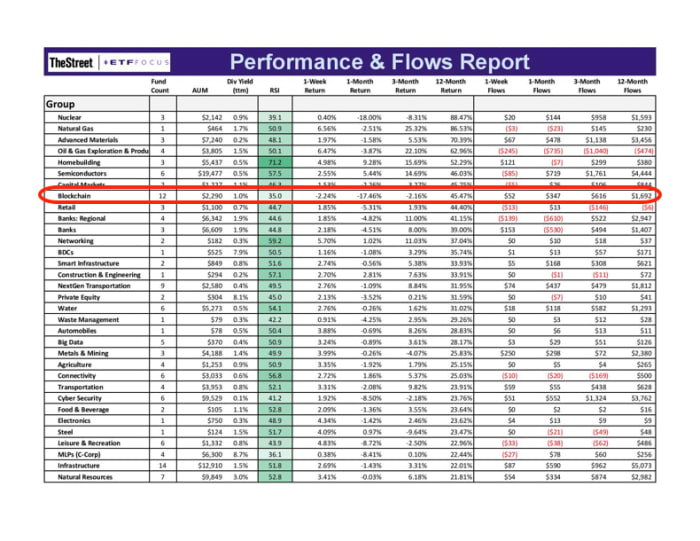

Blockchain has been one of the top performing market sectors of 2021. The link to bitcoin and ethereum is pretty clear and the sector clearly benefited from the crypto boom that occurred in the post-COVID recession environment.

Over the past year, blockchain has gained more than 45%, which puts it at #8 among 85 different market groups within the ETF Action database.

A year ago, blockchain ETFs accounted for less than $500 million in total assets. Today, that number is $2.3 billion and likely to keep climbing as cryptocurrencies gain more widespread acceptance and businesses begin migrating to defi as the next wave of technology.

Note: Interested in getting periodic e-mail notifications when articles are published here? Drop your e-mail in the box below!

The blockchain ETF space began in 2018 with the launch of 4 different funds within two weeks of each other. It wasn’t until 2021 that a 5th ETF debuted, but it was just one of 9 new ETFs that entered the space this year. ETF issuers clearly see a great deal of potential in this space and want to jump on the trend. Where the original blockchain ETFs attempted to target more pure blockchain plays, many of the ones that launched this year go beyond pure plays and may include more direct crypto plays, crypto miners and others. The blockchain space is evolving and the ETFs targeting the industry are evolving with it.

With an increasingly diverse set of investing options available, here are the 6 blockchain ETFs that you should consider for 2022.

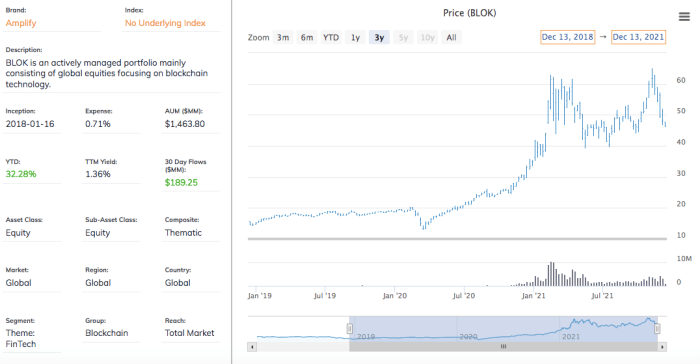

Amplify Transformational Data Sharing ETF (BLOK)

BLOK was the first blockchain ETF to debut and remains my favorite within this universe. Thanks to its first mover advantage, BLOK manages nearly 2/3 of the total assets in this space, making it easily the most liquid and cheapest to trade.

My approval of BLOK goes beyond the numbers. The biggest advantage for the fund is that it’s actively-managed, making it one of only 4 ETFs in the space that do not track an index. Given how rapidly the blockchain space is evolving and changing, being actively-managed is incredibly important to remaining nimble and responsive to the latest trends. Passively-managed funds may update only once every six months and could get left behind from where the industry is headed.

BLOK’s objective is simple – invest in the equity securities of companies actively involved in the development and utilization of blockchain technologies. The fund’s 0.71% expense ratio is slightly higher than the group average, but considering that you’re getting an actively-managed portfolio for a mere few basis points more than one of the index funds makes BLOK a clear favorite choice for blockchain exposure.

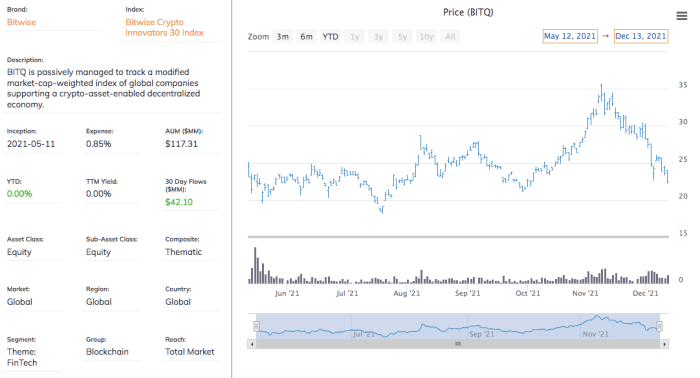

Bitwise Crypto Industry Innovators ETF (BITQ)

Bitwise is one of the global leaders in crypto asset management and proper indexing, so if you’re looking for blockchain exposure, there are few better companies to have driving the bus. Bitwise is one of the largest crypto asset managers, with over $1.6 billion in assets.

BITQ is an index fund and offers exposure to the fast-growing bitcoin and crypto economy without the complications of owning cryptocurrencies, such as bitcoin, directly. BITQ will not hold individual cryptos.

It targets having at least 85% of the portfolio in pure play crypto companies, including bitcoin- and crypto-trading venues, crypto mining & mining equipment firms and service providers, such as Coinbase, Silvergate Capital and MicroStrategy. Up to 15% of assets can go into what the company calls “supporting” companies, such as PayPal, Nvidia and Square.

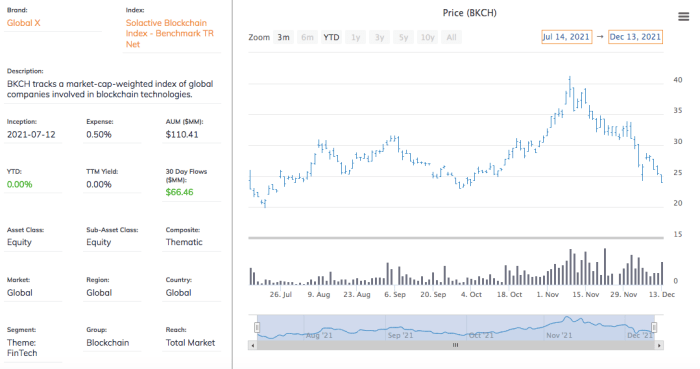

Global X Blockchain ETF (BKCH)

Global X is a leader in the thematic ETF space, so it’s not at all surprising to see it developing a blockchain ETF. Like other funds in this space, BKCH invests in companies positioned to benefit from the increased adoption of blockchain technology, including companies in digital asset mining, blockchain & digital asset transactions, blockchain applications, blockchain & digital asset hardware, and blockchain & digital asset integration.

While I’m not a big fan of the fund’s index-linked approach, it is one of the more competitively priced offerings at 0.50%. In high growth sectors, such as blockchain, minor advantages in cost probably won’t be a driving factor in decision making, but BKCH has already grown to $110 million in assets, so it does fall on the cheaper end of the spectrum.

Top holdings include Coinbase, Riot Blockchain, Marathon Digital and Hut 8 Mining.

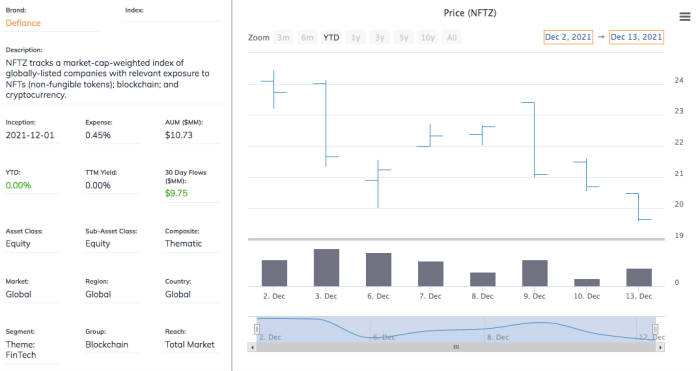

Defiance Digital Revolution ETF (NFTZ)

If you hear about an “NFT ETF” in the news lately, this is the fund they’re talking about. That characterization is a bit of a misnomer since it isn’t actually investing in non-fungible tokens, but if you’re looking for some exposure to the space, this ETF might be the closest you can get at this point.

NFTZ was just launched two weeks ago and is quite tiny, so investors might want to hold off until it becomes a little more investable. It tracks the composition of the BITA NFT and Blockchain Select Index, which is comprised of stocks with relevant thematic exposure to the NFT, blockchain and cryptocurrency ecosystems. Eligible companies mus either derive revenue from the crypto & blockchain space or offer issuance services and investment in NFTs.

The specific call-out of NFTs make this fund a little more unique than some of the other ETFs listed above, but NFTs will be such a small part of a company’s overall business model that it’s probably best to just consider this a straight blockchain ETF for the time being.

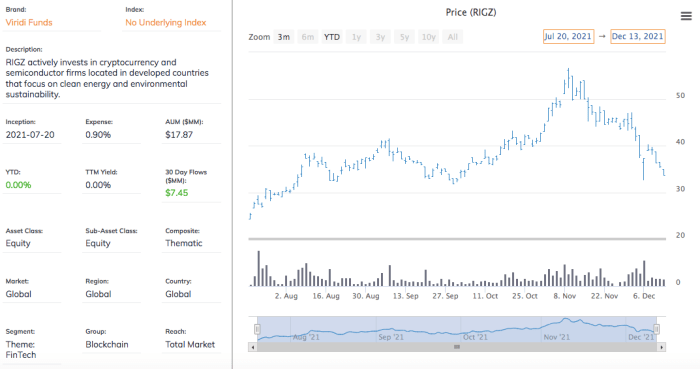

Viridi Cleaner Energy Crypto Mining & Semiconductor ETF (RIGZ)

RIGZ is unique in that not only is it focused on the crypto mining space, it’s focused just on those miners that meet certain “clean energy” screens. In particular, the fund considers the size of the miner’s operation, the energy mix of the miner’s operation, the subcategory of energy mix, purchased carbon offsets and future expected clean energy commitments made by miner’s management team.

The semiconductor piece is more of a separate piece to the RIGZ portfolio. It will focus on those names that develop or manufacture computer chips used in crypto-mining industries, but adds that “investments in these firms will not be limited to those that are solely focused on the crypto-currency industry.”

RIGZ debuted just five months ago and is relatively small with just $18 million, but it is actively-managed. The 0.90% expense ratio is a little on the high side, but could find interest from investors willing to leverage a preference for ESG investments or believe that clean energy is an attractive longer-term play.

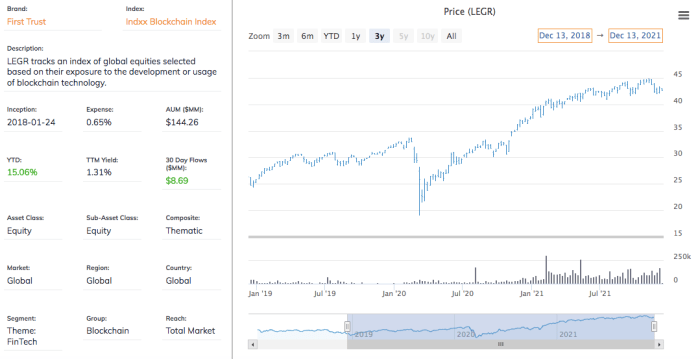

First Trust Indxx Innovative Transaction & Process ETF (LEGR)

In my latest ETF Focus fund rankings, I have LEGR as my #2 ranked blockchain ETF. It deserves a spot on this list based on asset size, tradeability and below average costs alone.

LEGR is a little more interesting because it tiers potential components based on their exposure to the industry and weights them appropriately. “Active enablers” are actively developing blockchain technology products or systems for their own internal use and for the sale and support of other companies. “Active users” are companies that are using blockchain technology that is generally supported by an active enabler or have at least one use or test case of using blockchain technology. “Active explorers” have publicly disclosed that they are active in exploring the incorporation of blockchain technology into their business.

Within the portfolio, active enablers receive 50% of the portfolio weighting, while active users receive 50%. The selected companies are weighted equally within each category and the index is capped at 100 constituents.

Note: Interested in getting periodic e-mail notifications when articles are published here? Drop your e-mail in the box below!

Read More…

144 Dividend ETFs Ranked For 2022

Roundhill Launches A Meme Stock ETF

87 Technology ETFs Ranked For 2022

ARK Transparency ETF To Launch: Here’s What You Need To Know

ETF Battles: ARKK vs. GTEK – Which Is The Best Growth ETF?

Top 4 SPAC ETFs For 2022

Why The 3rd Bitcoin ETF Is Better Than The First Two

Invest In The Metaverse? There’s An ETF For That!