Slack is set to go public, and its listing is turning heads — and not just because it’s a rare direct listing, either.

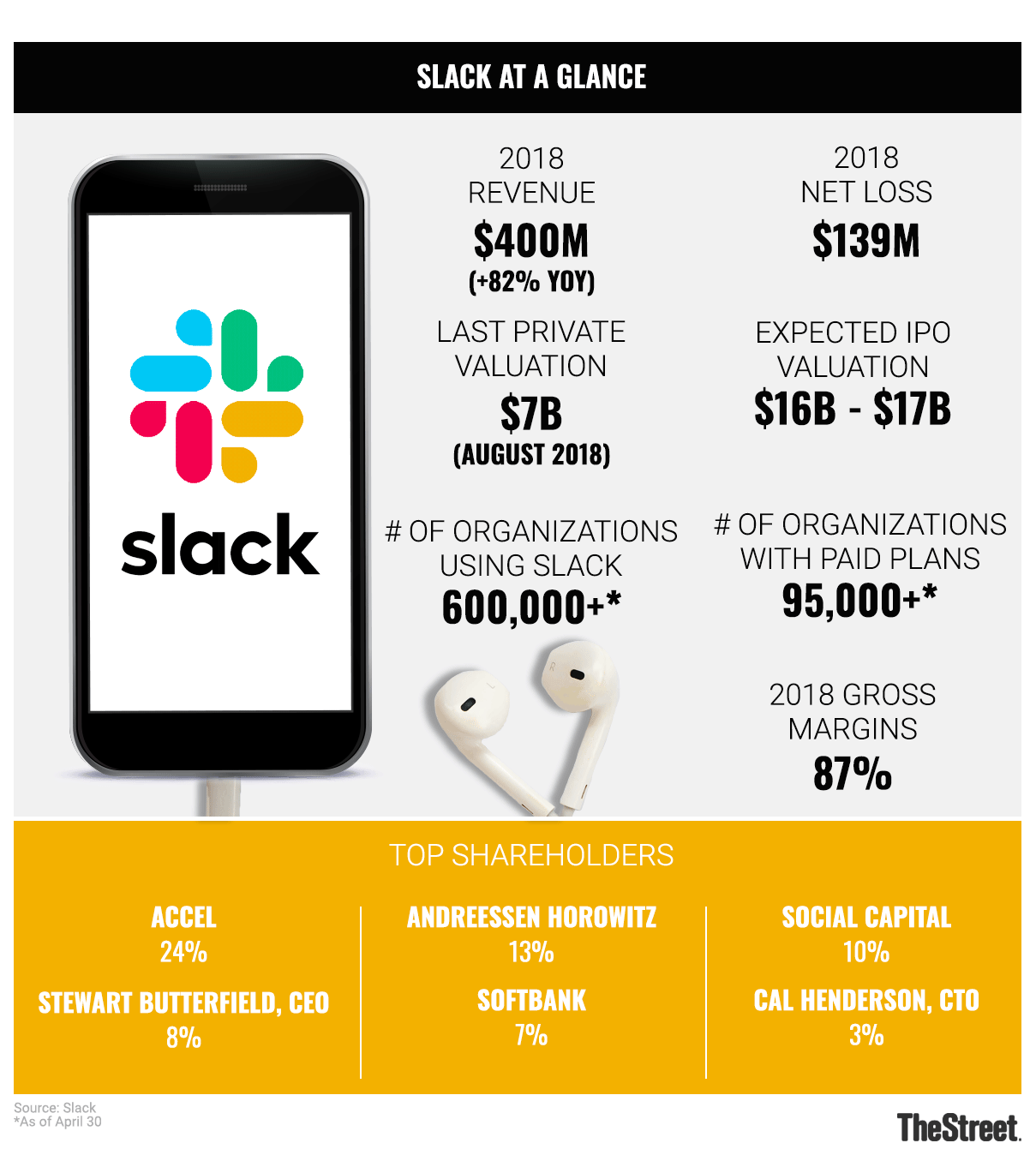

The enterprise tech firm is planning a direct public offering (DPO) — a listing that bypasses the traditional underwriting process — on Thursday, June 20, and it’ll be the latest unicorn to launch into the public markets. On Wednesday, the NYSE set a reference price of $26 per share, a figure that places Slack’s valuation at roughly $16 billion.

In a season of many attention-grabbing IPOs, Slack’s financial picture draws comparisons to Zoom (ZM) , another highly-valued enterprise communications firm. Shares of Zoom, which began trading publicly in April, have skyrocketed 60% since its IPO and are up 25% since it posted robust revenue growth and a small profit in its first earnings report on June 6.

Don’t anticipate a similar trajectory for Slack, however, according to Duckju Kang of the personal finance site ValueChampion.

“Slack’s valuation is already matching Zoom’s in terms of its EV [enterprise value] to Sales ratio. And that’s after Zoom’s stock has soared through the sky,” said Kang. “It will be hard to expect Slack’s stock to have a similar performance, especially with slowing revenue growth in face of tougher competition from Microsoft.”

Kang noted in an analysis of the two firms that Slack’s fixed costs are about 3.5 times those of Zoom’s, which will make it that much harder to turn a profit in the coming quarters. In the meantime, its revenue growth also seems to be slowing: For 2018, it reported revenue of $400 million, equivalent to growth of 82%, compared to 110% growth between 2016 and 2017.

Slack’s growth prospects will lie in more aggressively converting free users to paid users. As described in its S-1 prospectus, its growth strategy hinges on expanding its sales and marketing efforts as well as investing in international expansion.

Still, some observers are skeptical of how Slack will fare in the face of formidable competition, which includes dominant workplace players Alphabet (GOOGL – Get Report) , which competes with Slack through G Suite, and Microsoft (MSFT – Get Report) , which has Teams. Ryan Duguid of enterprise tech firm Nintex, said that Slack needs to play its cards right to avoid being left with castoffs from the dominant enterprise players.

“While Slack has an edge right now as the first mover, the battle is heating up as Microsoft is pouring significant resources into Teams and seeing success as a result, first with broad deployment of licenses and second with rapid growth in adoption,” Duguid wrote in an email. “This will make it harder for Slack to justify the additional spend at the CIO level, given the [Microsoft] customer already has Teams included in their enterprise agreement.”

Slack’s stock will trade on the NYSE under the ticker symbol WORK.

Microsoft and Alphabet are holdings in Jim Cramer’s Action Alerts PLUS Charitable Trust Portfolio. Want to be alerted before Cramer buys or sells MSFT or GOOGL? Learn more now.

Watch: What Jim Cramer Doesn’t Like About Slack’s Direct Listing