Sergei Dubrovskii

By: Alex Rosen

Summary

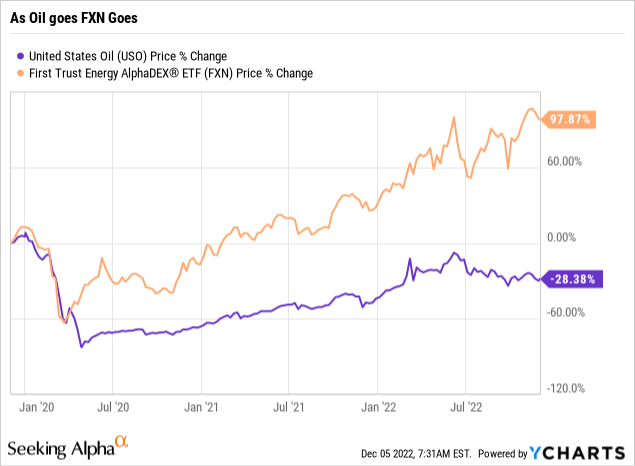

First Trust Energy AlphaDEX Fund (NYSEARCA:FXN) tracks an index of large- and mid-cap US energy stocks. This fairly uncomplicated fund has hit on a sector focus that is seeing record returns this year. As one would expect, the fund, too, is seeing record returns, up 60% on the year and 130% over the past three years. By focusing on finding winners, as opposed to just taking a basket of the biggest companies, FXN has so far succeeded in beating the OIL ETF by almost a 2 to 1 ratio YTD.

Strategy

FXN seeks to follow returns similar to the StrataQuant Energy Index. The idea being that rather than simply representing the entire U.S. energy field, it tries to choose high performing stocks through quantitative analysis and a multileveled weighting system. As a result the portfolio leans toward mid-caps.

The fund is rebalanced quarterly.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Energy

-

Sub-Segment: U.S. oil and gas

-

Correlation (vs. S&P 500): Moderate

-

Expected Volatility (vs. S&P 500): Low

Holding Analysis

As expected FXN holds 100% U.S. equities, primarily in the oil and gas sector with a small holding in green energies. The top ten holdings constitute roughly 40% of the fund, and overall the fund holds 42 individual stocks.

The largest holdings are Marathon Oil (MRO) (4.8%), PDC Energy (PDCE) (4.48%), and Diamondback Energy (FANG) (4.36%).

Strengths

When a fund focuses only on one sector or one commodity, it had better make sure that sector or commodity is a winner. FXN tries to only pick winners, and in picking the U.S. oil and gas industry, it has picked a winner. At least for right now it’s a winner. How long it will stay that way is hard to predict, but you can look at some of the exogenous factors that have contributed to the U.S. oil and gas sector recent renaissance, and it is a good indicator that the good times should continue to roll like a barrel of oil.

Demands for U.S. oil and gas production is set for record highs in 2022 and 2023. International production issues (Thank you Mr. Putin) have created an unprecedented demand for U.S. energy exports. Even if the global price of oil remains constant, the source of supply has changed making profits in the U.S. sector that much higher.

Weaknesses

For every rise there is a fall. My father used to tell us how he walked to school every day uphill in the snow, and walked home uphill in the snow too. Only in stories does the hill go up both ways. Oil, like any commodity, is cyclical. We all remember how in 2020, oil went negative. No one knows when the top of the market is, and without any redundancies to hedge against a decline in prices, FXN is subject to the whims of the market.

Just this week, the EU announced they would cap Russian oil prices at $60 a barrel. That’s a bit of a turnaround from the previous no Russian oil stance. Overall, oil is trading at around $80 a barrel. What does this mean? Will the broader price of oil drop to $60? Will countries suddenly be buying more Russian oil? Or will some enterprising young arbitrager buy all the Russian oil at $60 a barrel, and repackage it as other leading brand oil and sell it for $75 a barrel? No one knows.

Opportunities

The oil train, or pipeline in this case, may continue to gush throughout the winter with prices soaring back to $120 a barrel. If that happens, then FXN is extremely well positioned to capitalize on that.

Germany, which is the country most affected by Russian oil sanctions, is feverishly working to build LNG plants in order to import from the U.S. They have turned construction time from five to six years to two to three months. Talk about operation warp speed.

Maybe the war in Russia ends, but the Houthi rebels in Yemen attack the Saudi oil fields again. Any number of possibilities exist that could drive global oil prices over $100 and even $150 a barrel.

One thing for certain though is the threat to U.S. energy production is very low, and as a result is really only subject to the threats from production in other countries.

Threats

As just mentioned all real threats come from abroad. A sudden increase in global supply: a secession of hostilities in Ukraine, and Saudi Arabia; maybe Venezuela gets its act together. Heck, even Israel, a land famous for its lack of oil in the Middle East, suddenly has found a massive natural gas play off the coast. The price of oil is volatile, and while all signs point toward it trending upward, these things are unpredictable at best.

Beyond that, the fund’s stated strategy of “picking winners” has an inherent risk involved in it. Today’s winners may be tomorrow’s losers and so on. Only time will tell if they really picked winners based on fundamentals and deep quantitative and qualitative analysis, or they just liked the logo of the company.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Hold

- Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

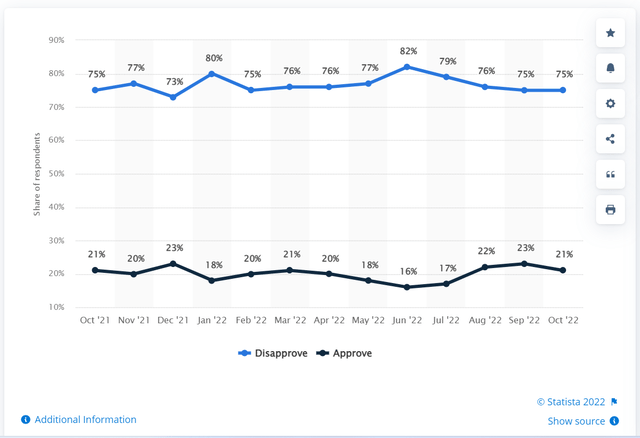

I am always hesitant to advocate for a fund that looks to pick winners. After all, who is picking the losers for their portfolios. Everyone wants a winner. It’s kind of like the House approval ratings. Overall they are terrible, but ask anyone about their own representative, and they will tell you how great they are.

Everyone says their representative is the best (Statista)

However, they do seem to be doing some solid picking there, so who are we to judge?

ETF Investment Opinion

FXN has ridden a great wave of strong returns this year. While the S&P is down 15% YTD, FXN is up 60%. Should you pick your funds based purely on past performance? Absolutely not. Should you expect this level of return to continue? Probably not. However, if you have been holding the fund so far, we recommend you continue to Hold. The market may not have peaked, or maybe it has, but we suspect it is closer to peaking than it is to continuing to grow, so keep an eye on it and the oil market in general for indicators one way or another.