. The unemployment rate had been expected to hold steady.

The uptick in the unemployment rate reflected an increase in the size of the labor force, which expanded by 335,000 people compared to the 247,000-person jump in the household survey measure of employment.

The report also said average hourly employee earnings edged up by $0.06 or 0.2 percent to $27.90 in June, leaving the annual rate of wage growth at 3.1 percent.

ING Chief International Economist James Knightley called the annual wage growth “a little disappointing given the tightness of the jobs market.”

“However, it is well ahead of all the key inflation measures so real household disposable income growth is in great shape, which bodes well for consumer spending in the months ahead,” Knightley said.

For comments and feedback contact: editorial@rttnews.com

Business News