There are about 43 percentage points between the best- and worst-performing exchange-traded products (ETPs) in August, with returns for the month ranging from 28.4% to -14.6%.

We have looked at the key trends in the eight month of the year, excluding inverse and leveraged funds. These instruments, being purely passive products, reflect the evolution of the markets without the bias (good or bad) of an active manager.

The Leaders

According to Morningstar Direct, the podium of August’s Top 15 list of best performing ETFs sees three trackers exposed to the Turkish equity market (respectively provided by Lyxor, iShares, and HSBC).

Better-than-expected quarterly results (particularly from banks), a 100 basis point interest rate cut by the central bank (which has cooled the value of the lira and made it less volatile) and positive macroeconomic data on the back of a rebound in domestic demand – in turn driven by inflationary fears for the future (the highest inflation in 24 years has convinced consumers to bring forward their purchases in anticipation of higher prices) – have revived the interest of investors in Turkish stocks. Especially international ones, with the MSCI Turkey index rebounding by more than 24 percentage points in August.

Among the new entries in the ranking are two funds exposed one to the uranium mining industry and the other to its spot price.

In particular, in sixth position is the Sprott Uranium Miners UCITS ETF (URNM). This ETF seeks to invest at least 80% of its total assets in securities of the North Shore Global Uranium Mining Index, a benchmark designed to track the performance of companies that devote at least 50% of their assets to the uranium mining industry.

That may include mining, exploration, development, and production of uranium, or holding physical uranium, owning uranium royalties, or engaging in other, non-mining activities that support the uranium mining industry.

Three positions down follows the Global X Uranium UCITS ETF (URNG LN), tracker of the Solactive Global Uranium & Nuclear Components Total Return v2 Index.

The investment case of uranium mining came back into the spotlight last July, when the Joint Research Centre – the European Commission’s science and knowledge body – published an official document essentially endorsing the decision to include nuclear power in the EU’s sustainable finance taxonomy.

This turn of events shows how much the EU wants to encourage investment in the nuclear industry in order to accelerate the shift away from solid or liquid fossil fuels, including coal, towards a climate-neutral future, in addition to being able to achieve greater energy independence from Russia.

Finally, in addition to cotton, coffee and corn, among the month’s best-performing ETFs there still WisdomTree Natural Gas (NGAS), which gained 16% in August and 135% over the last year, propelled by the European energy crisis: on the Amsterdam gas exchange (the TTF), the gas price reached an all-time high of EUR 341 per megawatt hour on August 26 (on the same day a year earlier it was around EUR 45).

The Laggards

The ranking of ETFs that lost the most in August sees lots of instruments exposed to cryptocurrencies and digital assets.

After a promising start to the month, the declines started around mid-August and came after the release of the minutes of the Federal Reserve’s latest meeting, which strongly confirmed that the central bank will continue to aggressively seek to fight inflation.

Bitcoin, the largest cryptocurrency by market capitalisation, fell by around 13% in the month, while Ether lost around 20%. However, the data show that not all cryptocurrencies performed negatively mainly due to positive news involving some of them.

Cosmos’ ATOM token, for example, outperformed the broader crypto market, rising 14.5%. The increase came after the project said it will announce its “tokenomics redesign” at its upcoming conference in Medellin, Colombia, in late September.

Among the laggards, we then find three funds exposed to gilts, with the SPDR® Bloomberg 15+ Year Gilt UCITS ETF (GLTL) losing 10.2% in August. Last month marked the biggest monthly fall for British government bonds since 1994, as surging energy prices create a perfect storm of higher inflation, tighter monetary policy and the prospect of greater government borrowing.

British government bond prices have been under pressure all year, but the most recent sell-off gained momentum after the Bank of England raised interest rates by half a percentage point early August, its biggest increase since 1995.

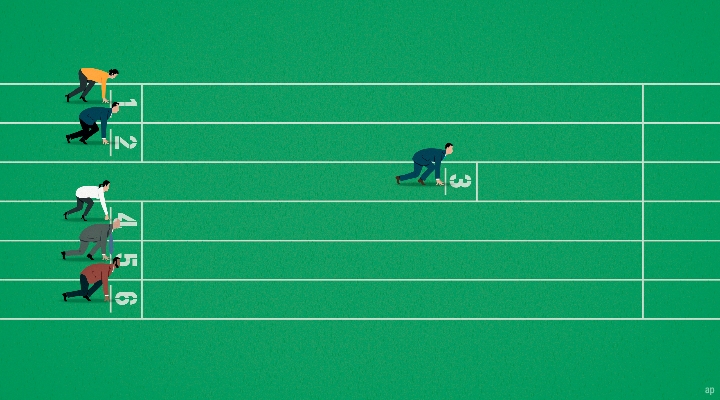

Monthly top and flop performers often coincide with very volatile and therefore risky products, which should play a satellite role in your portfolio. Below you have an overview of the biggest European-domiciled ETPs in terms of assets, which could be more appropriate to consider among core holdings.

Performances in August 2022 go from -1.3% of the iShares Core € Corp Bond UCITS ETF (IEAC) up to the iShares Core MSCI EM IMI UCITS ETF (EIMI), which gained 5.2% last month.