In my previous article, I forecasted a decrease in the price of VanEck Vectors Russia ETF (RSX) (a fund offers exposure to equities from Russia) over the next two months. Today, I have to adjust my forecast.

Mueller’s investigation has shown that there was no collusion between Trump and Russia during the presidential campaign. Taking into consideration the fact that for several months there have been no new scandals relating to Russia’s interference in the internal affairs of the United States, in my opinion, Mueller’s judgment has considerably reduced the probability of implementing the bill (DASKA) known as “sanctions from hell”.

Further, I believed that the arrest of Michael Calvey would act as a catalyst for the introduction of new sanctions against Russia by the United States. But his lawyers base their defense on the key statement that this case is not a political matter but a dispute between business entities. At my glance, this is probably a reasonable move for Michael Calvey. At the same time, it reduces the risks for the Russian market.

These two reasons make me abandon the idea that RSX is in for a collapse in the near future. But the analysis of the next portion of the Russian macrostatistics does not make it possible to give a positive forecast either.

First, I want to note that the actions of Rosstat (Russian Federal State Statistics Service) make it more and more difficult to analyze macroeconomic data. Let me remind you that not long ago a new official was placed at the head of this department. He promised to reconsider the principles for calculating key indicators and now we see the first results of his reforms…

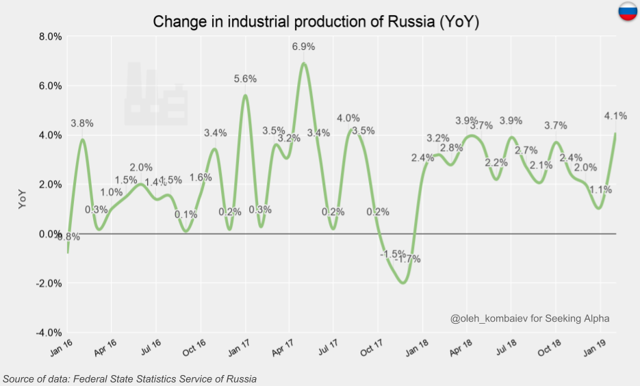

Thus, according to official data, in February the Russian industry grew by 4.1% YoY, which has been the best result since May 2017:

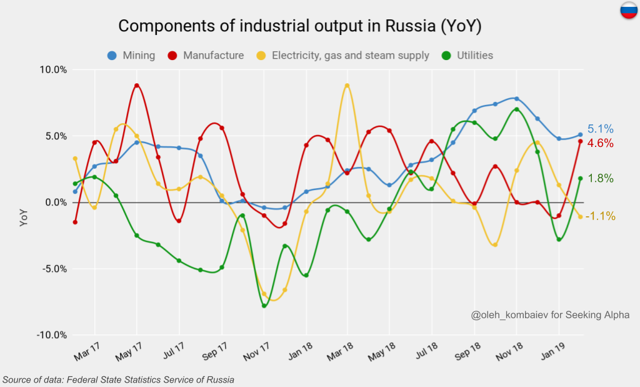

Mining and manufacture have demonstrated close-to-record growth rates:

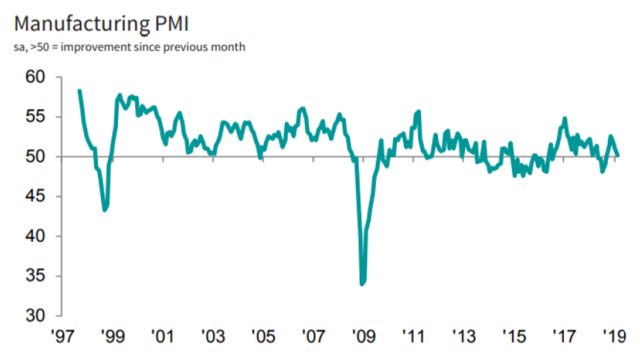

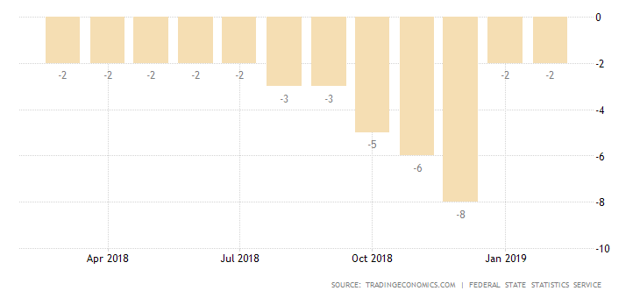

Partly, the reason for such positive results was purely technical factors. First, in February 2019, there was one working day more than in February 2018. Secondly, since the beginning of the year, Rosstat has expanded the list of representative goods that serve as a basis for calculating the index of industrial production. So, I see no reason for much optimism. Russia’s participation in the OPEC+ agreement, according to which the Russian Federation undertook to reduce oil production in the first half of 2019, will restrain growth in the mining industry which accounts for a good half of the country’s total industry. In addition, the dynamics of Manufacturing PMI and Business Confidence in Russia do not make us glad, to say the least:

Source: markiteconomics.com | RUSSIA MANUFACTURING PMI

Source: markiteconomics.com | RUSSIA MANUFACTURING PMI

Russia Business Confidence

Now let’s look at the retail sector.

It is worth noting that Rosstat has refused the monthly publication of Real disposable personal income. Probably, the stable negative dynamics of this indicator have become annoying…

In February, the Russian retail turnover has grown by 2% YoY:

I believe since January there has been no time for the effects of the increase in VAT to fully tell on this indicator because retailers are careful not to raise prices dramatically.

I believe since January there has been no time for the effects of the increase in VAT to fully tell on this indicator because retailers are careful not to raise prices dramatically.

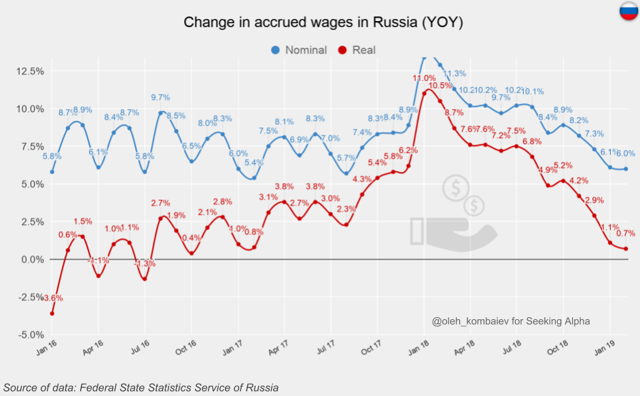

The growth rates of nominal and real wages have dropped to their lowest in two years, which is likely to induce Russia’s population to switch over to saving behavior. It is also bad for retail.

Final thoughts

Final thoughts

So, as noted at the beginning, the probability of an early collapse of the RSX has considerably reduced. But technically the RSX is still moving in the descending channel and I don’t see any fundamental factors that would make it possible for the market to reverse this trend. In the near future, the sideways dynamics will remain.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.