Canadian exchange-traded funds suffered their biggest monthly outflows since 2013 as investors dumped equity and cryptocurrency funds to escape a brutal selloff.

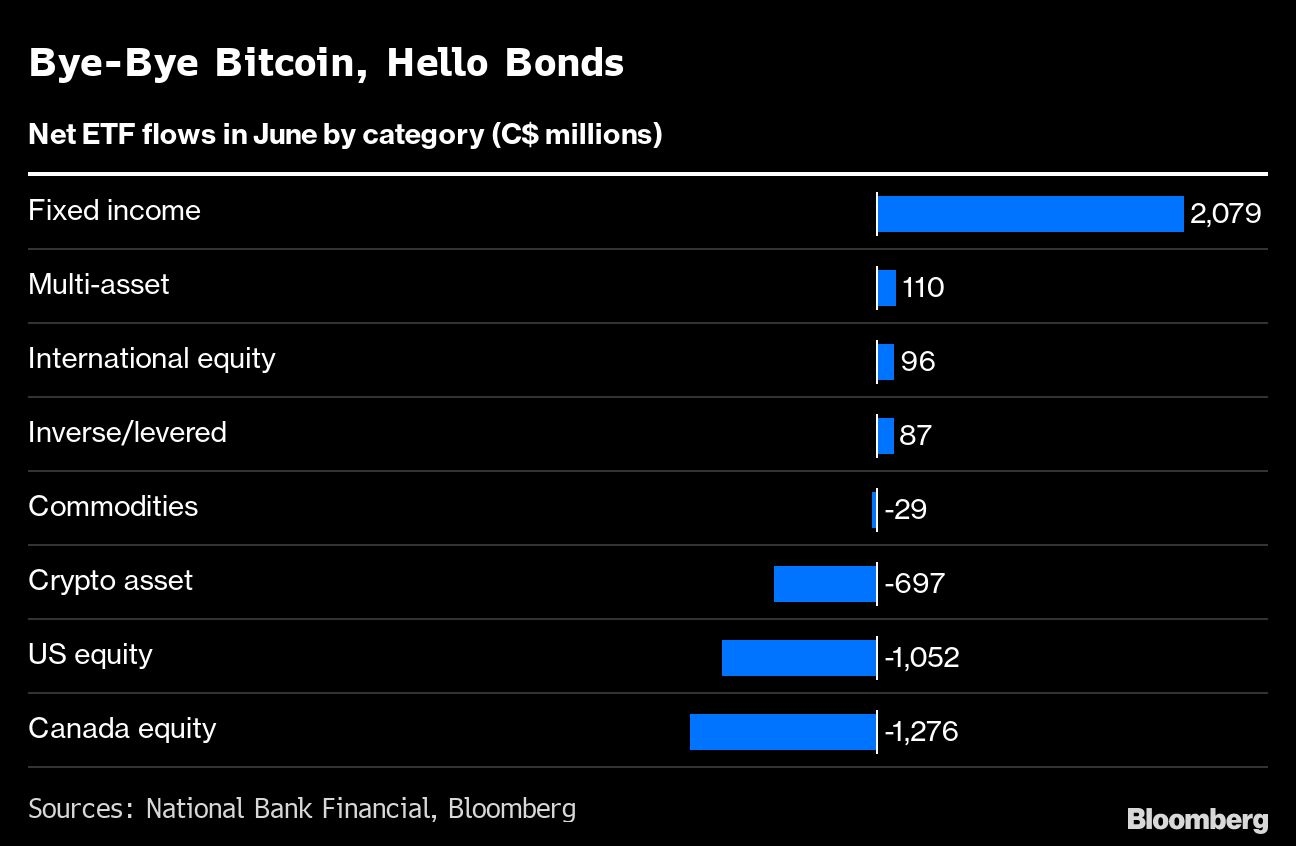

In a country that was early to embrace crypto exchange-traded funds, investors have abandoned them quickly. Crypto asset ETFs “faced sudden outsized redemptions” and saw nearly $700 million in net outflows in June, about 16 per cent of assets under management, National Bank Financial analyst Daniel Straus said in a report.

Equity ETF outflows came primarily from investors selling Canadian and US index funds. Total outflows for all Canada-listed ETFs were $682 million in June, the first monthly decline in three years.

RBC iShares, an alliance between Royal of Bank of Canada and BlackRock Inc., was hit with the biggest loss, more than $1 billion in withdrawals. An iShares fund that tracks Canada’s large-cap S&P/TSX 60 Index was hit with $719 million in outflows, or about 6 per cent of assets.

Investors poured $2.1 billion into fixed income ETFs during the month — despite the terrible performance of bonds so far in 2022 — “perhaps in expectation of a reversal in trend if central banks would be able to orchestrate a ‘soft landing,’ or to make strategic allocations as the yields on bonds finally start to make sense,” Straus said. Inflows into ESG-labeled funds were $292 million during the month.

Global equities and cryptocurrencies have plunged this year as soaring inflation and tighter monetary policy have triggered deep anxiety about a coming recession. The MSCI World Index has dropped 21 per cent this year and the S&P/TSX Composite Index has fallen more than 11 per cent.