[ad_1]

Ryan Sullivan

Ryan Sullivan

Vice President, ETF Services

Brown Brothers Harriman

As a global service provider with more than $500 billion in ETF assets under custody, Brown Brothers Harriman (BBH) has a unique perspective on the industry given its centralized role within the ETF ecosystem.

For the sixth year in a row, BBH has co-sponsored with ETF.com a survey of professional investors, including financial advisors, RIAs and institutional investors. Ryan Sullivan, vice president of ETF Services for BBH, discusses some of the key findings this year.

ETF.com: What is the most surprising find in this year’s data? What stands out?

Ryan Sullivan: There are a few things that may be new themes, and some surprising emerging trends.

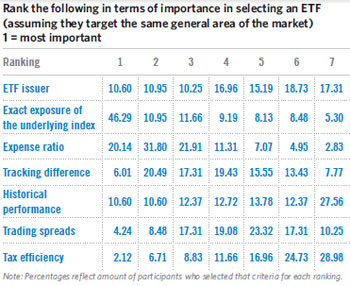

The first one relates to ETF selection and how investors are making decisions around which ETFs they’re going to buy. Historically, and especially last year, we saw expense ratio—the cost of the ETF—being of paramount importance in that decision. Compare that to this year’s results, and cost is still important, but now it’s becoming one among a handful of factors investors consider in their ETF selection.

In the U.S. in particular, cost is now tied with historic returns as the most important factor when selecting an ETF. Folks are pivoting and looking at a fund’s track record in addition to the fund’s expense ratio when looking at an ETF. That emerged across the three regions surveyed—U.S., Europe and Greater China. We’re seeing that kind of pivot point between cost and track record.

The third factor is the ETF’s brand—the ETF issuer.

ETF.com: What’s interesting is that we spend so much time reminding ourselves that past performance is no indication of future returns, and yet historic performance is the top factor in ETF selection right now? Why this new focus on past performance?

Sullivan: Investors are getting savvier and more focused on the structure of the ETF, and the underlying strategy. Track record, cost and brand were highly rated from a selection standpoint, but so was index methodology.

This tells me that investors are increasingly looking to pop the hood on ETFs, to understand the investment strategy, how it’s performed over multiple market cycles, all to better understand how it may impact their portfolio if they begin allocating dollars to it. And if you combine that with the need for historic returns and information, it shows a shifting focus on an understanding that ETFs aren’t always passive.

While most assets are still within passively managed strategies, there’s an increasing appetite for actively managed ETFs, and there’s going to be more focus on the funds’ historic returns there, and also with more complex smart-beta products.

ETF.com: The survey found that ETFs investors are looking for more actively managed and smart-beta ETFs. Outside of fixed income, active ETFs have struggled to find a following, and some say smart beta has lost some steam. How do you reconcile that?

Sullivan: When we looked at the way we positioned the questions, we were trying to get a feel for how investors might be approaching portfolio construction going forward.

What their responses show in terms of demand for active, demand for smart beta, how they’re using both, and what asset classes they’re looking for, is that there’s maybe some uncertainty as to what 2019 is going to bring from a market cycle perspective. Will we see the continued volatility we saw at the end of 2018? Will we see pullbacks on a regional basis, or are we approaching a recessionary period?

We’re seeing investors looking to reduce risk in their portfolio, to eliminate or reduce volatility, and for that, they’re looking to use smart beta to help.

Conversely, it appears that actively managed ETFs are being used more to position a portfolio to achieve some alpha and separate the beta piece with smart beta, maybe some core passive, but to seize alpha as well.

I’d tie that back to the demand for more choice around global equity products; for example, putting more of those into an active wrapper that may be more cost effective given the ETF structure, but one that still offers the chance for enhanced returns.

ETF.com: You also found investors want more ESG ETFs, but adoption of existing ones has been pretty slow. Why is that?

Sullivan: We had some interesting findings from the survey on ESG. On one hand, we saw, when we go back to the selection, ESG factors themselves were rated pretty low in importance. Index methodology itself was fairly high in comparison, so folks are certainly looking at the underlying construct of the strategy.

But I think what it speaks to is that here’s some uncertainty from investors as to what ESG investing actually is, especially in the U.S. where we don’t have a clear set of principles. But we did see demand from a product perspective in subsequent questions, suggesting ESG demand was still a top three as you go across the regions. That shows investors are looking to continue to invest along their values.

[ad_2]

Source link Google News