Risk assets, including the crypto market, have shown broad weakness in recent history.

Although bitcoin has outperformed most altcoins lately, with investors fleeing the smallest and most risky coins, the price of bitcoin fell nearly 7% over the past seven days, dropping to under $36,000, below the critical technical level at $40,000.

While cryptocurrency losses have dominated headlines so far this year, this has been an extremely volatile asset with years of tenfold growth and other years with more than 80% losses. In 2020, bitcoin returned nearly 303% — the following year, in 2021, it returned over 57%.

For investors who want access to the growing crypto space but are looking to diversify their exposure and mitigate some of the volatility associated with spot cryptocurrency, there are two funds in Invesco’s line-up that are worth consideration: the Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF (BLKC), which takes a broader approach aiming to capitalize on blockchain developments, and the Invesco Alerian Galaxy Crypto Economy ETF (SATO), which offers more focused exposure to the cryptocurrency industry.

Rene Reyna, head of thematic and specialty product strategy, ETFs, and indexed strategies, Invesco, said that an optimal approach to digital assets investing is to consider the broad ecosystem, especially in a wrapper that most investors are already comfortable with owning — like an ETF.

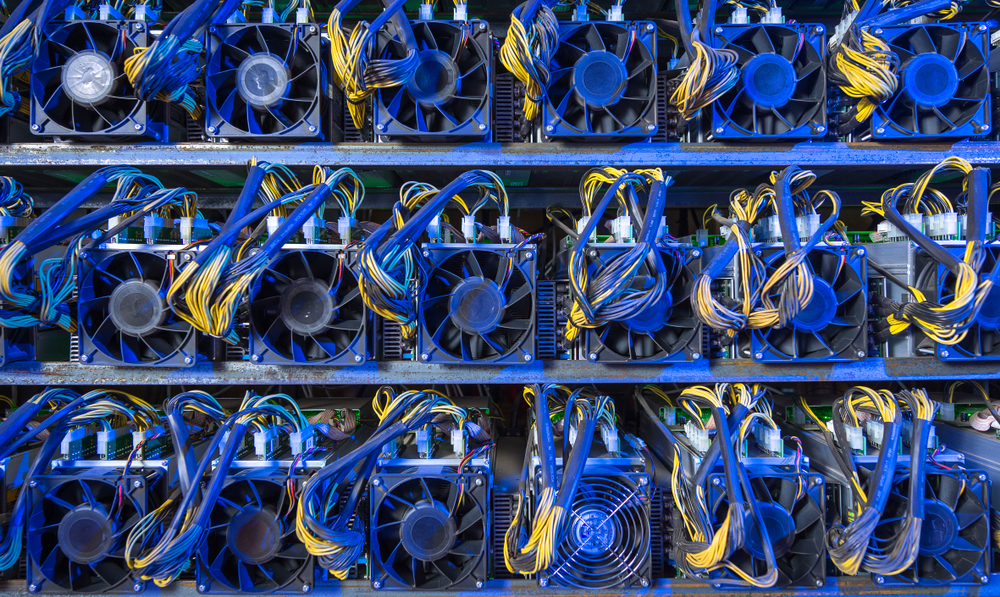

These broad ecosystem ETFs offer exposure beyond spot cryptocurrency, providing equities exposure to blockchain users and companies that are engaged in cryptocurrency and its relative mining, buying, or enabling technologies.

BLKC and SATO each use an equal-weighting approach, as opposed to a market cap approach, increasing diversification and lowering volatility for investors.

Reyna said equal weighting can reduce volatility, since it dilutes, to a degree, an investor’s exposure to bitcoin.

“GBTC, which is a current holding in our ETP sleeve, although it’s currently trading at a discount, is going to generally move in tandem with the Bitcoin marketplace. Same thing with your miners,” Reyna said.

BLKC and SATO each charge a 60 basis point expense ratio.

For more news, information, and strategy, visit the Crypto Channel.