[ad_1]

jzabloski/iStock via Getty Images

By Alex Rosen

Summary

As a child, I used to love watching reruns of the Beverly Hillbillies, a story about a poor mountaineer from Appalachia who struck it rich when he found oil on his property. SPDR S&P Oil & Gas Equipment & Services ETF (NYSEARCA:XES) may just be the modern day opportunity to invest in the Jed Clampetts of America. XES’s focus on the U.S. O&G equipment and sub-services industries comes at a time when the demand for fossil fuels from the U.S. is reaching all-time highs. New construction can be seen all around the country. From LNG trains in Western Louisiana, to wildcat rigs in North Dakota and Montana, all over the country people are looking to exploit that black gold.

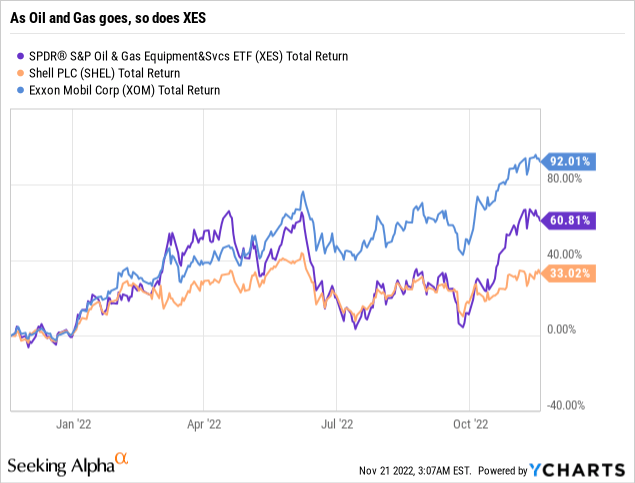

There may just be something in that model though, as XES has returned YTD 59.24% with a .35 expense ratio. While long term we see the demand for O&G infrastructure development cooling off, in the near future we rate XES a Buy, as the demand still remains strong.

Strategy

The exchange-traded fund (“ETF”) tracks an index of oil & gas equipment and services sub-industry companies in the S&P Total Market Index.

Proprietary ETF Grades

- Offense/Defense: Offense

- Segment: Oil and Gas

- Sub-Segment: Oil services

- Correlation (vs. S&P 500): Low

- Expected Volatility (vs. S&P 500): Low

Holding Analysis

XES has a fairly small portfolio, with only 33 holdings as of this writing. As mentioned, the entirety of the fund is invested in American companies, and is fairly evenly balanced with the top ten holdings accounting for around 42% of the fund and the top 25 at 90%.

Strengths

XES is not a super sexy brag to your friends at the next Greenpeace meet up fund, but it knows what it is and it does what it is supposed to.

Fossil fuels may be a dying industry, but don’t write the obituary just yet. For now the world runs on oil, and we can’t get enough of it. Companies and countries all around the world are targeting 2030, 2035, 2050 as the time when we wean ourselves off of fossil fuels completely, but this is 2022, and the truth is the industry is not shrinking, but expanding.

Every extra barrel of oil that is sucked out of the ground, and every fissure that is cleaved into the earth to extract shale needs equipment and services. Natural gas doesn’t liquify itself, it takes large liquefaction plants with multiple trains (in the LNG industry a train refers to a liquefaction terminal) thousands of miles of pipelines and countless other equipment to make that a reality.

XES invests in that process and it does it well. As long as other large oil producing countries are either under sanction, or producing capacity, the U.S. industry will continue to grow.

Weaknesses

XES is not investing in an infant industry that has just scratched the surface of what it can achieve. This is not an emerging market where the sector can really take off. U.S. oil and gas services and equipment is a well established industry with very few market inefficiencies to exploit. As long as the demand stays high, XES will show positive returns, but there is no residual excess to capture here. Much like the oil that is being pumped, once the tap runs dry, that’s it, show’s over, no encore. This industry will live and die on the demand curve.

Opportunities

Globally, supply has been cut for reasons both real and artificial. With the sanctions on Russia, Norway has become the largest supplier of natural gas to Europe. However there is a finite amount of gas they can produce, and as winter is arriving in Europe, the demand for home heating gas will far exceed the capacity of Norway alone to provide. Other countries must increase production to replace Russia. Even if the U.S. isn’t shipping to Europe, the other countries they supply will increase demand as other supplies are diverted to Europe.

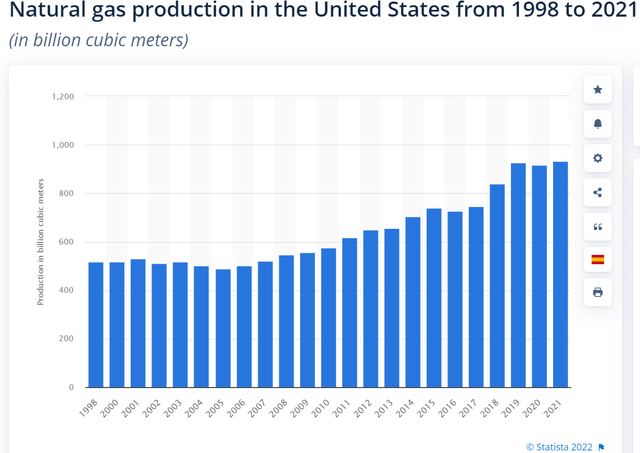

Right now, U.S. oil and gas companies are producing natural gas at record levels, but this increase in production is clearly not being reflected in U.S. consumer gas prices, because the supply is going to meet demand elsewhere. As mentioned above, this is not an infant industry and U.S. oil and gas companies have already pivoted to try and meet demand, but even that has done little to ease prices, so the expansion will continue.

Growth of the production of U.S. Natural Gas (Statista)

Threats

The biggest risk for XES is that demand is met, and the production continues, greatly lowering the price of natural gas. All the money invested in oil and gas services and equipment becomes redundant and we have fields and fields of rusting oil derricks and fallow LNG plants.

When the first LNG liquefication/gasification plants were built in the Gulf of Mexico, they were built not for export, but for import. At the time, Congress had a ban on export of U.S. natural gas. However with the shale revolution, the tide changed flow and the gasification plants were quickly retrofitted to become liquefaction plants and the export of U.S. LNG began.

There is no guarantee this won’t happen again, and even as recently as two years ago, the oil futures market completely collapsed.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Buy

- Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

XES is a lean and clean fund with a clear objective, and holdings that match that. No fancy tricks here, just buy and hold oil and gas services and equipment companies. A low expense ratio reflects that.

ETF Investment Opinion

We rate XES a Buy in the short term as the Oil and Gas industry is still rushing to meet demand. However, long term we believe the heavy investment now will be a drag on the industry later as other suppliers come back on line and alternative energy sources seek to meet some of the demand.

[ad_2]

Source links Google News