It’s that time again — welcome to the latest edition of Tim Bohen’s Take. We’ll talk about Midwest Traders and much more!

You’re about to read about the adventures I had while presenting on stage alongside my most famous friend, Mr. Tim Sykes…

I’ll also tell you about a bunch of traders from the Midwest getting up to some farmhouse mischief…

You’ll learn about a few awesome trade setups in a single stock that was recently on the Weekly Watchlist and a favorite in StocksToTrade Pro chat.

I’ll also tell you about how I’m working to tame my inner critic so that I can better focus on all things trading and fitness.

Let’s dive right in.

What’s the Haps

Well, gang, I’ve had quite an action-packed life recently…

I had an absolute ball last month, attending the TradersEXPO in Chicago with Tim Sykes.

Sykes and I had the honor of presenting on stage together a few times.

I know some people hate public speaking … but I gotta say, I love getting up and talking trading to a bunch of traders. And public speaking is easier when you’re presenting alongside Sykes — that guy can talk!

It’s also great meeting so many traders in person between presentations. I think traders are generally a pretty cool bunch.

I really recommend that you attend a TradersEXPO event if you have the opportunity. These events can be so great … and they’re free to attend. You can meet other traders, listen to interesting talks, and get some pretty advanced education. There’s no reason not to go!

Apart from that, I got to hang out with Sykes and a bunch of his top students in what we’ve called the Midwest Traders Meetup.

That was a lot of fun. Sykes secured a big farmhouse about 45 minutes down the road from my house. So, take a bunch of Midwest traders, stick ‘em in a farmhouse, and throw in some free time … That’s a recipe for a good time and maybe some shenanigans.

Thankfully the farmhouse is close to my place, so I was able to drive home and sleep in my own bed.

Something I find really interesting is how there are so many successful traders and top Sykes students that come from the Midwest. It’s hard to know why that is exactly. Maybe it has to do with the cold winters and the kind of personality you need to develop to endure them…

Think about it. If you head outside in a t-shirt and shorts in the middle of January in Michigan … you wouldn’t last long. In a cold Midwest winter, you need survival skills. You gotta grind it out, salt driveways, shovel snow, and cut firewood.

Now, I think it’s that grinding, persevering mindset that can help a lot with learning to day trade. Day trading isn’t about getting started and then making millions super fast. It’s about grinding things out step by step, getting after it, and working to improve each and every day…

But, hey, I could be wrong about all of this. Sykes has the simple explanation that there’s just nothing to do in the Midwest, so traders have nothing better to do but focus on learning…

Maybe it’s a little of both.

The Setup of the Week

Picking this edition’s setup was super easy. It ticks so many boxes for what makes a setup exciting. In fact, you could say there were multiple setups in one stock…

If you receive our weekly watchlist, you’ll likely recall this stock.

I’m talking about Smith Micro Software, Inc. (Nasdaq: SMSI), a little tech company in the exciting Internet of Things (IoT) sector.

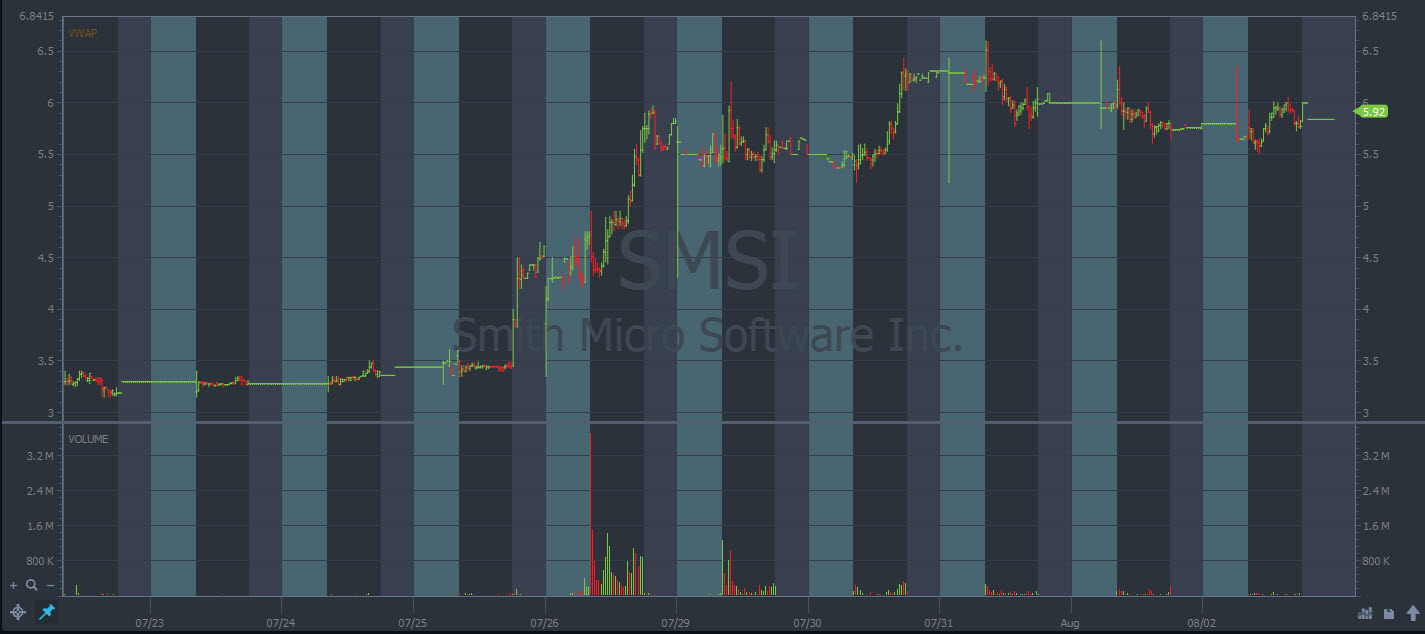

Smith Micro Software, Inc. (Nasdaq: SMSI) with an earnings play breakout (Source: StocksToTrade)

Smith Micro Software, Inc. (Nasdaq: SMSI) with an earnings play breakout (Source: StocksToTrade)

For this stock, we had an earnings winner, a ‘real’ company doing REAL things, a 52-week breakout, and multiple opportunities for good trades.

It all started when the company released earnings on the night of Thursday, July 25. When the market opened on Friday, there was a killer dip in the morning before the stock rebounded and broke the high of the day.

We quickly saw the stock spike $1 or so from $5 to almost $6. A pretty quick and easy trade for anyone watching.

Over the following weekend, we had SMSI on the weekend watchlist. We talked about the possibility of a dip and possible reclaim of the high in the coming week.

That’s basically spot-on for what happened. The market opened on Monday, the price dipped and then spiked all the way to $6.25. Another pretty straightforward trade for anyone who was watching SMSI that day.

But, it wasn’t until Tuesday that we saw what was probably the best set up on the stock.

On Tuesday, we saw the stock once again break the $6 level. Everything was lining up. We had a 52-week high, a break of a whole dollar/half dollar level, a new recent high, and solid volume. And a lot of traders in the StocksToTrade Pro chat noticed it too.

That Tuesday, the stock rocketed up to the $6.40–$6.50 level for a pretty killer day trade opportunity…

That’s a great example of a great setup, and much of it is thanks to earnings season … I actually tell many new traders that earnings season is where they should try to trade.

In earnings season you can find real, low-priced companies making solid moves. It’s not always just sketchy crypto and pot stocks.

Here’s my advice: Earnings season goes for about six weeks, four times a year. That’s 24 weeks or almost half the year. If you’re new to trading, this can be a great time to focus on trading. And when it’s not earnings season, focus on developing your skills.

StocksToTrade Feature of the Week

There’s an awesome feature that you can make full use of — even if you’re not a StocksToTrade member.

It’s the free monthly educational webinars that we run here at StocksToTrade…

Each month, we assess what our customers are asking for. Maybe they want help on how to use VWAP or advice on risk management…

I recently did a webinar on short-selling, which you can check out here…

These webinars are usually pretty fun. We dive deep in them and often get into some pretty advanced tactics. They’re once a month, generally last about an hour, and there’s a Q&A session at the end.

So, free education, anyone can attend, and you can ask your big trading questions … What more can you ask for?

Grab your spot in the next free monthly webinar — click here to sign up!

What Am I Reading Now?

For regular readers of my updates, it’ll probably seem like I mention Kim Ann Curtin, The Wall Street Coach, all the time…

No, I’m not obsessed, but I’m a big fan. My sessions with her have been pretty darn powerful.

Kim currently has me reading a book called “Taming Your Gremlin: A Surprisingly Simple Method for Getting Out of Your Own Way” by Rick Carson.

The book is all about that little voice inside your head that I think we can all struggle with at times. I’m talking about that self-talk that can affect your self-esteem and how you see yourself.

I for one know that my inner commentary can be BAD … If I said some of the things that I say to myself to other people, I’d probably get into a number of fights each day. Not good!

Carson’s book is all about taming that inner critic so that you can work toward harmony and high performance in your life. A lot of the tactics are very meditative, which, turns out, is great timing for me…

I’ve been a big fan of meditation for a long time, but at some point, I fell off the wagon. I’m now jumping back on board thanks to the Ten Percent Happier meditation app. I’ll you know how it goes in future updates.

Tim Bohen’s Take: The Wrap

That’s it for now.

If you struggle with critical self-talk, Carson’s book might help you tame your inner gremlin.

Even if you don’t do that, I invite you to come and use the Ten Percent Happier app with me. I’m going to try and do a streak of months without missing a day of meditation … Hopefully, I can do it. Try to match me and tell me how it’s affecting your trading in the comments below or on social media.

That SMSI earnings play and the subsequent trade setups were pretty darn good. I hope you’re able to learn a powerful lesson with my breakdown above.

If you like those kinds of setups, you need to know two things:

First, this stock was on the weekly watchlist. We send it out every weekend, and it’s completely free. Sign up to receive the watchlist here if you’re not already on our list…

Second, these are the kind of setups we hunt for each and every day in StocksToTrade Pro. That’s our elite trading community where you can see my screens, hear my thoughts, attend webinars, and participate in our chat room.

If you want to hone your trading skills and have fun along the way, join StocksToTrade Pro now!

Tim Sykes and I have different opinions about why the Midwest creates many great traders. Why do you think it happens? I’d love to hear your thoughts — leave a comment below!