[ad_1]

(Source – Pexels/Eugene Shelestov)

It is only a matter of time before leveraged long ETF finally explodes. It is often said in the financial world that leveraged ETFs such as (SPXL) are not a good investment for long-term holders because of their leverage decay and extremely high volatility. While that is true, leverage “decay” has worked in favor of SPXL, and I’m sure that most “buy and hold” investors in the fund are not complaining about the 30X+ performance since its 2009 trough.

Indeed, it is very difficult to judge a high-risk fund like SPXL when it has never truly gone through a high-risk period. In order to demonstrate the true risks in the fund, I thought I’d simulate its hypothetical price changes during past recessions so investors can see what to expect during the next big crash.

SPXL is yet another hot potato in our financial system. It has been a frankly amazing fund until the market stopped rising last year; I worry that many investors don’t know what will occur if the market reverses. The fund is 3X daily levered S&P 500 performance. This means that a 1% loss in S&P 500 equals a 3% loss in SPXL and vice versa. Importantly, a 5% monthly return does not equate to a 15% monthly return for SPXL because of the daily re-leverage effect.

Of course, no recession is the same, which is why I want to go over performance after each. Without further ado, in reverse order of S&P 500 crashes, let’s begin.

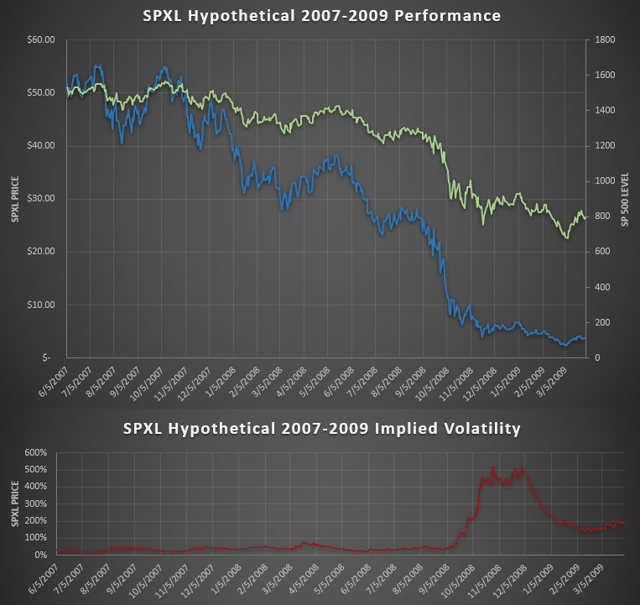

If 2007-2009 Crash Occurred Today

The current price of SPXL is $53.3, so let’s see where that price would likely go if another GFC occurred.

Here is a chart of that hypothetical situation:

(S&P 500 Data Source – CBOE)

As you can see, SPXL would, for lack of a better word, implode and reverse almost all of the ETF’s 2009-2019 performance with an estimated maximum drawdown to $2.40 or a 96% loss. Implied volatility, estimated using GARCH, would rise to 500%. As I’ll show later, buying super out-of-the-money options on SPXL may be an amazing “lottery ticket” trade.

Now, 2007-2009 was a very violent and extreme situation. Let’s go over a slower and less violent crash as in 2000-2002

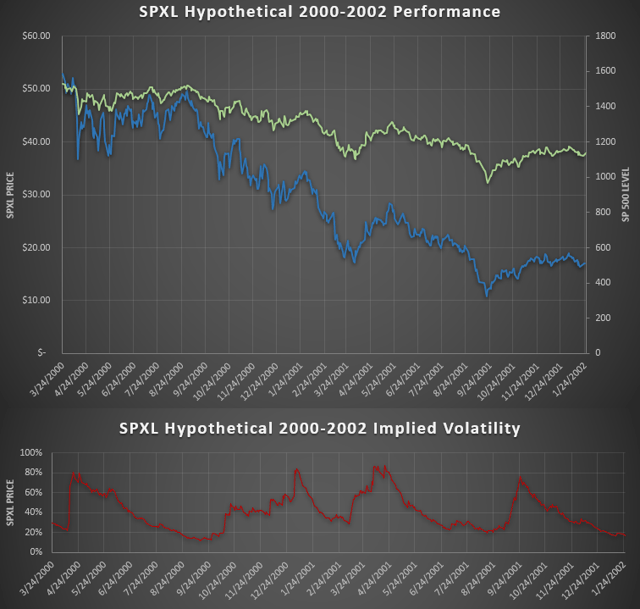

If 2000-2002 Crash Occurred Today

A 2000-2002 style bear market would be much less painful for SPXL investors, but still wipe out most of their position. This bear market was a bit longer than 2007-2009 and was a nice slow downtrend with occasional violent spurts instead of a terrifying discontinuous drop as in 2008.

Take a look at the chart:

(S&P 500 Data Source – CBOE)

(S&P 500 Data Source – CBOE)

While this situation would “only” cause holders to lose 91% of their position as opposed to 96%. Most notably, implied volatility would be unlikely to jump so high and would have likely stayed below 100%. That said, it would clearly be disastrous for fund holders.

Now we know what a long bear market is likely to look like and what a financial crisis would do to SPXL. What about a very short-term violent crash that did not even correspond with a recession?

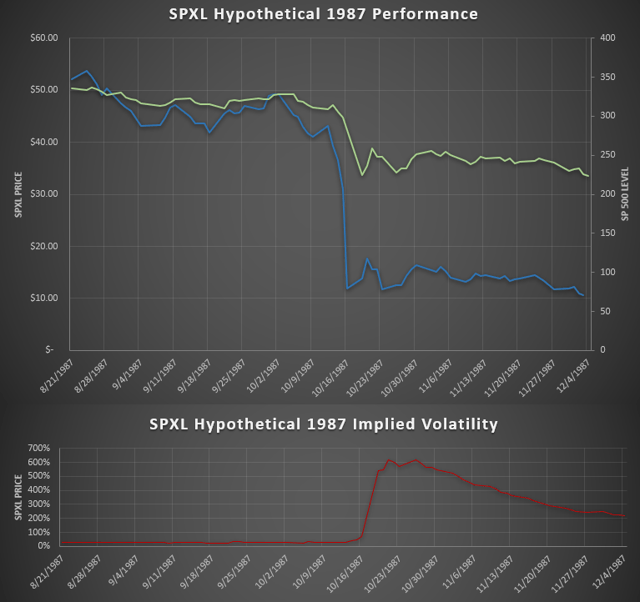

If 1987 Occurred Today

Compared to the other two, the 1987 stock market crash was extremely short and really only occurred in a matter of days from October 9th to October 22nd of 1987. Still, this crash would have likely resulted in the largest increased in SPXL’s implied volatility. Take a look at the chart below:

(S&P 500 Data Source – CBOE)

(S&P 500 Data Source – CBOE)

In a single day (Black Monday – October 19th, 1987), you would have lost 61% of your position and seen implied volatility increase many-fold. Over the entire period from August to December, you would have seen a maximum drawdown of 80%. Lower than the other two, but still extremely high for how short a period this is.

Do you believe that a 1987 style crash could not occur today? Frankly, huge short time frame crashes like that occur more often than many believe in equity markets around the world. Just weeks ago, we saw Argentinian stocks (ARGT) lose 25% of their value overnight simply due to an election.

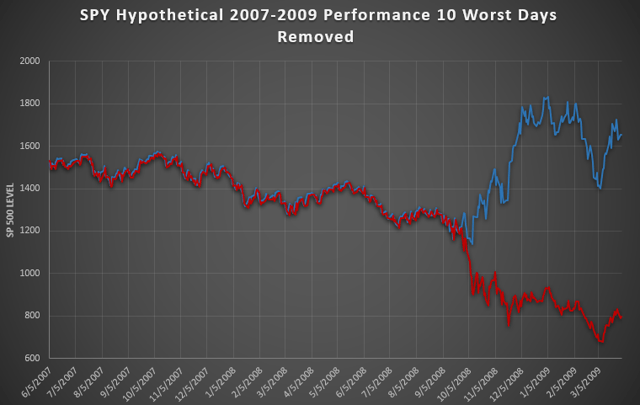

Not Suitable Even For Short-Term Traders

Many analysts say “levered funds are only suitable for short-term positions”. In my opinion, they are not suitable for any holding time frame because most bear market negative performance is concentrated in a single day or a few days.

To illustrate, let’s imagine we removed the worst 10 days from the 2008 recession:

(S&P 500 Data Source – CBOE)

As you can see, you would have actually made a pretty nice profit if you were lucky enough to have closed your position on the 10 worst days.

My point is that levered funds like SPXL can implode at any moment. If you look at a stock chart from far away, it appears that bear markets occur in trends and are easily predicted. Indeed, I have tools and methods that have historically predicted bear market periods well, but the reality is a huge crash could occur at any moment (without warning) and that the bulk of negative performance occurs in very few days. Thus, even if you own SPXL and plan to sell in two days, you could easily lose half your position or more.

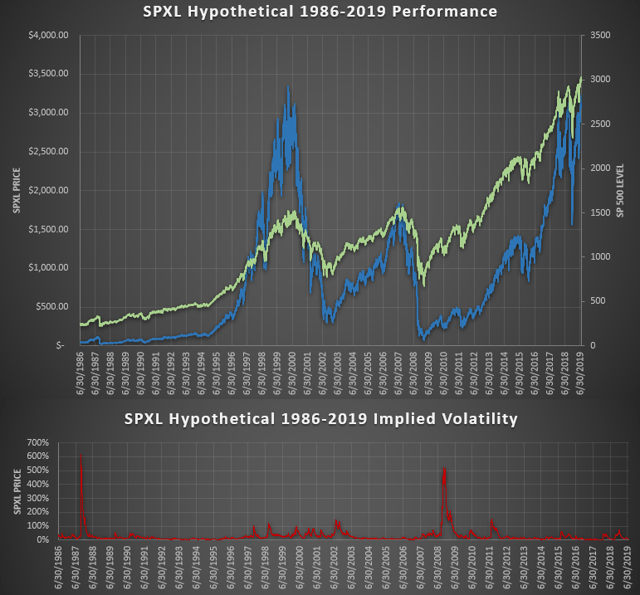

Moving on, what would happen if you bought a hypothetical SPXL share in 1986 and held it to today? Let’s see.

Buy and Hold – 62X To 95% Loss

On average, no buy-and-hold strategy should consistently outperform or underperform the market on a risk-adjusted basis. This is true for SPXL. On average, you will actually see similar performance, but with extreme 90%+ losses followed by equally extreme 20X+ gains. Take a look below:

(S&P 500 Data Source – CBOE)

Talk about a boom-bust cycle. I think the chart says everything I can and more.

For fun, let’s end with a simulation of SPXL during the 1929 crash as an interesting treat.

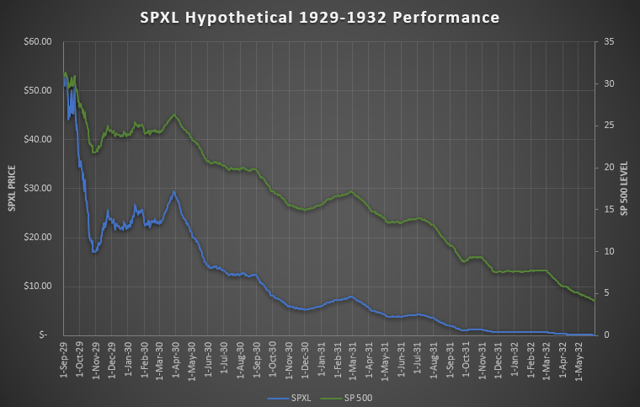

If 1929-1932 Occurred Today

The reason I added this to the end is it really is not reliable because I don’t have daily S&P 500 data for this period and have to use monthly interpolations subject to some simulated daily randomness.

Still, I think the results are interesting and likely accurate in a broad sense:

(S&P 500 Data Source – Multpl)

As you can see, a 1929 style crash would be much worse than any of the others. During this period the S&P 500 fell around 90% and our hypothetical SPXL fell 99.8%. In other words, a $100 investment in two years became worth twenty cents.

Of course, because I don’t have the daily data this should be taken with a grain of salt, but still goes to show just how dangerous a fund like SPXL can be.

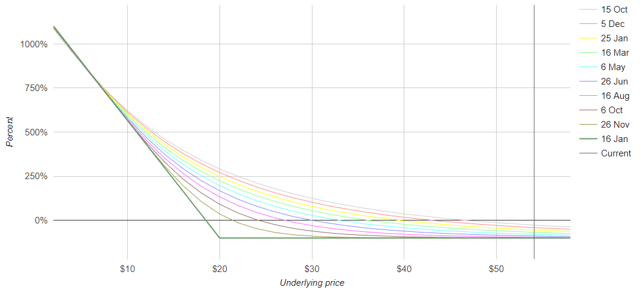

Put Options – The Only Way to Play SPXL

As you saw, in the three hypothetical drawdown scenarios, SPXL fell to between $5 and $15. Indeed, if a crash occurs, SPXL will most likely fall below $20 or worse. So, what if you bought a super out-of-the-money long-term put option on SPXL?

Of course, liquidity constraints make this impossible to do with a large position and that may be for the best. But, for those with small accounts, I honestly believe that put options on SPXL are the best way to hedge the market considering the likely drawdowns in the fund. Today, a January 2021 put option on SPXL has a bid of $0.45 and an ask of $2.00. The previous close was $1.23, so let’s say you could get in at $1.5. Here would be the performance of the option as it crosses below $20.

(Source – Options Profit Calculator)

As you can see, with a $2.5-20 “crisis range,” you’d profit between 250% and around 10X+. Now, this is obviously a higher risk strategy, but in all historical equity crashes, SPXL would be expected to reach such levels.

Personally, I believe the odds of a crash over the next 15 months (the life of the option) is about 50%. Thus, the expected return:

50%* 300 (crisis range average profit) – 50%* 100 (option expires worthless – 100% loss) = 50%

Not a bad deal in my opinion. To sum it up, SPXL really is not suitable for trading or buy and hold. The only value it provides is by betting against it (with options) for portfolio crash hedging purposes.

Interested In Closely Following Global Events?

“The Country Club” is a dedicated service that focuses on single-country and regional ETFs with the goal of helping our subscribers diversify globally and get a better grasp on how world events will affect their portfolio. We will certainly be providing subscribers further updates on this idea.

Subscribers receive exclusive ideas, model portfolios, and a wide range of tools including our exclusive “Country Club Dashboard” which allows them to visualize global financial and economic data. If you haven’t already, please consider our 2-week free trial and get your passport to global markets today!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in SPXL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News