[ad_1]

In this article, we examine the significant weekly order flow and market structure developments driving XLE’s price action.

The primary expectation for this week’s auction was for price discovery lower within the context of an incomplete corrective phase from 64.60s. This week’s primary expectation did not play out as price discovery to key support, 61.80s, was met with buying interest early week developing balance, 61.74s-63.44s, before a sell-side probe developed to 60.88s ahead of Thursday’s close, settling at 61.28s.

29 July-01 August 2019:

This week’s auction saw buying interest early in Monday’s auction amidst buy excess at key demand. Balance development ensued, 61.74s-62.25s, into Monday’s close. Price discovery higher ensued in Tuesday’s auction driving price higher to 63.05s before selling interest emerged, 62.87s, into Tuesday’s NY close. Tuesday’s late sellers failed to hold the auction as price discovery higher continued in Wednesday’s trade to 63.44s where buyers trapped amidst sell excess halting the buy-side sequence. Aggressive long liquidation developed to 62.18s ahead of Wednesday’s close as selling interest emerged, 62.69s-62.66s.

Wednesday’s late sellers held the auction as a gap lower open developed, driving price lower in a sell-side breakdown. Price discovery lower developed to 60.88s ahead of Thursday’s close, settling at 61.28s.

NinjaTrader

NinjaTrader

This week’s auction saw buying interest emerge at key demand early week, driving price higher to 63.44s where selling interest emerged with key supply, driving price lower as a sell-side breakdown attempt developed into Thursday’s close. Within the larger context, this week’s sell-side phase developed within a larger corrective phase from 64.66s.

Looking ahead, the focus into Friday/next week will center upon response to this week’s sell-side breakdown attempt at 61.80s. Buy-side failure to drive price through this key supply will target key demand clusters below, 60.75s-60.40s/60s-59.50s, respectively. Alternatively, sell-side failure to defend this area will target key supply clusters overhead, 63.50s-63.90s/64.30s-64.68, respectively. From a structural perspective, the highest probability path for next week is sell-side within the context of a likely incomplete corrective sequence from 64.68s.

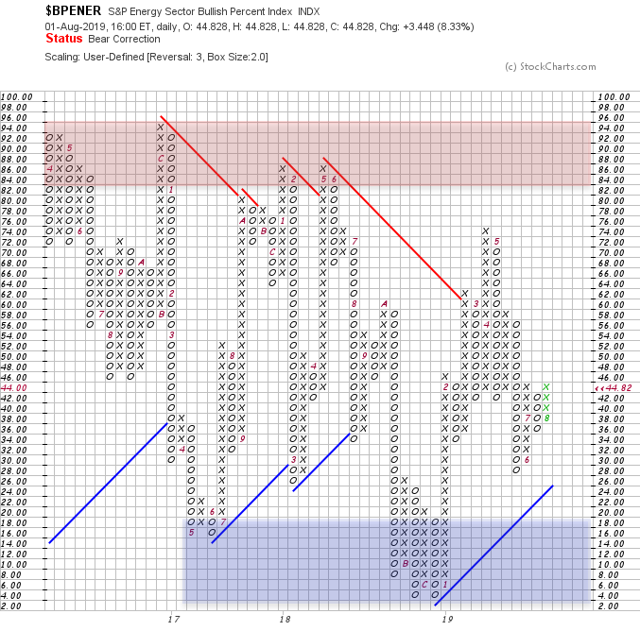

It is worth noting that sentiment based on the S&P Energy Sector Bullish Percent Index bottomed into early June, consistent with the termination of the correction from April’s high. Stocks more broadly, as viewed via the NYSE, have now also seen a bounce from a similar level. At present, sentiment is neutral in both the broad market and energy sector. Asymmetric opportunity develops when the market exhibits extreme bullish or bearish sentiment with structural confirmation. Currently, conditions favor a neutral bias.

StockCharts

StockCharts

The market structure, order flow, and sentiment posture will provide the empirical evidence needed to observe where asymmetric opportunity resides.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News