We recently spoke with Stephen Blumenthal, the ETF strategist heading CMG Capital Management Group in King of Prussia, Pennsylvania, on the sidelines of Inside ETFs this month. The well-known tactical asset manager said one of four key recession signals is now flashing, even if a potential recession may still be several months off. Luckily for ETF investors, there are plenty of tools with which to manage looming risk, including some fresh innovation in the ETF space.

We recently spoke with Stephen Blumenthal, the ETF strategist heading CMG Capital Management Group in King of Prussia, Pennsylvania, on the sidelines of Inside ETFs this month. The well-known tactical asset manager said one of four key recession signals is now flashing, even if a potential recession may still be several months off. Luckily for ETF investors, there are plenty of tools with which to manage looming risk, including some fresh innovation in the ETF space.

ETF.com: At Inside ETFs, a lot of the conversation centered on the macroeconomy, on concerns about a recession. Are they overblown? As a tactical investor, what’s your big-picture view?

Steve Blumenthal: The reason recession is so important for all of us investors is that that’s when the bad stuff happens. You get the massive amounts of defaults. High yield and debt markets really come unglued, especially the higher risk. The equity markets’ average decline is 37% in all the recessions that have happened since 1950. The last two recessions saw a 50% decline in markets.

Because of how high the debt is within our system, how high margin accounts are, how high corporate debt is, how high we are relative to all times in history, when you have a recession, it’s very hard for people to find funding. Businesses are operating on borrowing and suddenly can no longer borrow; liquidity dries up.

ETF.com: What signals do you look at specifically to assess the risk of a recession—one that would cause you to reallocate assets?

Blumenthal: There are ways for us to get in front of a recession.

Once a month, I post the latest recession charts. I’ve got four recession-watch charts. The first one is employment trends. There’s an employment trend index, and it’s measuring whether employment trends are increasing, and businesses are hiring, so things are good. When it’s decreasing, then something’s happening. We’re starting to deteriorate on that chart. When the employment trends index drops by roughly 4% from any high, you start to get concerned. That’s an economic contraction signal. When it starts to rise by about 1% from a low, it’s an expansion signal.

This signal has avoided every recession since 1980. It typically has some lead time, so when you start to see that move, recession usually follows, but not right away.

Another chart looks at the stock market, which is a leading economic indicator, and rolls over and tops prior to recessions. This chart actually fired a sell signal—or a recession signal—at the end of January. Specifically, you’re looking at the five-month moving average of the S&P 500 Index. If it declines by about 4.5% from any high, you start to get concerned. That’s a contraction signal. Now, that indicator has an 80% accuracy rate since 1978. So, for now, just keep the lights on.

We also follow the yield curve. When it inverts—meaning the short-term yield is higher than the 10-year yield—something’s messed up in the system. You should be rewarded for owning longer bonds than shorter-duration bonds. It has a high accuracy rate, and typically a 12- to 14-month lead time to recession when it inverts. At the end of January, we were just 13 basis points from inverting. Since then, it’s backed off a little bit, but should be watched.

The last one follows lending conditions, meaning, can people get a loan? If you’ve got this huge maturity calendar, companies are borrowing, individuals are borrowing—when credit conditions are good, we can refinance, we can continue to party on. When credit conditions invert, they’re bad. Currently, the lending conditions are strong. I see no immediate risk as it relates to that indicator. That also has a very high accuracy rate.

The Stock Market and the Economy

For a larger view, please click on the image above.

The Employment Trends Index and the Economy

For a larger view, please click on the image above.

NDR Credit Conditions Index

For a larger view, please click on the image above.

Yield Curve Recession Indicator

For a larger view, please click on the image above.

Global Recession Watch Indicator

For a larger view, please click on the image above.

ETF.com: Do you need all four indicators to turn to say recession is really here?

Blumenthal: I’m a weight-of-the-evidence kind of person. I’m looking at the odds. And when you start seeing several of these things line up, you get really concerned.

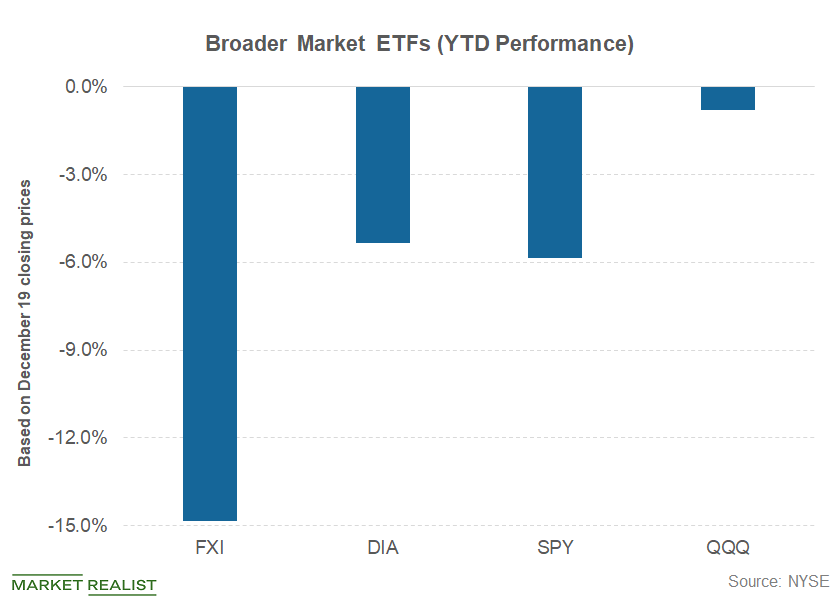

I wouldn’t just trade on the stock market indicator. And part of the reason is that we know what happened in the fourth quarter of last year. That’s largely why that fired a signal.

But the Fed has made a complete U-turn in a month in policy. There’s some sort of footing by Fed policy to the downside of the market. So I wouldn’t use that as my only indicator to say “let’s hedge everything we’ve got.” But it’s a warning. So far, I see no recession in six months.

ETF.com: As an asset manager, when do you start reallocating, going defensive, possibly giving up some upside potential?

Blumenthal: There are multiple ways to manage risk. I like to diversify to trading strategies.

Somebody might follow a 200-day moving average as a risk-off/risk-on type of measure; somebody might say that when this recession evidence has advanced, we’ll do things to reduce exposure; and some will use the wonderful world of ETFs to find other types of ETFs that might do better. For example, value plays, which have been completely out of favor, probably will outperform relative to growth plays. You kind of de-risk your portfolio that way.