Slack (WORK) recently listed on the NYSE, soaring 50% on its first day of trading.

Nevertheless, given that its execution is largely unproven, investors should firmly avoid any speculative urge to get involved with the name.

What Does Slack Do?

Slack bills itself as a technology stack that allows people, applications and data to communicate. It declares that emails are too rigid and cumbersome and create silos of inaccessible information, hidden in individual inboxes.

Among its customers, Slacks boasts big firms such as Oracle and Autodesk (ADSK) as well as government entities such as NASA Jet Propulsion. So far, it’s very exciting.

Now onto some troubling issues. First and foremost, it has to be said that Slack’s number one competitor is Microsoft (MSFT) . The one thing that Microsoft is widely known for is having no qualms about copying software and incorporating other company’s software on its own platform, having a long and rich history of having done just that. There are many companies Slack might succeed in disrupting. I doubt Microsoft will be one of them.

Slack’s Revenues Are Fizzling Out

Slack’s disruptive narrative does not appear to be lining up with the facts, see the graph below.

The graph shows a very clear trend, which unfortunately is going in the wrong direction. Slack’s total revenue in 2020 in the best case will approximate $600 million. This implies that its top line grows 50% compared with 2019.

Now, given that it was growing at north of 80% in 2019 and doubling during 2018, one should minimally question, what will be Slack’s growth rating over the next 12 to 24 months? The odds that its growth rate will fizzle out further are very high.

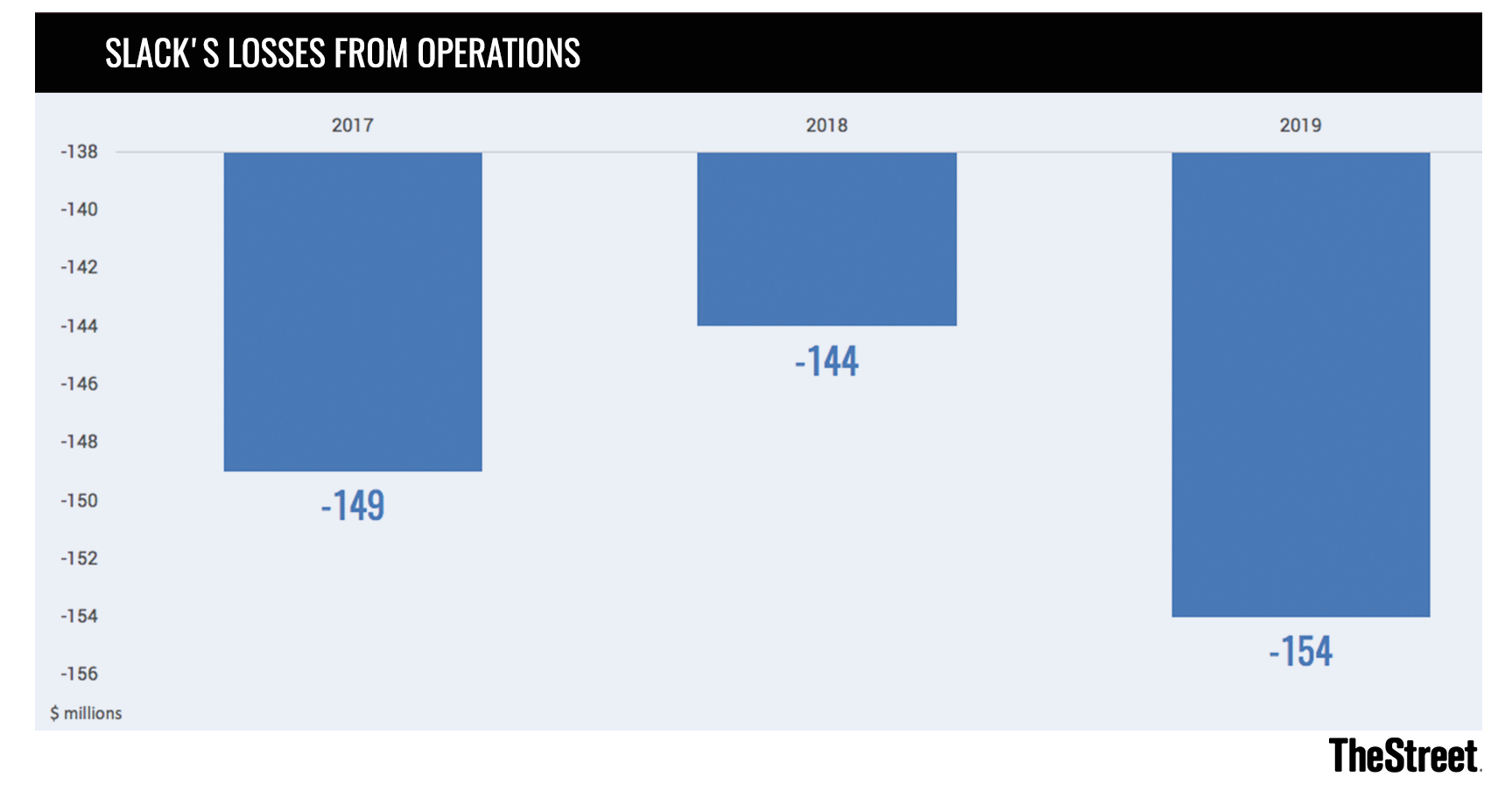

Searching For Slack’s Profits?

In the same vein as many of the most recent newly listed companies, particularly those whose business models are focused on enterprise software, Slack is extremely unprofitable.

What is perhaps most shocking of all, is that unlike many software companies, where their reported earnings are pushed down due to elevated stock-based compensations, Slack’s free cash flow prospects fare no better.

Despite continuing to grow its top line, Slack’s free cash flow in 2017 was negative $114 million. It improved slightly in 2018, then worsened again in 2019 to $97 million. For 2020, its free cash flow will come out at approximately negative $76 million if we do not include the $34 million set aside for one-time direct listing-related expenses.

Valuation – No Margin Of Safety

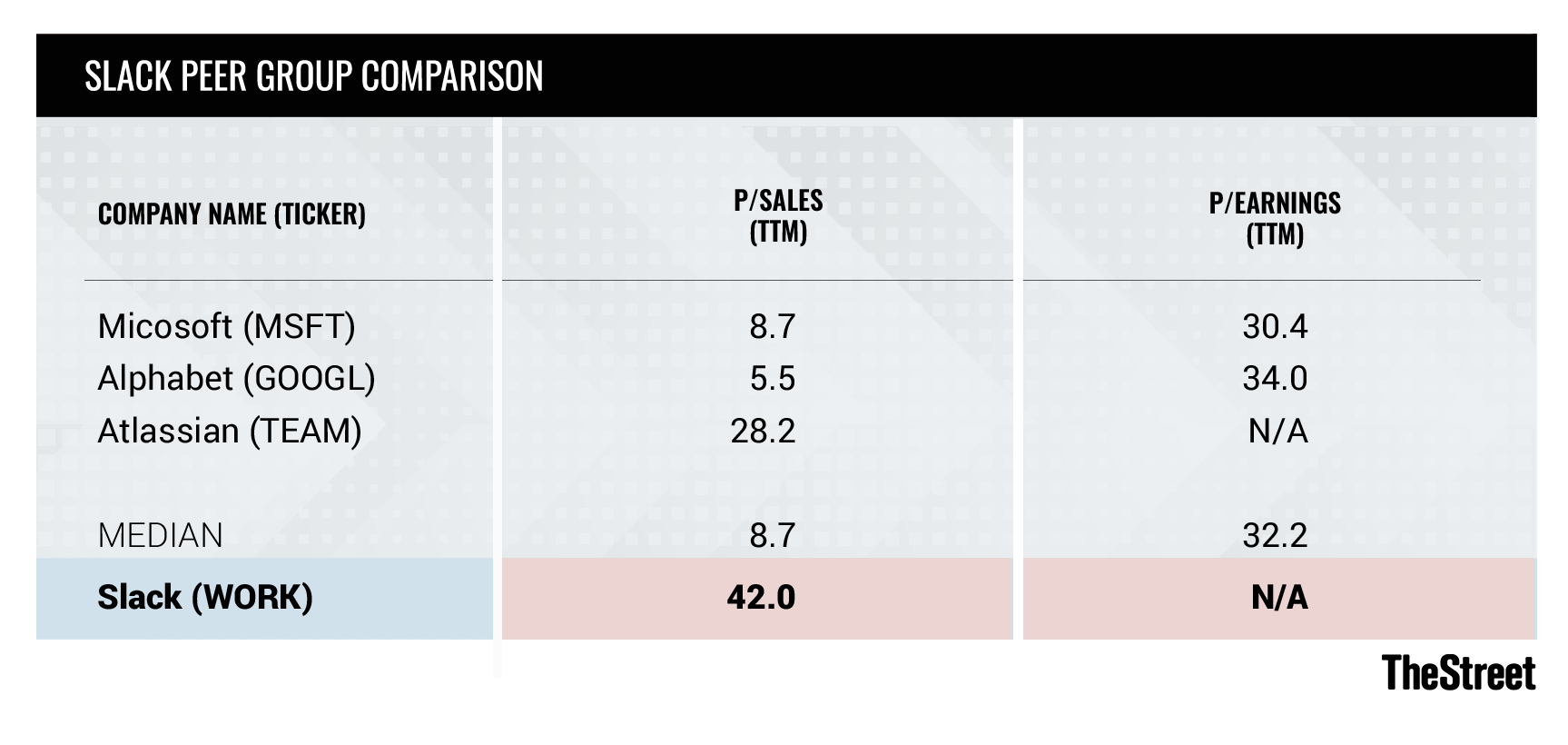

The table above highlights that Slack’s valuation is pointing towards investors paying more than 30x its revenues. Now, investors are paying for Slack’s revenues without having any idea of what kind of profit margins Slack will ultimately bring.

For context, it is insightful to note that investors are willing to pay more for Slack’s revenues than they are willing to pay for Microsoft’s earnings, even though Microsoft has one of the highest profit margins available. Very few companies, even software firms, are able to boast of having margins as high as Microsoft.

Also, as we have seen, there is limited evidence as to what Slack’s sustainable growth rates are likely to be. When we compare Slack with one of its peers, Atlassian (TEAM) , this peer has a history of growing its revenues at more than 35%, as well as generating free cash flows. The same can not be said about Slack. Yet, investors are happy to pay even more for Slack than they are willing to pay for Atlassian.

The Bottom Line

Slack’s valuation is being met with extremely positive investor sentiment. There is no room for doubt being priced in, nor for any mishaps in execution. Investors who feel positively attracted to Slack are highly likely to be able to invest in the company in the near future at a much cheaper entry point once passions have abated.

Save 57% with our July 4th Sale. Join Jim Cramer’s Action Alerts PLUS investment club to become a smarter investor! Click here to sign up!

Microsoft is a holding in Jim Cramer’s Action Alerts PLUS Charitable Trust Portfolio. Want to be alerted before Cramer buys or sells MSFT? Learn more now.