Our thoughts on the Invesco Fundamental High Yield Corporate Bond ETF (PHB) can be summed up pretty succinctly. Don’t invest in junk bonds, and if for some reason you feel you have to, don’t pick PHB.

Just Say No to Junk Bonds

There is no compelling reason for most, if not all, investors to include junk bonds in their portfolio. While there may have been a historical case for some junk bond strategies (e.g. “fallen angel” bonds) decades ago, today’s junk bond market is quite different. In fact, discounting studies or paper from people and organizations attempting to sell you junk bonds there is very little evidence junk bonds and junk bond funds today give investors adequate risk-adjusted returns.

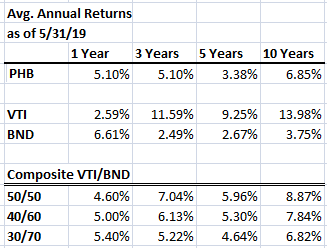

As an example of this, below are the average annual returns of PHB compared to a portfolio of bonds and stocks.

It’s quite easy for an investor to construct a portfolio of stocks and bonds that either a) provides higher returns for similar levels of volatility or b) provides similar returns but with lower volatility. We see how a portfolio that’s split 50/50 or 40/60 between US stocks represented by Vanguard’s Total US Stock Market ETF (VTI) and US investment grade bonds represented by Vanguard’s Total Bond Market Fund (BND) provides higher returns over the long term.

We’d recommend David Swensen’s book Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment for investors that want a more thorough explanation of why junk bonds don’t belong in an investor’s portfolio and more information about the risk adjustment component of comparing returns.

Junk Bond ETF Liquidity Issues

There’s also an additional area of concern (besides risk-adjusted performance) when it comes to junk bond funds, and that is liquidity. ETFs are by their nature very liquid and easy to buy and sell. There are no issues when the underlying investments are liquid as well (e.g. an ETF that tracks large-cap US stocks or Treasury bonds for example). But problems can arise when the underlying investments are much more illiquid than the ETF itself. This is the case for junk bond ETFs and many bond traders have voiced concerns about what could happen during periods of market panics. So far liquidity issues seem to be muted, and on the other hand, we haven’t seen any real market panics even approaching the degree of the Great Recession. The liquidity issue remains more of an unknown at this point and just another point of risk investors in junk bond ETFs are taking on. As you’ll see below, PHB possibly ranks among the worst when it comes to potential liquidity issues.

PHB Probably Isn’t the Best

If for some reason you do feel the overwhelming urge to invest in a junk bond ETF, we don’t think PHB is the best. There are three major competing ETFs – JNK, HYG, and USHY. All four funds follow different indices but are still quite similar.

|

Ticker |

Expense Ratio |

Duration |

Number of Holdings |

Fund Assets ($M) |

|

PHB |

.50% |

3.09 |

242 |

736 |

|

HYG |

.49% |

3.11 |

988 |

17,447 |

|

JNK |

.40% |

3.28 |

827 |

9,237 |

|

USHY |

.22% |

3.42 |

1772 |

1,377 |

(Source: Fund websites)

The durations for the funds range from 3.09 to 3.42. The main differences are fees and the number of bonds each fund holds.

Two of the funds, HYG and JNK, follow indices that aim to exclude ill-liquid bonds.

HYG tracks the Markit iBoxx USD Liquid High Yield Index that specifies there must be at least $400M outstanding for a bond to be included. JNK tracks the SPDR Bloomberg Barclays High Yield Very Liquid Index. This index has even stricter liquidity requirements. It only includes the three largest bonds from each issuer and there must be a minimum of $500M outstanding.

That’s not to say the other funds don’t have liquidity restriction either. PHB which tracks the RAFI Bonds US High Yield 1-10 Index specifies there must be $350M outstanding for inclusion. USHY tracks the ICE BofAML US High Yield Constrained Index which has the loosest liquidity constraints, only requiring $250M or more outstanding for a bond.

Something that is worth considering when looking at liquidity is that USHY has the highest number of holdings compared to AUM. Would this help liquidity in the event of a market panic? We’re not sure, but it’s certainly something worth considering.

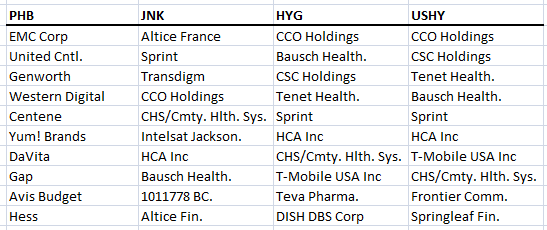

It’s also interesting to see how similar the holdings are for two (and even three) of the four funds.

(Source: Fund websites)

The top 10 holdings for HYG and USHY are practically identical. Only PHB really differs from the group.

As you may expect with bond funds that track similar indices, performance is very close amongst all funds. After all, as long as a company can service its debt, there is no difference between the bonds of two companies as long as they are mathematically identical (e.g., price, coupon, maturity, etc. are all the same). We think investors who insist on putting money in junk bonds would be best served by USHY given its expense ratio is almost half of what the other funds are charging.

Summary

As we stated in the beginning, there is almost no reason for investors to allocate a portion of their portfolio to junk bonds (especially tempting given low interest rates around the world) given their poor risk-adjusted returns. Even among a group of bad choices, PHB isn’t that great either. USHY offers exposure to a similar junk bond portfolio at about half the cost of PHB.

Disclosure: I am/we are long BND, VTI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.