The adage of “change is the only constant” is certainly applicable to the exchange-traded fund (ETF) space. As the number of ETFs continue to grow at a rapid pace, it opens up the arena for innovation in order for issuers to discern themselves and their products from the masses.

In the latest update of “In The Know,” Yasmin Dahya, Executive Director, Head of Americas Investment Specialist Team, Beta Strategies Group at J.P. Morgan Asset Management, discusses how current market trends are making the ETF space rife for innovation.

Thinking Beyond the Box

Gone are the days when ETFs like the SPDR S&P 500 ETF (NYSEArca: SPY) for U.S. equities and the iShares Core US Aggregate Bond ETF (NYSEArca: AGG) for fixed income was all an investor needed to gain broad-based exposure to the markets. While this may still be the case in certain instances, the market landscape is constantly changing and warrants adjustments to fit a case-by-case scenario.

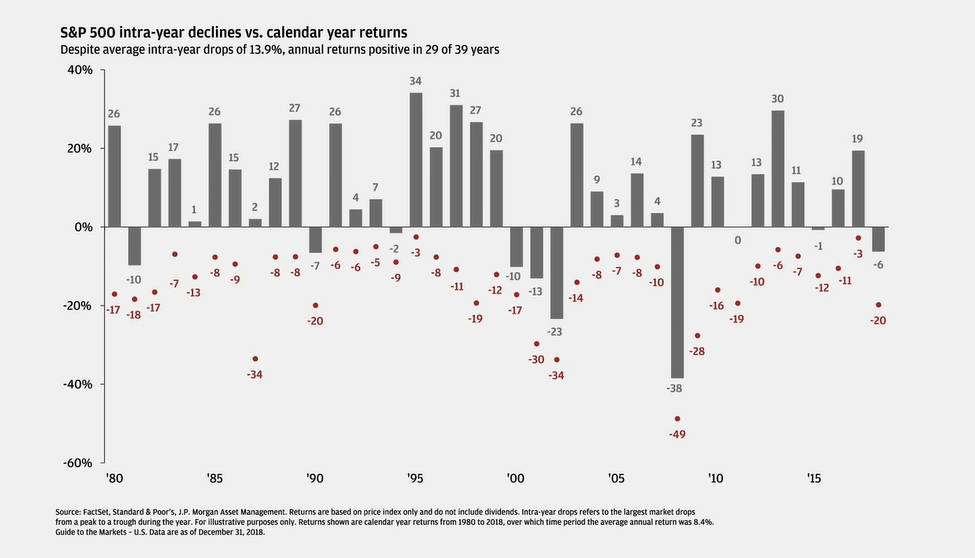

“What I think it means for advisors who are building portfolios is you need more in your toolkit for that kind of environment, both on the, as we’ve talked about, declining return expectations, but also, the reality of volatility,” said Dahya. “And 2018 was the year that reminded us and reminded our clients of what it’s like to stay though equity markets.”

The Case for Multi-Factor Investing

Investors witnessed a final quarter of 2018 that marked a low point for U.S. equities–the Dow Jones Industrial Average fell 5.6 percent, while the S&P 500 was down 6.2 percent and the Nasdaq Composite declined 4 percent–as volatility rained down on the capital markets.

“I genuinely believe that 2018 was the year that proved why you’d maybe want to consider something different than a pure market cap exposure,” said Dahya. “Now, that fits in the broader context of this, it did really well for you for the last 10 years, what’s it going to do for you for the next 10 years?”

The multifactor strategy can also work for diversification overseas as in the case of funds like the JPMorgan Diversified Return International Equity ETF (NYSEArca: JPIN) and the JPMorgan Diversified Return Emerging Markets Equity ETF (NYSEArca: JPEM).

So why hasn’t the capital markets embraced multi-factor funds wholeheartedly?

Part of the resistance for multi-factor investing that Dahya experiences stems from a lack of historical data. However, Dahya points out that these funds are starting to get longer in the tooth and have years of live testing behind them to fortify their results.

“They’re hitting four, five years, six years worth of live data. And now we’ve been able to see them in both up-markets and down-markets,” said Dahya.

For Dahya, a multifactor-based portfolio makes much more sense versus one that relies on a single factor. Given certain market conditions, investors need more than just a passive index that goes beyond a one-size-fits-all template that uses market cap weighting.

While these indexes provided simple, low-cost solutions, the need for even greater scrutiny is necessary in the quest for more alpha–a case for multifactor funds.

“I’ll tell you, as an investor, I want a multifactor portfolio because as we saw last year, factors are incredibly cyclical and they drive returns in your portfolio,” said Dahya. “So, if you just look at the dynamics between value and momentum last year, that will tell you what factor timing … where it can really catch you off guard. So, the benefit of a multifactor is these factors have low correlation to each other. In fact, if you look at value and momentum over long periods of time, it’s around a negative 0.5 correlation. So, when one’s doing well, the other’s sort of zigging and zagging. That’s the benefit of a multifactor.”

The Value Perspective

As a result of 2018’s bull market run, the value factor often goes overlooked compared to growth, but with market volatility still a primary consideration and many investors favoring defensive sectors, quality stocks and the related ETFs are worth examining in 2019.

Even during the volatile moments of the market, investors were quick to react to news–trade wars, inverted yield curves and now government shutdowns. It’s the type of noise that muddies the minds of investors and disconnects them from the fundamentals of an asset.

This is where the value factor comes into play and in the current marketplace, it comes at a discount.

“I think right now, value is very attractive,” said Dahya. “I mean, it has to be after what it did last year. But to put some numbers on it, value by definition, those stocks and those portfolio are cheap relative to the entire universe. But you can look at how value looks right now relative to what it was historically. And we see value right now as three standard deviations cheap.”

Fixed Income Innovation

The market sell-offs at the end of 2018 spurred a move to bonds as investors sought after safe-haven alternatives amid the volatility. This fixed income space is an area that Dahya sees is poised for more innovative products.

The default bond play to get broad-based exposure might be the AGG ETF, which tracks the investment results of the Bloomberg Barclays U.S. Aggregate Bond Index. The AGG gives bond investors general exposure to the fixed income markets, but there are times when current market conditions warrant a deconstruction of the AGG to extract maximum investor benefit.

Dahya cites active management and factor-based funds as future trends for fixed income.

“A lot of managers are bringing their active strategies into fixed income and they fit in the wrapper,” said Dahya. “And not it just means if you liked them in mutual funds, you can like them in the ETF ecosystem. But secondly, factor based fixed income. Improving upon the indexes within the fixed income world. Factors like value, quality and momentum can be used to pick better bonds, similar to how they are in equities.”

To watch the entire latest “In the Know” show, click here.