FRANKFURT, Germany–(BUSINESS WIRE)–Jan 13, 2022–

MV Index Solutions (MVIS®) today announced that at year-end 2021, there are $2.9bn in digital asset products that are attached to licensed MVIS indices, which equates to 5% of the total market share. The firm is proud to be working their clients (21Shares, 3iQ, VanEck) to provide investors with some of the largest and most liquid investment products in the digital asset space.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220113005738/en/

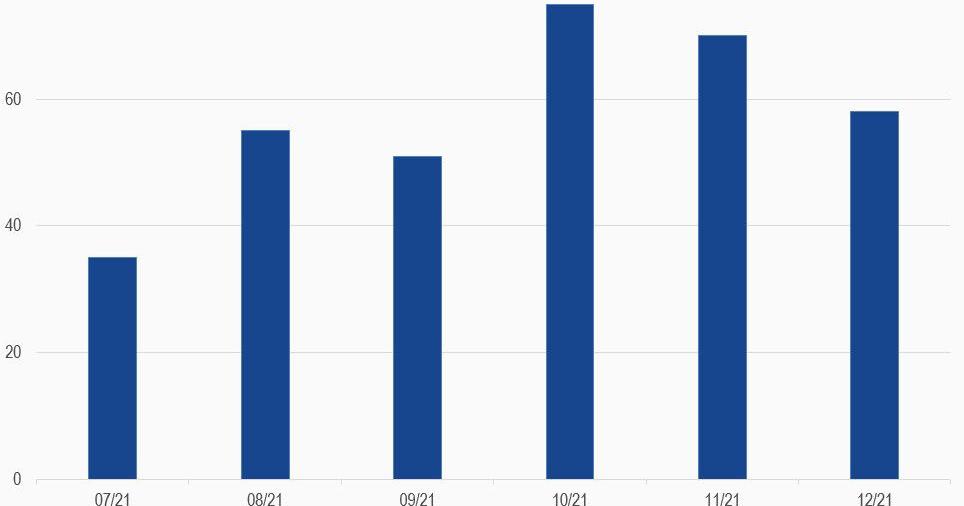

Exhibit 1: Total Assets under Management in Digital Asset Investment Products by Asset Manager (Source: MV Index Solutions. CryptoCompare Digital Asset Management Review, Data as of December 2021.)

In total, the total market capitalization of digital assets skyrocketed during 2021, peaking at over $3tn. In-line with the rise in digital assets market capitalization, AUM for digital asset investment products jumped as well, ending the year around $57bn.

In 2021, MVIS Launched 22 new digital asset indices. Alongside the firm’s broad digital asset indices, they also launched a classification scheme, to help investors understand the various segments within digital assets. MVIS applies strict and demanding liquidity screening to digital assets to underlie liquid, tradeable products. Among the top ETNs/ETFs, VanEck’s Ethereum product (VETH), which tracks the MVIS CryptoCompare Ethereum VWAP Close, traded at $9.49mn (up 54.7%) in December 2021, capturing 7% of the shares outstanding.

The MVIS CryptoCompare Digital Assets 25 Index (MVDA25) returned -13.8% for the month. It is a modified market cap-weighted index which tracks the performance of the 25 largest and most liquid digital assets. Most demanding size and liquidity screenings are applied to potential index components to ensure investability. Despite the drop in December, MVDA25 returned 321% for the year ending 2021.

Heading into 2022, MVIS is excited to be a part of the continued growth with our clients and partners.

Note to Editors:

About MV Index Solutions – www.mvis-indices.com

MV Index Solutions GmbH (MVIS®) develops, monitors and licenses the MVIS Indices, a selection of focused, investable and diversified benchmark indices. The indices are especially designed to underlie financial products. MVIS Indices cover several asset classes, including equity, fixed income markets and digital assets and are licensed to serve as underlying indices for financial products. Approximately USD 33.50 billion in assets under management (as of 13 January 2022) are currently invested in financial products based on MVIS Indices. MVIS is a VanEck company.

View source version on businesswire.com:https://www.businesswire.com/news/home/20220113005738/en/

CONTACT: Eunjeong Kang, MV Index Solutions

+49 (0) 69 4056 695 38

media-enquiries@mvis-indices.com

KEYWORD: GERMANY EUROPE

INDUSTRY KEYWORD: BANKING PROFESSIONAL SERVICES FINANCE

SOURCE: MV Index Solutions

Copyright Business Wire 2022.

PUB: 01/13/2022 01:49 PM/DISC: 01/13/2022 01:49 PM

http://www.businesswire.com/news/home/20220113005738/en

Copyright Business Wire 2022.