Blockchain may seem complicated, but its core concept is really quite simple, it is a digital ledger. The key difference between a typical ledger and a blockchain is the way the data is structured. The information existing on the ledger is shared and continually reconciled. Since the blockchain ledger is not stored in one location, this means records are decentralized, made public, and more easily verifiable. Hosted by a peer-to-peer network of millions of computers, information on the blockchain is stored in “blocks” that are identical across the network, making data and transactions more transparent and less corruptible, without the need for an intermediary. There are public blockchains, private blockchains, and hybrid versions that combine both public and private access.

Source: EQM Indexes, Emerita Capital Indices

Most of us are now aware of cryptocurrency or digital currency as one giant application of blockchain, but there are many more. That is one reason why it is so difficult to pigeon-hole blockchain as an investment. Is it fintech? Is it technology? Is it software? The truth is that it is all those things and more! This also makes it difficult for investors to figure out where to position blockchain in an investment allocation as it has Financial AND Technology exposure.

Some of the exciting applications of blockchain are:

BaaS – Blockchain-as-a-Service: Blockchain-as-a-service (BaaS) is the third-party creation and management of cloud-based networks for companies in the business of building blockchain applications. BaaS is based on the software as a service (SAAS) model and allows customers to leverage cloud-based solutions to build, host, and operate their own blockchain apps and related functions on the blockchain.

VC & SSI – Verifiable Credential & Self Sovereign Identity (Universal Identity): Self-Sovereign Identity (SSI) offers verifiable, globally resolvable, and privacy-preserving credentials that we store and manage from the security of our own devices and can show it to anyone, anywhere. It can be used for industry that can be used for personal identification purposes. e.g. claim benefits, bank account, loan, insurance, healthcare services etc.

DeFi – Decentralized Finance: Decentralized finance (DeFi) is shifting from traditional centralized financial systems such as brokerages, exchanges, or banks, and instead utilizes smart contracts on blockchains.

NFT – Non-Fungible Tokens: A NFT (non-fungible token) is a special cryptographically-generated token that uses blockchain technology to link with a unique digital asset that cannot be replicated. NFT digital content represented as tokens which ascribe value to uniquely distinguishable assets by artist, gaming companies, content creators, is driving a new wave of crypto adoption.

CBDC – Central Bank Digital Currency: A Central Bank Digital Currency (CBDCs) is a digital form of central bank money based on Blockchain, which is a legal tender created and backed by a central bank. Many CBDC pilot projects are going on across the globe.

According to Fortune Business Insights, the Blockchain market is expected to expand at a 56.1% CAGR with a projected reach of $69.04 billion USD by 2027.

Blockchain ETFS

Blockchain ETFs are a great way to play this nascent, but growing theme, offering diversified exposure and avoiding single stock risk. Who will emerge as the “Amazon” (AMZN) of blockchain? It is too early to tell. It may even be Amazon! But owning a basket of names with exposure to the theme, is a lower risk way to invest in the public companies involved in blockchain.

Currently, the odds of approval for a Bitcoin ETF are looking grim. There are at least nine applications for Bitcoin ETFs in the SEC’s inbox, and some issuers are betting on blockchain as a workaround. A slate of companies are releasing or planning “Bitcoin related” products to skirt regulation. For example, Bitwise, who also has a Bitcoin ETF filed, launched the Crypto Industry Innovators ETF (BITQ). It owns crypto-heavy companies like MicroStrategy (MSTR), Coinbase Global (COIN) and Galaxy Digital Holdings, which is listed in Canada.

Truth is, the Amplify Transformational Data Sharing ETF (BLOK) and other blockchain ETFs have held many of those companies for some period of time. This despite the fact that when they launched in 2018, they were not allowed to use “Blockchain” in their names. Invesco is the biggest player to try the “workaround” tactic, recently filing the Invesco Galaxy Blockchain Economy ETF and Invesco Galaxy Crypto Economy ETF.

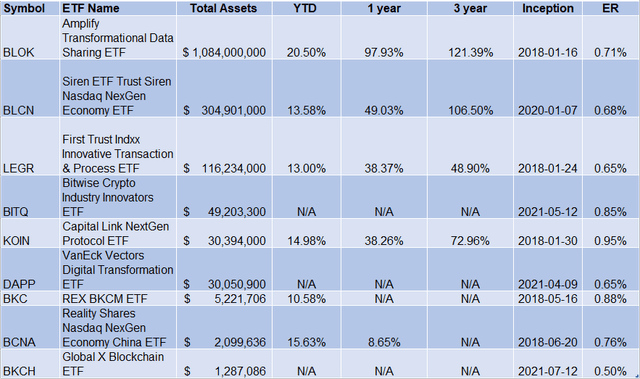

Looking at the slate of ETF offerings, the biggest difference is their management and performance.

Source: ETF Database

Clearly, BLOK is the performance winner, up 20.5% YTD, 97.9% over the last year, and 121.4% over the last 3 years. It was also one of the top-performing ETFs among all ETFs for the first half of 2021, up 36.28%. BLOK is the behemoth of the group, with over $1 billion in assets under management and is actively managed, which has paid off from a performance standpoint. Interestingly, despite its active management and stellar performance, it does not have the highest expense ratio, at 71 bps.

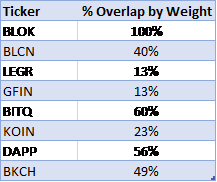

Looking at the holdings of these ETFs, they are part technology, part crypto, part financial, but surprisingly have taken very different approaches. This is apparent in looking at the fund overlap by weight relative to BLOK.

Source: ETF Research Center

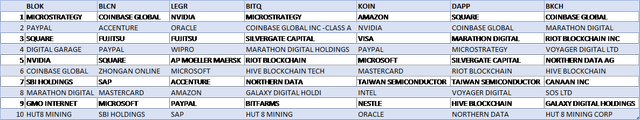

One nice attribute about ETFs besides diversification and tax efficiency is their transparency. Know what you own! Both BLOK and the new BKCH (launched last week) are actively managed, but transparent.

Source: Bloomberg

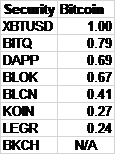

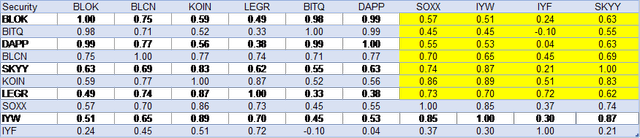

BLOK, DAPP (inception 4/9/21), and BITQ (inception 5/12/21) have sizable correlations to Bitcoin as you can see from the table below, but are not yet tested over the long term. BKCH (inception 7/12/21) is too new to calculate the correlation.

1 Year Correlation (6/30/2020 – 6/30/2021)

Source: Bloomberg

But how correlated are blockchain ETFs to semiconductor (SOXX), technology (IYW), financials (IYF), and cloud (SKYY)? The answer is that this varies by fund.

Source: Bloomberg

Conclusion

While there are a lot of “blockchain” ETFs to choose from, they are not all created equal. Investors should do their homework and decide what exposure makes sense for them from a risk and return perspective. BLOK is the leader in terms of assets and performance. Only time will tell how the newly minted “workaround” offerings will do on a relative basis in the newest “battle of the blockchain ETFs”.