Hello! Market volatility remains elevated after last month outflows in exchange traded-funds listed in the U.S. for the first time in almost three years, according to State Street Global Advisors. In this week’s ETF Wrap you’ll see some of the bright spots in last month’s rough patch and this year’s market tumult.

May is off to a shaky start, with the U.S. stock market tumbling Thursday as bond yields rose.

In April, investors withdrew a net $10.5 billion from U.S. listed exchange-traded funds, snapping a 34-month stretch inflows, according to a State Street Global Advisors report. Equity ETFs suffered, with funds focused on U.S. stocks seeing a record $28 billion of outflows as “systematic investors de-risked,” State Street said in the report.

But April’s equity outflows are perhaps not as bad as they first appear, according to Todd Rosenbluth, head of research at ETF Trends. Unusually large outflows that iShares Core S&P 500 ETF

IVV,

and Vanguard S&P 500 ETF

VOO,

saw within a few days in April “feels like” it may have been trading activity tied to a large institutional investor, Rosenbluth said in a phone interview.

“It would concern me more if we saw a steady stream of outflows throughout the month for each of those products as opposed to a massive trade,” he said. “It doesn’t feel as if this is the masses moving away from equity ETFs.”

According to State Street, April’s equity outflows were heavily influenced by three funds focused on the S&P 500 Index. Without those funds, the report says, equity ETF flows would have been positive, including $7 billion of inflows for U.S. equity exposures.

The SPDR S&P Dividend ETF

SDY,

Health Care Select Sector SPDR Fund

XLV,

Vanguard Total Stock Market ETF

VTI,

JPMorgan Equity Premium Income ETF

JEPI,

and VanEck Semiconductor ETF

SMH,

had some of the largest inflows among equity ETFs in April, excluding leveraged or inverse funds, an email from Elisabeth Kashner, director of global fund analytics at FactSet, shows.

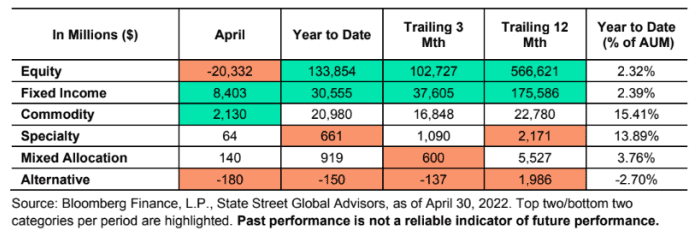

State Street pointed out that investors in April put capital to work in high-quality dividend strategies and defensive sectors, such as health care and consumer staples, in April. See below for sector flows highlighted in the firm’s report.

STATE STREET GLOBAL ADVISORS REPORT

Fixed-income flows

Fixed-income flows were positive in April, but below their long-term average of $16 billion a month, with the vast majority of fixed-income ETFs trading at a loss this year, according to State Street.

The total $7 billion of inflows into bond ETFs in April were led by “government exposures,” the firm said in the report. Short-term government bond ETFs had the most inflows, followed by intermediate government debt, according to State Street.

Based on FactSet data, the Schwab Intermediate-Term U.S. Treasury ETF

SCHR,

SPDR Bloomberg 1-3 Month T-Bill ETF

BIL,

and iShares iBoxx $ Investment Grade Corporate Bond ETF

LQD,

had some of the biggest inflows in fixed-income last month, Kashner’s email shows.

But junk bonds funds struggled again last month. High-yield ETFs had almost $4 billion of redemptions in April, suffering a fourth straight month of outflows, according to State Street.

Commodity ETFs attract capital

Investors added capital to commodity ETFs in April, showing interest in precious metals and broad-based strategies, according to State Street. Check out the asset class flows for ETFs in the firm’s report:

STATE STREET GLOBAL ADVISORS REPORT

The Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF

PDBC,

iShares Silver Trust

SLV,

Invesco DB Agriculture Fund

DBA,

First Trust Global Tactical Commodity Strategy Fund

FTGC,

and SPDR Gold MiniShares Trust

GLDM,

attracted some of the biggest inflows among commodity funds in April, the email from FactSet’s Kashner shows.

On the bright side

Despite tumult for stocks and bonds this year, it’s been a “bull market for inflation-sensitive assets,” said John Davi, founder and chief investment officer of Astoria Portfolio Advisors, by phone. Shares of the actively managed AXS Astoria Inflation Sensitive ETF

PPI,

are up 14.6% this year through Wednesday, FactSet data show.

Another ETF has emerged as a bright spot amid this year’s selloff of stocks and bonds.

Shares of the actively managed Leatherback Long/Short Alternative Yield ETF

LBAY,

have soared 15.2% this year through Wednesday, according to FactSet data. The fund saw a 16.3% total return over that period, compared with a 9.4% loss for the S&P 500 on a total return basis.

It’s “a fully transparent ETF” that was launched in November 2020, said Michael Winter, founder and chief executive officer of Leatherback Asset Management, in a phone interview. “I report holdings nightly.”

Exxon Mobil Corp.

XOM,

and Bunge Ltd.

BG,

and Nutrien Ltd.

NTR,

have been the fund’s biggest winners on the long side this year, with Bunge and Nutrien each being a “food inflation play,” said Winter.

On the short side, bets the ETF made against Carvana Co.

CVNA,

an e-commerce business engaged in the buying of used cars and auto finance, Netflix Inc.

NFLX,

and pet insurer Trupanion Inc.

TRUP,

helped drive gains this year, he said.

A short bet is a wager that the price of a company’s stock will decline. Investors profit when their bets turn out to be correct, but short selling is generally risky as the potential for losses is unbounded.

“If you’re of the opinion that the market over the last decade or so has been driven by artificially low interest rates and Fed-fueled liquidity, well it’s turning the other way,” said Winter. “The Fed’s hand is forced with inflation. They have to do something.”

And that means the central bank is raising interest rates to tame the surge in the cost of living, which generally hurts valuations in the equities and bond markets, he said. But that’s also opened up many “opportunities on the short side,” said Winter.

The stock market sold off Thursday, with the S&P 500

SPX,

sinking 3.6%, the Dow Jones Industrial Average

DJIA,

falling 3.1% and the technology-heavy Nasdaq Composite

COMP,

tumbling 5%, according to FactSet data.

ETF launches

In new ETFs, J.P. Morgan Asset Management announced May 4 that it was launching the JPMorgan Nasdaq Equity Premium Income ETF

JEPQ,

an actively-managed fund that seeks to produce “attractive distributable yield while also delivering a significant portion of the returns associated with the fund’s primary benchmark, the Nasdaq-100 Index, with less volatility.”

“Investors are looking for yield, which is proving particularly challenging given the current economic backdrop,” said Hamilton Reiner, portfolio manager and head of U.S. equity derivatives at J.P. Morgan Asset Management, in the announcement.

Read: Stock market starts to price ‘rising risk of stagflation,’ says Research Affiliates CEO. Here’s how investors may be positioning.

In other recent launches, CI Global Asset Management announced May 3 that CI Galaxy Blockchain ETF

CBCX,

and CI Galaxy Metaverse ETF

CMVX,

would begin trading on the Toronto Stock Exchange. CI Global has a partnership with Michael Novogratz’s Galaxy Digital, according to the announcement.

As usual, here’s your weekly look at the top and bottom ETF performers in the past week through Wednesday, according to FactSet data.

The good…

| Best performers | %Performance |

|

KraneShares CSI China Internet ETF KWEB, |

11.4 |

|

Invesco China Technology ETF CQQQ, |

8.2 |

|

iShares China Large-Cap ETF FXI, |

7.0 |

|

EMQQ The Emerging Markets Internet & Ecommerce ETF EMQQ, |

6.6 |

|

iShares MSCI China ETF MCHI, |

6.6 |

| Source: FactSet, through Wednesday May 4, 2022 excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

…and the bad

| Worst performers | %Performance |

|

AdvisorShares Pure US Cannabis ETF MSOS, |

-6.4 |

|

Invesco DB Base Metals Fund DBB, |

-5.6 |

|

SPDR Dow Jones REIT ETF RWR, |

-5.1 |

|

iShares Residential and Multisector Real Estate ETF REZ, |

-5.0 |

|

iShares Paris-Aligned Climate MSCI USA ETF PABU, |

-4.9 |

| Source: FactSet |

Weekly ETF reads:

China-focused ETFs sink as Blinken reportedly plans to affirm China is main U.S. rival (MarketWatch)

Stagflation ETF Launches as Fed Attempts to Tame Sky-High Prices (Bloomberg)

These Equity ETFs Are Fighting Inflation (ETF.com)

US regulatory scrutiny of ‘complex’ ETFs prompts fears of crackdown (Financial Times)

BlackRock targets ‘industrial renaissance’ with new ETFs (Financial Times)

Anti-Ark ETF Adds Double-Leveraged Fund Mimicking Cathie Wood’s (Bloomberg)

ETF Flows in April Were Stronger Than They Might Appear (ETF Trends)

SEC lays out path to coveted spot-bitcoin ETF, but… (CNBC)