Check here for the latest news on how the conflict is affecting markets, businesses and the economy

Article content

Russia’s invasion of Ukraine has sparked unprecedented economic and financial retaliation from western nations which are piling on sanctions in what France has called “all-out economic and financial war.”

Advertisement 2

Article content

But the conflict will have consequences for the whole world as it cuts off crucial energy and crop supplies, disrupts businesses and upsets financial markets, already under stress as central banks tighten policy.

There is a lot going on out there so check here for the latest news on how the conflict is affecting markets, businesses and the economy.

12:54 p.m.

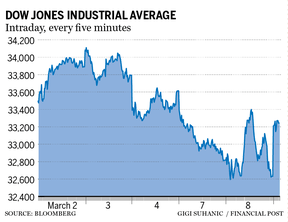

Profit-taking and bargain hunting has turned trading upside-down today.

While stocks are soaring, commodities are plunging, the reverse of the equity havoc we’ve seen for the past few days.

“The pullback in oil and commodity stocks have induced this rally. It’s just profit-taking in terms of oil, gold and the agricultural products and some bargain hunting in equities,” Peter Cardillo, chief market economist at Spartan Capital Securities in New York, told Reuters.

Advertisement 3

Article content

“Nothing has changed. We could still have one more trip downwards, test the lows that we saw yesterday or trade around that before we can say that the market has bottomed out.”

At midday, the Dow Jones Industrial Average was up 710.93 points, or 2.18 per cent, at 33,343.57, the S&P 500 was up 108.39 points, or 2.60 per cent, at 4,279.09, and the Nasdaq Composite was up 412.57 points, or 3.22 per cent, at 13,208.12.

The TSX was up 253 points at 21,485.

Oil is also down (7 per cent) after reports that the United Arab Emirates will call on fellow OPEC members to boost production, potentially easing some of the supply concerns caused by sanctions on Russia after its invasion of Ukraine.

— Reuters

12:25 p.m.

Russia inflation could surge to above 20% this year

Advertisement 4

Article content

Russia is headed for one of its biggest inflation spikes this century after waves of sanctions over the invasion of Ukraine touched off the collapse of the ruble and disrupted trade.

In the first full week since the military offensive began late in February, prices for new domestic cars soared over 17 per cent and the cost of television sets jumped 15 per cent. Some medicines and vegetables became 5 per cent to 7 per cent more expensive in the seven days ending March 4.

Overall, inflation in the period reached 2.2 per cent, according to a report by the Federal Statistics Service on Wednesday, the sharpest weekly increase since it started tracking the data in 2008 and more than double the previous record. On an annual basis, price growth was 10.4 per cent as of March 4, according to the Economy Ministry.

Advertisement 5

Article content

It’s one of the starkest measures yet of the damage wrought on Russia’s economy by the war. For a country increasingly cut off from the outside world, the risk of shortages has already prompted the government to impose a temporary ban on re-exports of foreign medical products and to say it will restrict trade in some goods and raw materials.

The ruble’s collapse of nearly 40 per cent so far this year will further ravage household finances, threatening a crisis in the cost of living reminiscent of the 1990s.

Bloomberg Economics predicts inflation will peak at an annual 19 per cent around July, compared with 9.2 per cent last month, and end the year at about 16 per cent. Before the war, it saw price growth cresting below 10 per cent and reaching 5.8 per cent at end-2022.

Advertisement 6

Article content

Bank of America Corp. expects inflation will surge to 20 per cent over the course of this year, while the National Institute of Economic and Social Research in London sees it rising even above that level. Russian inflation hasn’t been at 20 per cent since 2001.

The upswing in inflation is already playing out in the streets of Russian cities. Abu Ghosh, a Middle-Eastern cafe off Moscow’s historic Arbat neighbourhood, said on Instagram that it had seen prices for some ingredients rise 300 per cent.

— Bloomberg

11:25 a.m.

U.S. Russian oil ban an ‘earthquake’: Jason Kenney

Alberta Premier Jason Kenney is calling the United States’ decision to ban imports of Russian oil and gas an “earthquake” with the potential to reshape the global energy industry.

Advertisement 7

Article content

“It’s an earthquake,” Kenney said in an interview with Calgary Herald columnist Chris Varcoe on Tuesday from the sidelines of CERAWeek by S&P Global energy conference in Houston.

“It is, I think, the beginning of a potential global realignment in how we supply energy.”

Oil prices have spiked and this week’s events are likely to push them even higher, adding to inflation already putting the squeeze on consumers, Varcoe writes.

“This is a really historic moment. Energy markets and policy will be defined in the future significantly by this event,” said Jackie Forrest, executive director of the ARC Energy Research Institute in Calgary.

“You are going to see more movement to care about energy security. In terms of policy, there will probably be some initial pulling back on some of those environmental goals but, long term, potentially accelerating them with the idea of getting off hydrocarbons.”

Advertisement 8

Article content

Read the column from Chris Varcoe here.

11:19 a.m.

Energy stocks are soaring along with oil prices, but don’t look for investment to flow back to the oil patch, writes the Financial Post’s Barbara Shecter.

While politicians in Alberta are pushing Canada’s oil patch as a solution for the United States and parts of Europe looking for alternatives to Russian oil, sector observers say Canada’s prospects of stepping up have been dampened by years of underinvestment. Combined with a push for cleaner energy and memories of past boom and bust cycles, this is creating reticence among investors and producers. Read on

9:43 a.m.

U.S. stocks just opened sharply higher after four straight sessions of losses.

The Dow Jones Industrial Average rose 227.78 points, or 0.70 per cent, at the open to 32,860.42.

Advertisement 9

Article content

The S&P 500 opened higher by 52.40 points, or 1.26 per cent, at 4,223.10, while the Nasdaq Composite gained 318.15 points, or 2.49 per cent, to 13,113.70 at the opening bell.

The TSX composite index was up 27.35 points, or 0.13 per cent, at 21,259.38.

9:29 a.m.

CAE is O-U-T

Add Montreal-based CAE Inc. to the list of global companies that have quit Russia in protest of President Vladimir Putin’s invasion of Russia.

The maker of flight simulators and medical devices said on March 8 that it had suspended, “all services and training to Russian airlines, aircraft operators and healthcare distributors, in light of Russia’s invasion of Ukraine.”

The company won’t sell simulators to Russian airlines, nor will it service existing ones, the statement said. CAE doesn’t have any facilities in Russia, but it had been servicing simulators sold to Russian airlines in the past, and Russian airlines were clients in its global network of training centres.

Advertisement 10

Article content

CAE said it has donated $60,000 to the Red Cross to support Ukrainians fleeing the war.

The Financial Post’s Gabriel Friedman spoke to CAE’s chief executive, Marc Parent, in an exclusive interview in January. Read the story here.

— Kevin Carmichael

8:40 a.m.

Oil is falling today and stocks are rising. What gives?

Analysts say markets are having a bit of a relief rally, but it probably won’t last.

MSCI world equity index was up 0.7 per cent this morning, Europe’s STOXX 600 gained 3.1 per cent and Wall Street futures were also up on news of talks between Russia and Ukraine.

Analysts consider the rebound to be a technical correction, rather than signalling a tangible change in sentiment about the conflict, which is Europe’s biggest war since World War Two, reports Reuters.

Advertisement 11

Article content

“For now, markets are relieved by the fact we haven’t had any fresh bearish news since yesterday’s announcement of a ban in oil imports from Russia,” Fawad Razaqzada, market analyst at Think Markets, told the news agency.

“The markets were severely oversold… this is also typical of a bear market when you sometimes see multiple percentage point gains in a short period of time as the shorts are squeezed, before the rally runs out of steam and the downward trend resumes.”

Better known as a dead cat bounce.

Oil prices climbed higher yesterday after the U.S. banned Russian fossil fuels, but are falling today. Goldman Sachs said the ban had already been priced in and traders say there is a view today that the ban may not worsen shortages.

Advertisement 12

Article content

Brent crude futures were at US$124.78 a barrel, down 2.5 per cent on the day, having eased since Monday’s high of US$139.13. U.S. West Texas Intermediate (WTI) fell $3.19, or 2.6 per cent, to US$120.51.

7:24 a.m.

Good Morning!

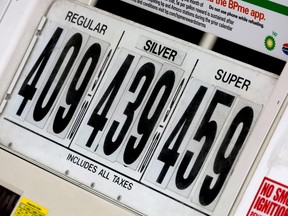

U.S. President Joe Biden’s announcement yesterday that America would ban all Russian fossil fuel imports, appears to have the support of the people.

A Ipsos poll, taken shortly before the announcement, found that 62 per cent of Americans say they are willing to pay more for fuel and gas because of sanctions against Russia to defend another democratic country. That’s up from 49 per cent two weeks ago.

Eighty per cent said they believe the United States should not buy oil or gas from Russia during this conflict.

Their resolve will be tested.

Gas prices have never been this high in the U.S. rising to US$4.196 this week, higher than the record of $4.165 in 2008, according to numbers from the U.S. Energy Information Administration.

With Biden’s ban and the conflict continuing they are likely to go higher.

“Americans have never seen gasoline prices this high, nor have we seen the pace of increases so fast and furious,” said Patrick De Haan, GasBuddy’s head of petroleum analysis in a statement this week.

“It’s a dire situation and won’t improve any time soon. The high prices are likely to stick around for not days or weeks, like they did in 2008, but months.”

Advertisement 13

Article content

Additional reporting by Reuters and Bloomberg

Listen to Down to Business for in-depth discussions and insights into the latest in Canadian business, available wherever you get your podcasts. Check out the latest episode below: