[ad_1]

paule858

Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF (NYSEARCA:SRVR) invests in a comparatively small cohort of real estate investment trusts and traditional corporations with significant tech exposure, which are at times called tech REITs for the sake of simplicity. Most of the revenues for these players come from data centers, cellular towers, etc.

Common stocks and REITs from this segment saw strong investor attention a few years before the pandemic and also remained comparatively resilient to the coronavirus headwinds, as their revenues were bolstered by advances in artificial intelligence, big data, cloud computing, and 5G that translated into resilient demand for their properties, while the robust market appetite for growth regardless of valuation contributed to the expansion of their trading multiples.

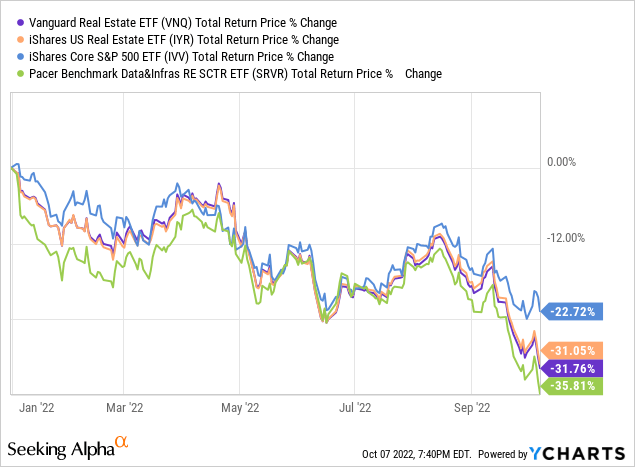

Yet as inflation, higher interest rates, and the subsequent capital scarcity issue made investors rotate out of generously valued names, exiting the pandemic winners at an unprecedented pace, the broad tech sector bore the brunt. Uncoincidentally, the sell-off reverberated through tech REITs also, with SRVR’s holdings suffering badly. After delivering double-digit returns for three years since inception in a row, SRVR is down by almost 36% this year, which dwarfs even the ~33% decline in the Invesco QQQ ETF (QQQ), the U.S. tech barometer, let alone the iShares Core S&P 500 ETF (IVV).

Even though a great deal of froth has arguably been removed, I highlight the risks that are still in the mix, principally related to the ETF’s inherently generous valuation, and the purpose of my article today is to elaborate on what issues deserve closer attention before investing in SRVR or any other vehicle with a similar investment paradigm.

What is at the core of the strategy?

The cornerstone of SRVR’s strategy is the Kelly Data Center & Tech Infrastructure Index, before November 2021 known as the Benchmark Data & Infrastructure Real Estate SCTR Index.

It features a three-step process when the universe of the developed market companies is screened for those with at least 85% of revenues coming from real estate operations; these names form the Kelly Composite Real Estate Index.

After that, the property, tenant, and revenue types are taken into account to whittle the list down to those eligible for inclusion in the data center & tech infrastructure sector. In a nutshell, such companies must have either 50% of revenues or profits coming from

… owning or managing real estate used to store, compute, or transmit large amounts of data (e.g., data centers, communications towers).

There are other rather typical criteria concerning market cap and liquidity, i.e., companies valued at less than $500 million are shown the red light. The reconstitutions and rebalancing happen every quarter.

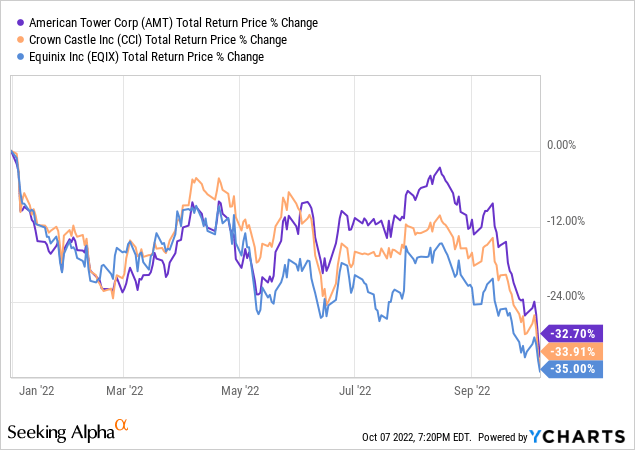

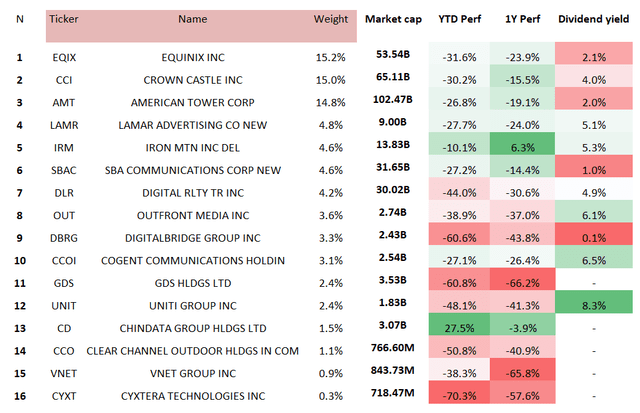

The product of this strategy is a portfolio encompassing 22 names at the moment, heavily concentrated in just three positions, Equinix (EQIX), Crown Castle (CCI), and American Tower Corporation (AMT) that each sport weight either slightly above or below 15%. Valued at ~$672 million, Cyxtera Technologies (CYXT), a global data center operator, is the smallest holding in the portfolio; for this IT company, 2022 has been merely catastrophic as its share price has declined by around 75%. As illustrated by the chart below, the year has been exceedingly challenging for the top trio as well.

In terms of sectors, real estate is expectedly the fund’s favorite, with a weight in excess of 76%, while there are also communication services names in this basket, accounting for almost 15%, and those from IT sporting ~8.9% weight.

It should be noted that U.S.-quoted players account for most of the portfolio, thus somewhat immunizing the NAV against the pressure the higher interest rates in the U.S. put on global currencies, yet a few DM companies could also be spotted, like London-quoted Helios Towers plc (OTCPK:HTWSF) (London ticker HTWS). And even though phenomenal softness in the pound sterling that defied bears’ gloomiest expectations has likely been amongst detractors from SRVR’s performance this year, the impact has been rather marginal since the stock has just ~1.5% weight.

Overall, we see players listed outside of the U.S. accounting for around 18%, mostly in Europe, like Milan-quoted Infrastrutture Wireless Italiane SpA (OTCPK:IFSUF), a heavyweight Italian tower operator with Vodafone Group (VOD) amongst key customers, and Barcelona-based Cellnex (OTCPK:CLLNY), with wireless telecommunications infrastructure assets in France, the UK, the Netherlands, Italy, etc., to name a few. In this regard, further developments in the eurozone in terms of interest rates and a possibility of a full-scale recession are to watch as they can send the euro lower, thus also eating into SRVR’s returns.

A closer look at performance

As I said above, due to rising interest rates in the U.S. and their impact on investors’ appetite for risk, a solid deal of the past gains have been removed from SRVR this year; uncoincidentally, assuming growth deceleration supervening from more expensive capital, this has also been the case for other real estate plays like the iShares U.S. Real Estate ETF (IYR) and the Vanguard Real Estate ETF (VNQ).

If we look at the U.S.-quoted players in the ETF portfolio, just one name somehow managed to deliver a positive return this year, and a solid one, namely Chindata Group (CD), a carrier-neutral hyper-scale data center solution provider with operations in the key Asia-Pacific developing countries. Others are deeply in the red, with above mentioned CYXT being the weakest.

Data as of October 6 (Created by the author using data from Seeking Alpha and the fund)

Valuation and quality issues under the hood

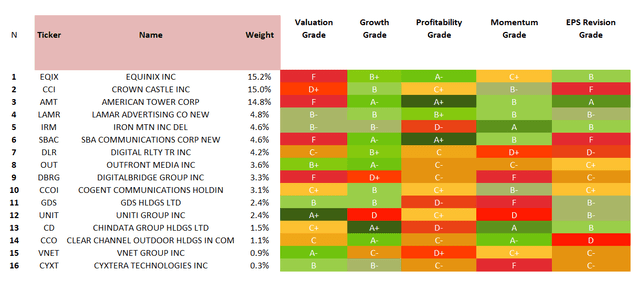

The question is whether this means softness should be treated as a buying opportunity. I would like to answer that question with the table below.

Data as of October 6 (Created by the author using data from Seeking Alpha and the fund)

What we see here is a meaningful share of companies priced for perfection; specifically, ~53% have a D+ Valuation grade or worse.

The ~1.6% dividend yield of the fund is another indication of the valuation problem inherent to it; this is partly the consequence of a few holdings not paying dividends, while also a sign of the expensiveness of others manifested in bloated multiples. Besides, quality looks fairly questionable, as less than 40% of the holdings have at least B- Profitability grade.

Large exposure to the growth factor (over 75%) is a benefit worth mentioning, yet I am skeptical about favoring growth over quality and value at this juncture.

Final thoughts

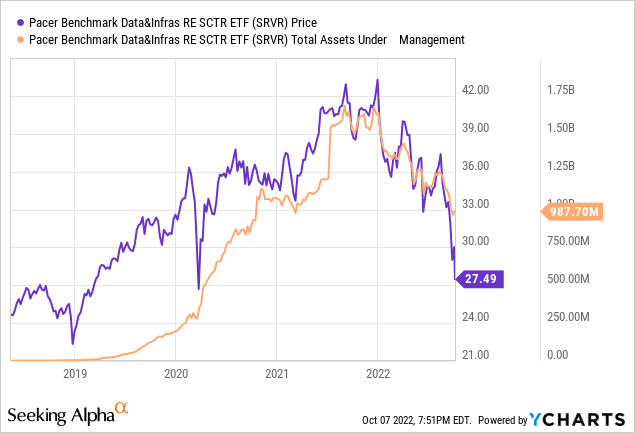

Rock-bottom interest rates that contributed to the outstanding performance of tech REITs secured a perfect backdrop for its assets under management to increase by around 10x from mid-2019 to mid-2021.

However, the ultra-loose monetary policy also grossly contributed to the persistent inflation, which was aggravated by supply chain issues and the energy crisis manifested in skyrocketing crude prices. As hawks stepped in, SRVR’s outperformance stopped.

Leveraging a hybrid strategy bringing together rather tedious yet mostly possessing strong income characteristics REITs and exposure to high-growth tech segment, SRVR is certainly unique and thus it does deserve its place in a long-term portfolio. Yet it is questionable whether the time is right to add it. I highlight valuation as the principal risk weighing on its short-term performance. Growth is a silver lining, but with soft quality and risky valuation, this mix is not worth buying into.

[ad_2]

Source links Google News