Riska/E+ via Getty Images

By: Alex Rosen

Summary

Roundhill Sports Betting & iGaming ETF (NYSEARCA:BETZ) tracks a weighted index of online sports betting companies with a focus in U.S. holdings, but also diversified across ten countries in four continents. After initially soaring out of the gate, the fund has struggled to maintain pace, returning -37% YTD.

By focusing on a sector that is still in its infancy, BETZ has the possibility of catch lightning in a bottle. The sector is still struggling with regulatory approval and subject to unpredictability. In many respects, it looks similar to the cannabis sector in that the demand is there, and one day someone might make a lot of money betting on its success.

Strategy

From the fund prospectus:

“BETZ is designed to offer investors exposure to sports betting and iGaming industries by providing investment results that closely correspond, before fees and expenses, to the performance of the Roundhill Sports Betting & iGaming Index (‘BETZ Index’).

BETZ is the first global index to track the performance of the sports betting and iGaming industries. The Index consists of a tiered weight portfolio of globally-listed companies who are actively involved in the sports betting & iGaming industry”.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Digital Technology

-

Sub-Segment: online gaming

-

Correlation (vs. S&P 500): Moderate

-

Expected Volatility (vs. S&P 500): High

Holding Analysis

As a frequent listener to sports radio podcasts, over the last year I have been bombarded by ad reads for online sports betting sites. A look at the fund holdings here looks like a who’s who of sports betting ad reads. Entain (OTCPK:GMVHF), the world’s largest online sports book based in England, Kindred Group (OTC:KNDGF), an online operator of casinos registered in Malta, Tabcorp Holdings Limited (OTCPK:TACBY), Australia’s largest online betting site, and DraftKings (DKNG), the largest American daily fantasy sports contest and sports betting company.

The fund is fairly evenly weighted with no one holding comprising more than 5.5% of the funds’ assets and it is spread out across 15 countries, though most of those are just holding companies domiciled in countries favorable to online betting.

Strengths

Besides all the terrible gambling puns that can apply to this fund, the real strength here is that it is the final frontier of sin funds that don’t involve human trafficking. There are plenty of funds that focus on alcohol, tobacco, guns, and even cannabis, but BETZ is the first fund to focus on the online gambling sector.

Betting has been around as long as there have been competitions. The first bet was on whether Eve could get Adam to take a bite of the apple. The snake took the over on that action. Since then, sports betting has evolved into a true science. Head to any horse track and you can still see countless “touts” sitting there trying to find the longshot trifecta. When I was growing up in New York, the big thing was OTB parlors, which are probably the precursor to online betting. The only legal option for live gambling was to head to Atlantic City for the weekend to play the tables. Back then the big talk was when would they allow casinos in the Catskills. Instead, the Native Americans beat them to it, and now sadly the Catskills are just the punchline for a series of Borscht belt jokes.

It’s a natural progression. The internet has brought everything from the brick and mortar stores right into your living room. Even the mecca of gambling, Las Vegas, has recognized that cards and roulette wheels are no longer enough of an enticement to get people out of their homes. People go there now more for the entertainment than the actual gambling.

Sports betting has moved off the street corners and back rooms of seedy bars and become front and center on the internet and in the public eye. At first, the operations were limited to sketchy off-shore companies registered in Belize and Antigua, but as regulations have increased and restrictions decreased, they are popping up more and more. Even the traditional casinos are getting in on the action with Caesars Entertainment (CZR) being one of the top ten holdings in the BETZ fund.

Weaknesses

Just because something is the future, doesn’t mean it is the present. The gambling industry has come a long way from card counters being roughed up by Don Rickles in the backrooms of Vegas casinos, but that doesn’t mean it’s all smooth sailing. Much like recreational and medicinal marijuana, it is still not a fully legal and regulated industry. The industry is rife with scandals, and it still struggles with image issues. A lot of work needs to be done before it can be fully accepted as a mainstream industry.

Currently, the Unlawful Internet Gambling Enforcement Act of 2006 (UIGEA) is still in force in the U.S., and as a result, online gambling is still technically illegal in the United States. Consequentially, the British online sportsbooks have refused to take bets directly from U.S. ISPs. Despite this, the demand for online betting persists. Where there’s a race there’s a bet.

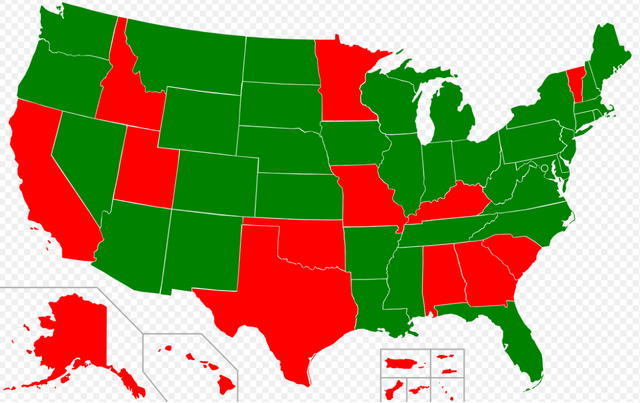

Currently 13 states and every territory still have prohibitions on physical sports betting.

The 13 states in red still ban sports betting (American Gaming Association)

Opportunities

The Cincinnati Reds recently announced that for 2023, they are set to open a new sportsbook at their Great American Ball Park home through a new partnership with BetMGM. If they have any sense of irony at all they will get Pete Rose to cut the ribbon at the opening.

In May of 2018, the U.S. Supreme Court struck down The Professional and Amateur Sports Protection Act of 1992, paving the way for states to decide on their own whether to allow sports gambling. Online gambling is still stuck in legal limbo, but the U.S. Justice Department is currently reviewing the UIGEA, and does allow states to decide individually whether they will allow online gambling.

Goldman Sachs estimates the 2033 market for U.S. online sports betting at $36.7 billion.

Threats

If the U.S. waits too long to sort this out, the bets will go elsewhere. While the fund is not exclusive to the U.S., it does have a large portion of its holdings in U.S. companies (47.5%). The risk is always there that an unfavorable congress can decide that this is not the direction the U.S. wants to go in, or more likely just drags its feet on the whole process.

While the tea leaves suggest sooner rather than later for a resolution of the status of online sports betting and gambling in the U.S., it is still not fully resolved ,and in the meantime, a fund that focuses on this sector could suffer.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Buy

Conclusions

ETF Quality Opinion

All the big names I hear on my sports broadcasts are in the holdings. The fund has a tight collection of holdings, but with a high expense ratio (.75). From a regional standpoint, the fund leans toward the U.S., but still covers at least 13 countries and four continents. Considering the relative newness of the online industry, the fund is fairly well developed.

ETF Investment Opinion

BETZ focuses on a sector which is still experiencing growing pains. It is unclear when the legality issues will be resolved, and how the landscape will look when all is said and done. One thing though for certain is that online betting will not just go away. The sector will continue to grow; the question is, at what pace. We think it will be faster rather than slower, and therefore we are betting on BETZ. We rate BETZ a Buy as the fund seems to have been caught up in the overall market correction, but will eventually separate itself and stand out as a winner.