[ad_1]

In the land of broad emerging market ETFs, where funds like the $30 billion iShares MSCI Emerging Markets ETF (EEM) and the $57 billion Vanguard FTSE Emerging Markets ETF (VWO) navigate, there’s a trio of funds that offers similar access without local currency risk. It’s the passively managed currency-hedged ETFs offering total market EM access.

These funds aren’t household names like their unhedged counterparts, and their total assets are nowhere near what unhedged emerging market ETFs have. Traction has been relatively slow even though these currency-hedged strategies have shown their worth this year in protecting from currency volatility.

The funds are:

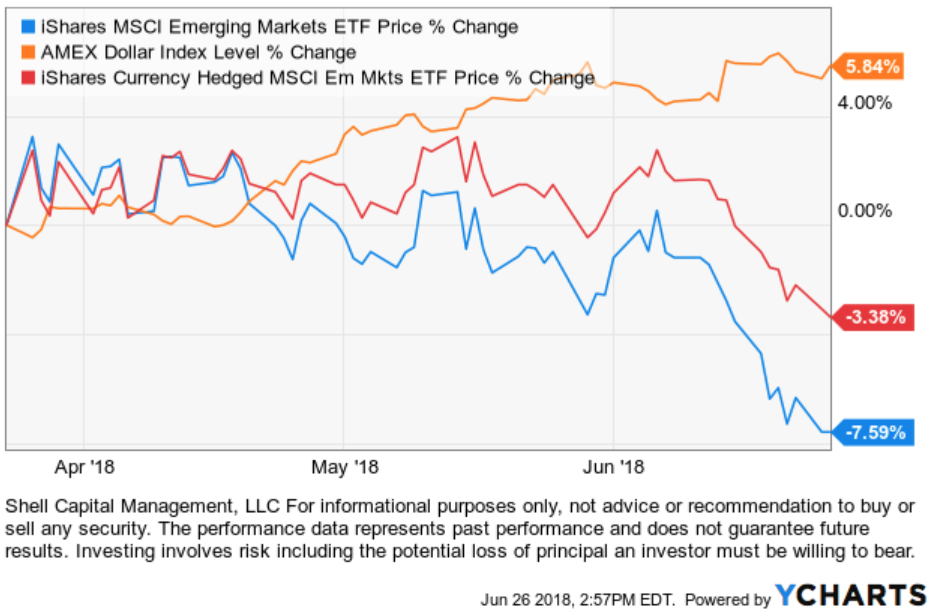

Consider the performance of EEM and its hedged version, HEEM, year-to-date:

Chart courtesy of StockCharts.com

That disparity has been seen across the board, with currency-hedged total market EM ETFs performing roughly twice as well as unhedged funds.

A look into asset flows this year shows that investors are on the fence when it comes to broad emerging market ETFs, as the region, broadly speaking, struggles with countries seeing high inflation, weakened currencies, rising political turmoil, economic contraction and hefty debt burdens. But it also shows that currency-hedged EM ETFs are all net asset losers this year—despite the performance.

Here are asset flows into/out of these ETFs year-to-date:

The question is, why? And it could primarily be a problem of tradition. Investors have long accepted that an allocation to a broad emerging market ETF meant taking in country risk, equity risk and currency risk as part of a whole package.

“Historically, people who bought into emerging markets accepted the currency risk as part of the risk premium,” Chris Dhanraj, head of iShares Investment Strategy for the U.S. ETF business, said. “That’s how people have historically modeled the risk/reward into the portfolio.”

According to him, slow adoption could also be due to an education gap—something that a year like 2018 could help fill as investors are faced with clear outperformance in currency hedged funds.

Dramatic Pickup

“This year, even as emerging markets have sold off, underneath the surface, emerging market currency volatility has picked up pretty dramatically whereas emerging market equity volatility has remained relatively tame,” Dhanraj said. “This spike in currency volatility is a good reminder that when you’re investing internationally, currency risk isn’t just baked into emerging markets. And you can hedge against it.”

HEEM, the biggest of these three ETFs, offers the exact same exposure as EEM but without the currency risk by investing in EEM itself, and overlaying that position with currency contracts. Competing DBEM is built much the same way, also tracking an MSCI index that offers pretty much the exposure EEM does, but without currency exposure.

TLEH is a bit different, taking on a multifactor approach that tilts toward small-cap and value stocks while hedging out currency exposure. Stocks are selected by market capitalization, but the weighting scheme is fundamental. Year-to-date, TLEH has dropped about 7.7%, slightly underperforming its market-cap-weighted competitors.

Looking ahead, it could be that a year like 2018, when emerging market currencies around the world saw double-digit declines in many cases, investors will take a closer look at currency-hedged total market EM ETFs. But for now, it seems demand for currency hedging will remain a thing of single-country funds—a space where investors can more easily discern the fundamental story of a market and its currency on a one-on-one basis.

“Adoption of currency-hedged ETFs has been more pronounced in single-country strategies because investors can bet on a country and/or on a currency specifically,” Dhanraj said. “In a broad EM ETF, there’s a basket of currencies, so it’s more difficult to have views on all these currencies. I think adoption of currency-hedged ETFs moving forward will be stronger at the country level.”

For a complete look at the 211 emerging market ETFs today, with $230 billion in total combined assets, check out our Emerging Market ETF channel. Currency-hedged ETFs, totaling 62 funds in all, can be seen here.

Contact Cinthia Murphy at [email protected]

[ad_2]

Source link