[ad_1]

imaginima/E+ via Getty Images

The VanEck Vectors Oil Services ETF (NYSEARCA:OIH) is up a whopping 42% so far this year. That stellar return places it among the best-performing funds in 2022. Obviously, skyrocketing oil prices are a boon to oil service stocks, but what does the balance of this year hold for the cyclical stocks held in OIH? Let’s drill down.

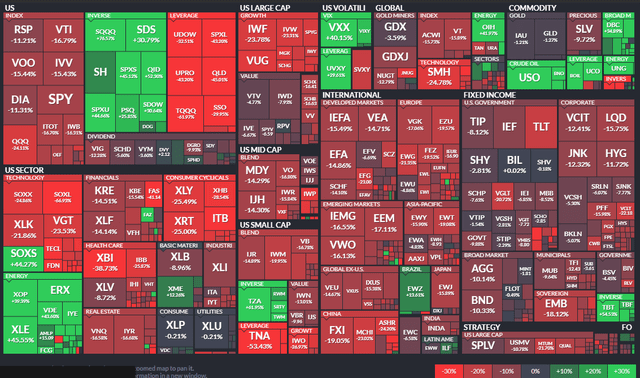

ETF Performances Year-to-Date

Finviz

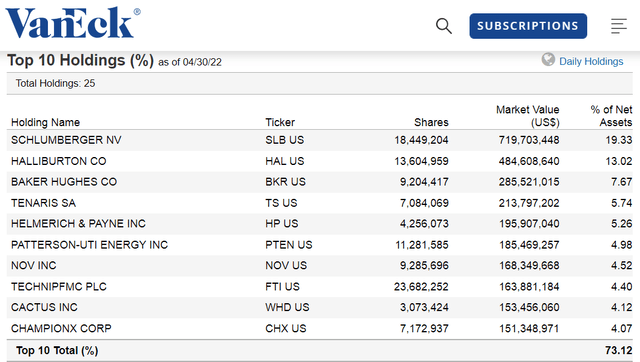

We must first understand what OIH is. According to VanEck, the ETF tracks as closely as possible, before fees and expenses, the price and yield performance of the MVIS® US Listed Oil Services 25 Index (MVOIHTR), which is intended to track the overall performance of U.S.-listed companies involved in oil services to the upstream oil sector, which include oil equipment, oil services, or oil drilling.

OIH rebalances quarterly and sports a reasonable expense ratio of 35 basis points. Some of this year’s hottest stocks are found here. Schlumberger (SLB), Halliburton (HAL), and Baker Hughes (BKR) make up about 40% of the fund.

OIH Holdings

VanEck

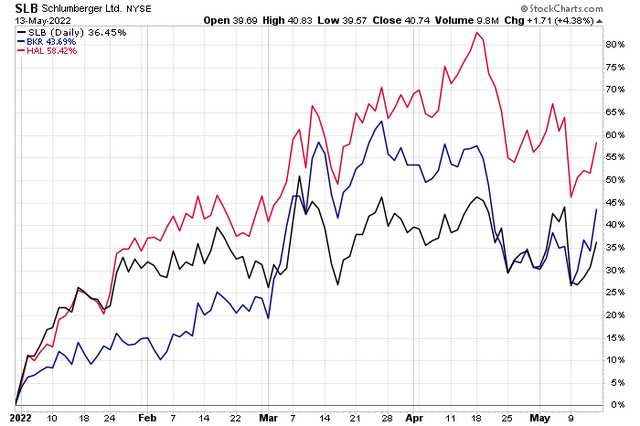

OIH’s top three holdings are all up between 35% and 60% this year, but the trio is collectively off the highs touched in April. Zooming out, the last two years have been fabulous.

SLB, HAL, BKR Year-to-Date Performances

Stockcharts.com

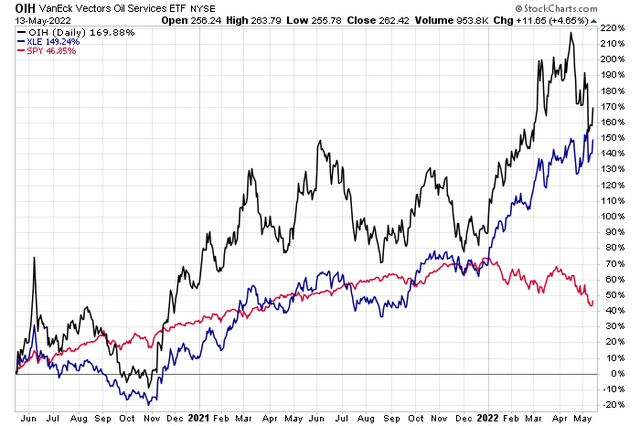

Over the past two years, the oil services industry has beaten the Energy sector (XLE) and the overall U.S. stock market (SPY). OIH is up 170% vs 149% on XLE vs just 47% for SPY. It’s helpful to compare an industry to its sector and the overall market.

OIH vs XLE vs SPY

Stockcharts.com

What’s the Outlook?

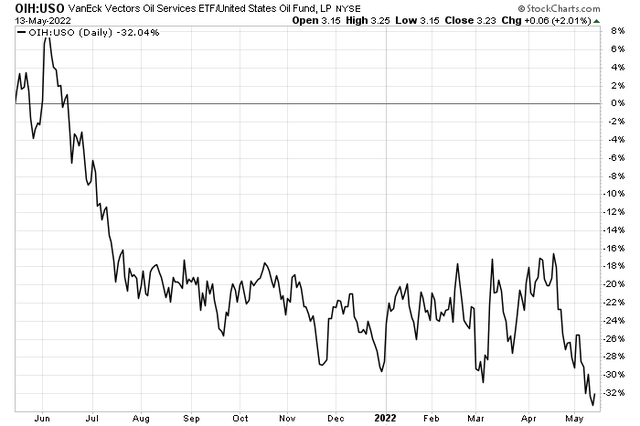

I assert that energy equities could be on the verge of a decline for the balance of the year. A global growth scare and the prospect of peak inflation could be significant headwinds for the oil complex. Consider that oil services stocks are essentially levered play on the commodity. Recent price action illustrates that there has been significant relative weakness among oil service stocks vs the oil ETF (USO). As a technician, this is a bearish signature for the equities.

OIH Relative Weakness to USO

Stockcharts.com

‘Tis the (Bearish) Season

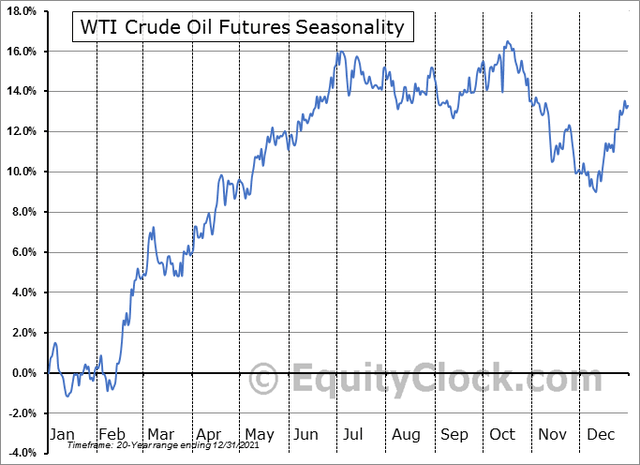

I also like to peek at seasonality. According to research from EquityClock, WTI crude oil tends to top out in early July. That’s not too far away. While oil prices have some momentum right now, the end could be near according to the seasonal factor. That’s just something to keep an eye on for energy investors.

WTI Crude Oil Seasonality

Equity Clock

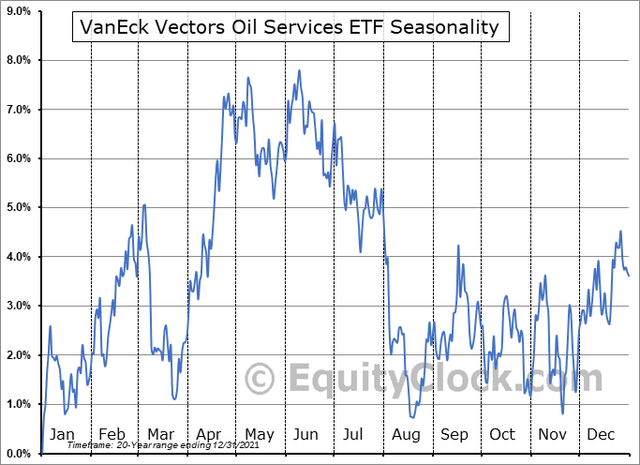

But what about seasonality for OIH itself? It paints an even bleaker picture. In the 20-year period ending December 31, 2021, OIH has a pronounced zenith in May and June. Summertime has been particularly bearish for ETF.

OIH Seasonality: Toppy in May-June

Equity Clock

Eyeing Moves in the Dollar

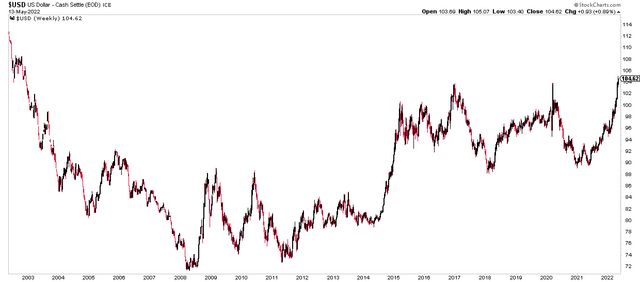

Finally, we have the U.S. Dollar (DXY) breaking to its highest levels in nearly 20 years. A strong Greenback is normally bearish for dollar-denominated commodities. This year has not been the case so far, but I suspect the traditional inverse correlation will return as concerns shift toward weakening GDP growth around the world.

The U.S. Dollar Index Breaks Out

Stockcharts.com

Levels to Watch

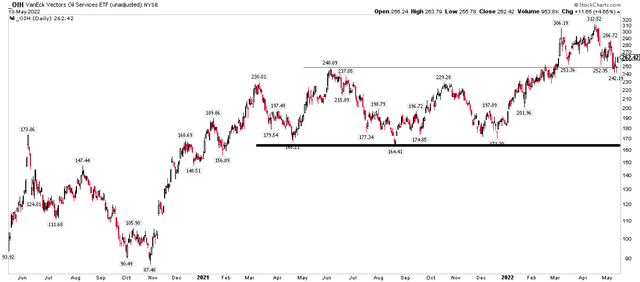

OIH probed below key support in near $248. If it falls back under $240, I see the potential for downside to the 2021-range lows around $165.

Stockcharts.com

The Bottom Line

OIH has had a tremendous run over the last two years. I recommend booking profits and moving on. There’s a confluence of technical factors that lead me to issue a sell rating on OIH for the balance of the year.

[ad_2]

Source links Google News