Just three months ago, investors were in a panic over the idea that the Federal Reserve might push borrowing costs too high and tip the United States economy into a recession. Now, Wall Street is toying with the idea that the central bank could actually be cutting interest rates by the end of the year.

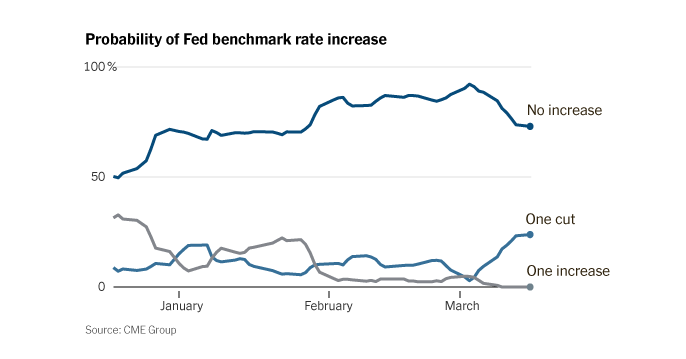

Those forecasts are evident in the market for interest rate futures, where the odds of another interest rate increase in 2019 have fallen to zero, from about 30 percent in December, while the chance of a decrease in rates has risen to almost one in three.

One reason for the changing forecasts? The Fed’s own signal to be more patient as it evaluates whether or not to keep raising interest rates. Since the central bank’s chairman, Jerome H. Powell, first spoke about this newfound patience, stocks have soared more than 15 percent.

“It’s been a night-and-day difference, the outlook for stocks going from December into the first quarter this year,” said Chris Rupkey, chief financial economist at MUFG Union Bank in New York. “And I think you could say that Federal Reserve policy was very important in underpinning the stock market rally.”

On Wednesday, the Fed left interest rates unchanged and members of its monetary policy committee issued projections that showed they expected no interest rate increases in 2019. Although stocks ended the day slightly lower, they rose in the afternoon after the central bank announced its decision.

The Fed isn’t the only reason that the market is up. Some analysts point toward rising hopes for a United States-China trade deal as helping to lift important technology and industrial shares.

But sectors sensitive to interest rates — small companies for which borrowing costs make up a significant expense, and homebuilders and carmakers whose customers depend on financing — have posted some of the bigger gains in this rally.

The stock market has risen even as forecasts for economic growth have shown concern about a slowdown. Economists expect that the United States grew at an annualized pace of less than 2 percent in the first quarter, a slowdown from the 3 percent growth posted in 2018.

And stock analysts have continued to downgrade their expectations for profits this year. Since the end of 2018, full-year profit estimates for companies in the S&P 500 have declined 3 percent, according to FactSet, a financial data provider.

Investors who have so far sat out the 2019 rally, because of concerns about the economy or profits, may be coming around to the idea that it is a mistake to do so when the Fed is so clearly the primary driver of gains.

Last week, more than $25 billion surged into funds that buy American stocks, according to data from EPFR Global, a firm that tracks mutual funds and exchange-traded funds.

“It could be that the chase is on,” said Michael Hartnett, chief investment strategist at Bank of America Merrill Lynch. “People could be suddenly saying, ‘I’ve got to get involved.’”