D-Keine/iStock via Getty Images

Growth style-averse investors have a year when they seemingly can breathe a sigh of relief. After the value drought that lasted for no less than a decade, sticking with cheaper equities instead of chasing growth stories has rewarded them decently or at least not left them nursing excruciating, demoralizing losses in 2022.

And when it comes to the pandemic winners, namely a slew of innovation-related themes from AI and EVs to space exploration, losses have been mounting for months, with the exception being July, notable for what turned out to be a fragile and thus short-lived bad news is good news narrative hamstrung by a new bout of inflation worries in August.

The Defiance Next Gen Connectivity ETF (NYSEARCA:FIVG) is one of those funds that have not emerged unscathed.

FIVG is a niche ETF overseeing a portfolio of U.S.-listed names closely related to the 5G theme. Incepted in March 2019, FIVG saw steady gains before and during the pandemic, buoyed both by ultra-loose monetary policy and expectations for immense growth that 5G tech was about to unlock over the years to come.

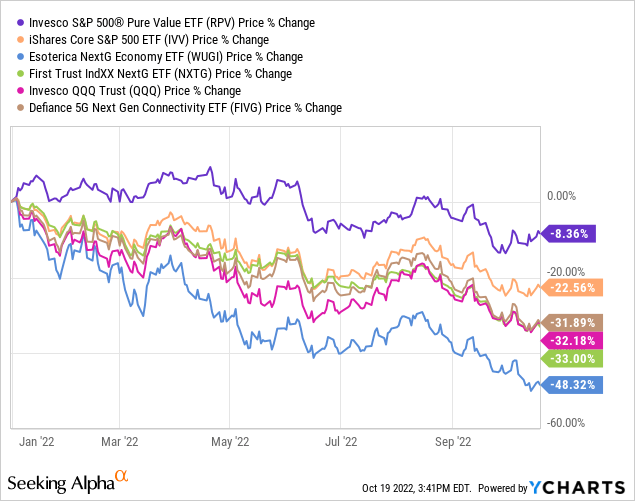

Yet the hawkish 2022 has wrought the excesses ruthlessly. FIVG is down by almost 32%, which is on par with the Invesco QQQ ETF (QQQ), the U.S. tech barometer, but materially below the price return of the iShares Core S&P 500 ETF (IVV) which has been somewhat propped up by value and energy stocks present in its portfolio as illustrated by the performance of the Invesco S&P 500 Pure Value ETF (RPV). Meanwhile, other investment vehicles targeting the 5G players the First Trust IndXX NextG ETF (NXTG) and Esoterica NextG Economy ETF (WUGI) also have a capital scarcity narrative (supervening from the aggressive Fed moves) reflected in the share prices of their holdings, with WUGI being especially weak this year, down by astounding 47.5%.

But the truth is, downturns create spectacular opportunities, and the 5G ETFs might look as such upon cursory inspection. Is it truly so? Perhaps, as when it came to factor analysis, I have come across a few surprising findings certainly worth sharing with my dear readers. Let us dig in.

FIVG investment strategy and the portfolio

Before we proceed to the discussion of the valuation, quality, and growth characteristics of FIVG, let us briefly review its strategy.

In essence, FIVG tracks the BlueStar 5G Communications Index, which draws its components from four segments, with 5G companies targeted ranging from those designing and producing the core cellular network equipment, the segment which the index provider overweights, to those that develop and produce “hardware and software focused on quality of service assurance” for customers like mobile net mobile network operators or media companies, etc. The index is rebalanced and reconstituted biannually. More details on the selection universe and the weighting methodology are available in the prospectus.

In the current iteration, FIVG’s portfolio consists of 86 equities, with the key ten accounting for a reasonable 37.1% of the net assets. A wide array of sizes is represented, from nano-caps like EMCORE (EMKR) valued at ~$57 million to the $1 trillion league members like Apple (AAPL) and Amazon (AMZN), yet owing to the index methodology, the portfolio remains nicely balanced, without overreliance on the most expensive firms, with the weighted-average market capitalization standing at $87.6 billion, as of my calculations. It is worth noting here that its actively managed peer fund WUGI has a much more concentrated portfolio, with only 28 equities present as of October 18 and a much larger share of its assets allocated to the $1 trillion league, with Microsoft (MSFT), Alphabet (GOOG), and AMZN together accounting for more than a fifth. In this sense, FIVG is more akin to NXTG, which has 102 holdings.

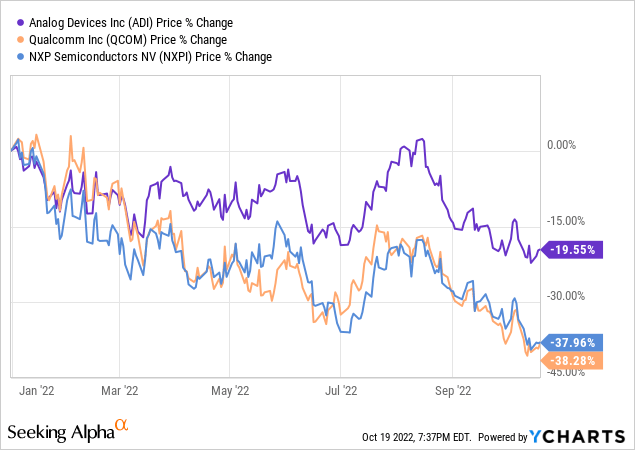

Delving deeper, Analog Devices (ADI), a semiconductor industry player, is FIVG’s most significant investment at the moment, with around 5.1% weight. Down the list, we see QUALCOMM (QCOM) and NXP Semiconductors N.V. (NXPI), with 4.9% and 4.1%, respectively.

Performance: not living up to expectations

Unfortunately, the overhyped 5G theme wrapped in an equity ETF has not produced returns strong enough, at least, it was incapable of consistently beating not only the Invesco QQQ ETF but even the U.S. market.

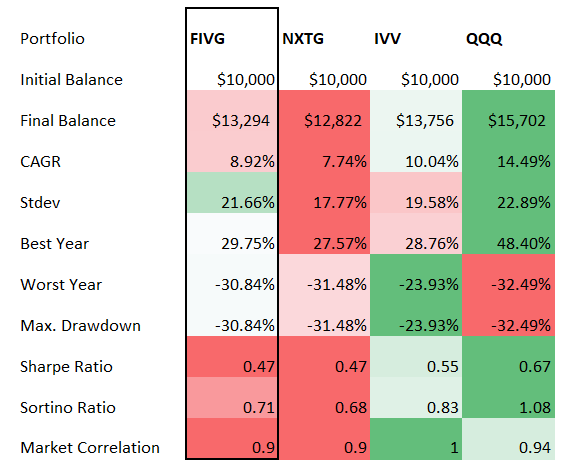

For better context, let us look at a few peers and benchmark them against QQQ and IVV. The period in focus was intentionally narrowed to June 2019 – September 2022 to account for the fact that NXTG changed its investment strategy in May 2019, replacing the Nasdaq CTA Smartphone Index with Indxx 5G & NextG Thematic Index.

Created by the author using data from Portfolio Visualizer

In this set, we see FIVG lagging IVV by slightly more than 1%, with softer risk-adjusted returns, yet with a higher standard deviation. QQQ is almost unrivaled, though its max drawdown is a disappointment. Interestingly, despite having just around 16% overlap with IVV in the current iteration, FIVG demonstrated a significant correlation with the S&P 500 (another way of saying the market), of 0.9.

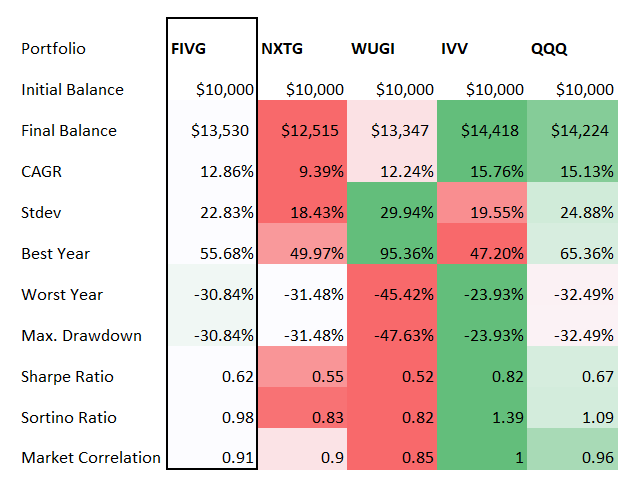

The next table incorporates WUGI which was incepted on 31 March 2020 and thus has the shortest trading history amongst the ETFs compared.

Created by the author using data from Portfolio Visualizer

Again, FIVG is the best among its peers (except for the best year, as WUGI delivered an unrivaled, fairly astronomical return in 2020), yet it was still unable to beat IVV and QQQ.

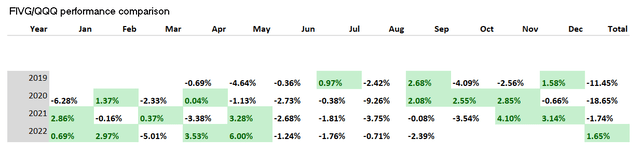

To illustrate that FIVG’s underperformance was caused not only by the devastating consequences the hawkish policy has for growth stocks this year, I compared its monthly and annual returns to QQQ, with results presented in the table below. As can be seen, despite a few bright spots, FIVG was behind every year except for (surprisingly) 2022.

Created by the author using data from Portfolio Visualizer

Key factor considerations: value, quality, growth

So has its valuation become attractive enough? Mostly yes, but with caveats.

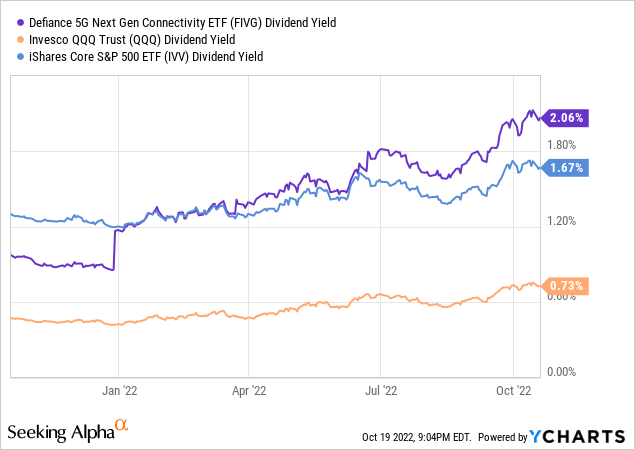

First and foremost, close to 42% of its holdings have at least B- Quant Valuation grade, with ~13% even boasting an A (+/-) grade. This is a solid achievement. Another interesting consequence of the overall reasonable valuation of FIVG’s holdings is its distribution yield, which is higher than IVV’s, let alone QQQ’s.

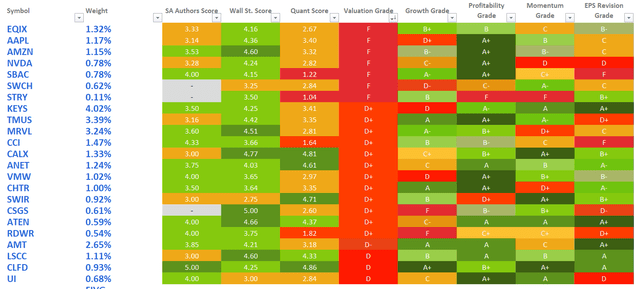

However, there are downsides too. ~31% of holdings are overpriced, with D+ ratings or worse. These stocks are presented in the table below.

Created by the author using data from Seeking Alpha and the fund

Next, my calculations show the weighted average EV/Sales ratio of the ETF is ~5.8x, over 2x the IT sector median.

This looks strange and unjustified if taken together with forecast revenue growth; for the fund with only around a quarter of the net assets parked in stocks with no less than 20% forward revenue growth rates, this multiple looks clearly lofty. However, this still might be explained by the fact that over 42% of the holdings are anticipated to deliver above 20% Forward EPS growth (which either implies an improvement in margins across the portfolio or aggressive buybacks), which the EV/Sales ratio reflects. Also, the premium valuation is partly driven by robust profitability, i.e., ~84% is allocated to stocks with B- Profitability ratings or better.

Final thoughts

Answering the question of whether the 5G theme has become inexpensive enough, I would say ‘more likely.’ Yet there are downsides, and not only related to the fact that ~31% of the fund is overpriced and might continue struggling in the higher interest rates environment.

Despite the unquestionably promising theme, the 5G ETF has simply not lived up to expectations, failing to outperform IVV, let alone its racier tech-heavy peer in the past. Perhaps, only for now. Also, fees are reasonable at 30 bps, the lowest level in the 5G ETF peer group, which is a silver lining.

Most importantly, I am still of the opinion simpler plain-vanilla products targeting bellwethers, QQQ included, are better options for longer-term investors than niche vehicles. To conclude, I believe FIVG is a Hold.