The payment processing space is seeing a growing number of big bets placed by venture capitalists, which could give financial technology exchange-traded funds (ETFs) a boost. It’s a $1.9 trillion industry that the largest tech firms are trying to tap into.

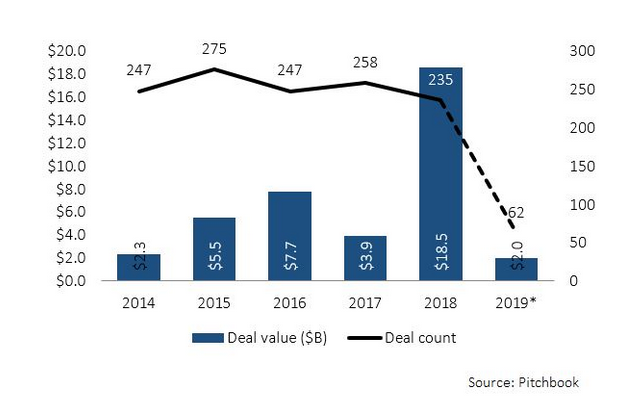

Payments are increasingly going digital with a number of start-ups seeing venture capital seed money to help facilitate online purchases. According to research company Pitchbook, data shows that investors put $18.5 billion into the payment processing sector in 2018–an increase of five times the previous year.

That influx of investment capital was spread over 235 deals compared to 258 in 2017. China’s Ant Financial was responsible for raising $14 billion in 2018, which shows its confidence in the payment processing space.

“High level the deal count fell a bit in 2018 but (was) still very healthy and I wouldn’t read anything into that small decline,” said Paul Condra, lead emerging technology analyst at PitchBook.

“Companies that can simplify payments for SMBs (small and medium-sized businesses) or focus on the complexity of cross-border payments have received tremendous attention.”

A number of mergers and acquisitions have already taken place, such as the following:

- Stripe raised a total of $345 million in its latest investment round at a $22.5 billion valuation.

- Try-before-you-buy payments firm Klarna recently closed a $100 million internal round of investing.

- GoCardless got a $75 million cash injection from Alphabet and Salesforce.

Earlier this year, international financial services provider Fidelity National Information Services agreed to purchase payment processing company Worldpay for $34 billion, making it the biggest deal thus far in a rapidly-expanding space that could put fintech exchange-traded funds (ETFs) in play.

ETFs to look at in the growing fintech space include the Global X FinTech ETF (NasdaqGM: FINX) and the ARK Fintech Innovation ETF (NYSEArca: ARKF). Both ETFs are up year-to-date–FINX is up 22 percent and ARKF is up 5 percent.

ARKF invests in equity securities of companies that ARK believes are shifting financial services and economic transactions to technology infrastructure platforms, ultimately revolutionizing financial services by creating simplicity and accessibility while driving down costs.

Contactless payment systems typically fly under the radar, but more popular applications like Apple Pay are drawing more attention to the industry. Prior to the FIS purchase, Fiserv agreed to buy payment processor First Data for about $22 billion earlier this year.

The purchase of Worldpay would give FIS a large footprint in the e-commerce market given that the former is responsible for facilitating 40 billion transactions per year.

For more market trends, visit ETF Trends