[ad_1]

Faced with whipsawing equity markets at home and political uncertainty abroad, U.S investors are scrabbling for safe, reliable investments in which to ride out the storm.

Quality-factor ETFs, which focus on stable, profitable companies that have proven themselves financially solvent—no matter what the broader economy is doing—have seen a jump in investor demand.

Exhibiting low leverage and consistent earnings growth, quality stocks offer a middle-of-the-road approach between capturing upside and mitigating downside—exactly what nervous investors seem to want right now.

Notably, the $8.6 billion iShares Edge MSCI U.S.A. Quality Factor ETF (QUAL) has taken in $1.84 billion in new net investment assets over the past month alone.

QUAL’s sister fund, the $492 million iShares Edge MSCI Intl Quality Factor ETF (IQLT), has also grown like gangbusters. Over the past month, IQLT’s assets under management have swelled an eye-popping 320%, or $372 million in net inflows, meaning it has well-outpaced any other fund we track.

Less Japan, More Europe

IQLT is a developed market, ex-U.S. single-factor ETF that screens for quality large- and midcap stocks in 13 countries. About two-thirds of the fund is in European stocks, and another 27% is in Asia-Pacific.

Notably, Japanese stocks make up just 12% of the fund, a significantly smaller percentage than in the segment leader, the $68 billion Vanguard FTSE Developed Markets ETF (VEA). Japan comprises 23% of VEA.

In contrast, IQLT has higher weights in the U.K. (19%), Switzerland (12%) and France (10%).

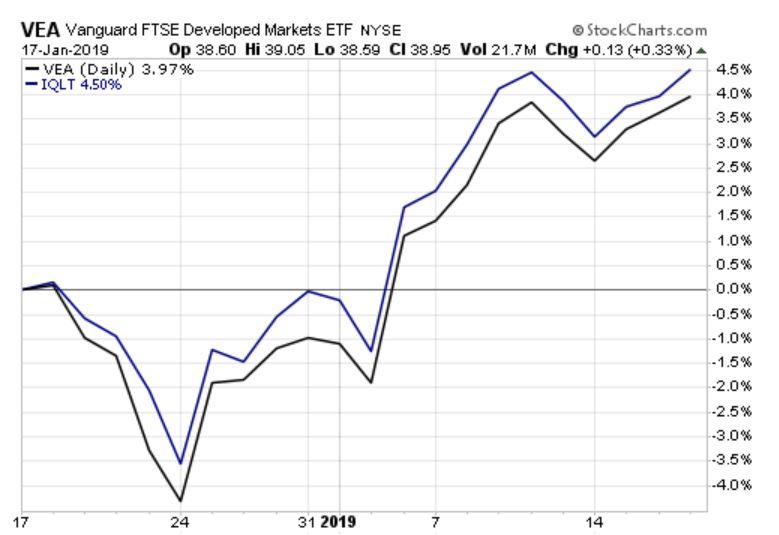

Over the past month, IQLT has slightly outperformed VEA, rising 2.7% versus VEA’s 2.4%:

Source: StockCharts.com; data as of 1/17/2019

Sectors Match Broader Market

Despite its different country weightings, IQLT cleaves closely to segment benchmarks for its sector composition. Banks and other financial institutions make up a full quarter of IQLT’s portfolio, followed by industrial firms at 13% and consumer cyclicals companies at 11%. That’s roughly the same proportions as VEA.

That’s intentional. IQLT’s index specifically weights sectors such that they match the broader market. Within each sector, however, securities are weighted by their quality score and scaled by market cap.

Individual securities are selected and weighted based on three fundamental metrics of quality: return on equity; debt/equity ratio; and earnings variability. Securities are given a composite ranking, and the 300 with the highest combined score are included in the index.

QUAL applies a similar methodology to U.S. equities.

Performance, Fees: Mixed Bags

IQLT charges 0.30% in expense ratio, which isn’t bad for a factor-based fund. However, it’s fairly unimpressive compared with vanilla developed-market ex-U.S. funds like VEA, or the SPDR Portfolio Developed World ex-US ETF (SPDW), which cost 0.07% and 0.04%, respectively.

Furthermore, IQLT isn’t tremendously liquid, with a fairly high average trading spread of 0.24%. Some of that is due to IQLT’s nature as an international fund, but some of it is probably due to low trading volume. (Over the past month, most of the trading that has happened in the fund has been in bulk, which has skewed its average trading volume by dollar.)

Still, as long as market uncertainty persists, more investors will likely continue to give IQLT and other quality-factor ETF options a second look.

Contact Lara Crigger at [email protected]

[ad_2]

Source link