[ad_1]

blackdovfx

The Amplify Transformational Data Sharing ETF (NYSEARCA:BLOK) is an ETF focused to a decent degree on the fintech space, with also quite major exposures to crypto. While there are reasons to be generally concerned about crypto exposures in the portfolio, we also worry about the part of the portfolio that is dedicated either to fintech venture incubation or are earlier stage fintech companies whose dependence on capital markets could become a problem. Otherwise, some of the more stalwart elements in the portfolio appear to be a little uncompelling.

Brief BLOK Breakdown

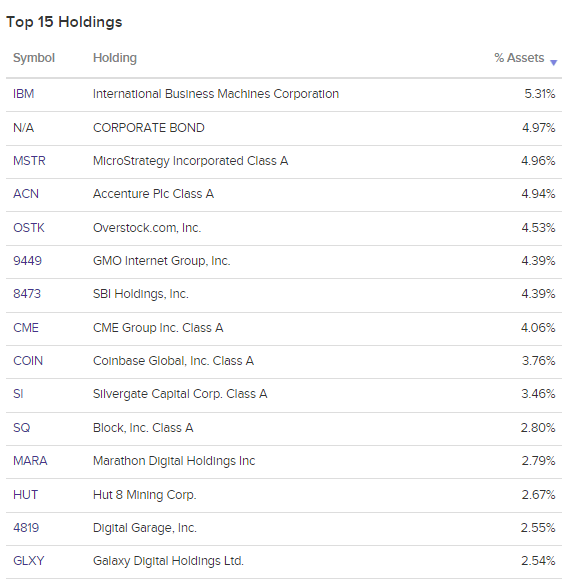

Let’s run through some of the key elements of this ETF, starting with its top holdings. There are 50 stocks in this ETF, and while not uniformly distributed, there is a certain active element to this portfolio where the weighting trend down quite linearly.

BLOK Top Holdings (etfdb.com)

Besides the corporate bond exposure, some of the larger and more traditional elements are International Business Machines (IBM), Accenture (ACN), Overstock (OSTK) and CME Group (CME).

IBM is in this ETF mainly because Red Hat fits the mandate of a modern, data oriented property which relies on an open source concept for development of enterprise hybrid cloud operating systems and to stay dynamic and ahead of potential hacks and exploits. Accenture is here because it’s the premier tech consulting house, and it continues to deliver growth. Overstock is surprising here because they have a non-operating blockchain oriented fund within their business. The problem with the Overstock exposure is that it gives exposure to retail trends which are very much on the decline as of late. CME is here because it is a clearing house for derivative products, also those based on cryptocurrencies. These stocks alone are already almost 20% of the portfolio.

Otherwise, there is substantial exposure to crypto mining within BLOK.

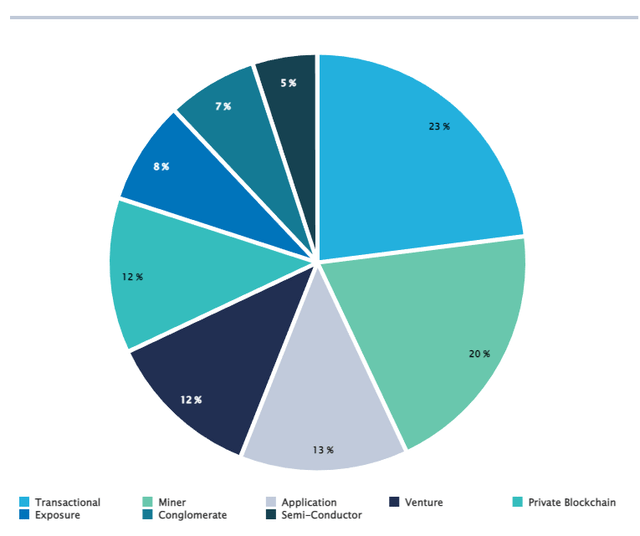

BLOK Exposures (amplifyetfs.com)

20% of the ETF is exposed to mining companies, whose economics are of course dependent on being long crypto. Within the semiconductor allocation there is Nvidia (NVDA) and other stocks that are exposed to sales of products used for crypto mining like ASICs. 12% of the portfolio is in fintech ventures, including venture incubation companies but also fintech startups. There are also companies that provide private blockchains. 23% of the portfolio are labelled as transactional, and these are essentially the exposures like Mastercard (MA) that depend on transaction volumes in the economy.

Remarks

There is quite a lot in this portfolio that is levered negatively to the recessionary pressures we are getting in the current economy. To begin with, semiconductor inventories are in the process of rising rapidly after having been totally depleted for a long period. In other words, semiconductors are generally coming into a glut, and in the case of ASIC companies and NVDA. pressure are indeed real from the crypto collapse which is killing a part of the retail demand for their products that was actually for homebrew mining.

Other parts of the portfolio are a little concerning as well. The fintech venture component of the portfolio, which includes fintech incubation companies and other fintech startups, is going to be affected by the poor financing conditions in venture capital, markets which have shut for a while, and reflexivity in their stock prices like with Nu Holdings (NU). The semiconductor and venture exposures already add to about 17% of the overall allocation, and that is quite substantial.

Another 30% is exposed to a long bet on crypto. This includes some of the businesses that would fall under transactional like Coinbase (COIN). These stocks are either miners, hold crypto assets or are directly dependent on positive price developments in crypto. Coinbase, like other platforms that host crypto trading activities, has seen pullbacks as people reduce exposure and activity in those markets, comprehensive of whatever countercyclical tendencies there are among traders to buy during volatility.

That leaves 50% of the portfolio in companies like payments businesses, IT, tech consulting, fintech or general financial services companies, many of which in Japan, and almost all of which are growing at a clip. Stocks like ACN count themselves in this number, and also the leaner and more Red Hat focused IBM.

The issue is the following: We’ve never been a huge fan of the ACN valuation, which remains high at 24x compared to other tech consulting companies, and the mirrored PE of 27x in the portfolio is not to our fancy. A 27x PE implies less than a 4% earnings yield. While ACN, IBM and quite a few of these other marquee companies generate earnings growth that could just about justify those earnings yields, although we worry about all businesses in the face of a recession, with lots of the portfolio seeing a definite negative increment in the current environment, the comprehensive earnings growth of the portfolio is likely to be limited. Just the crypto mining companies as well as the crypto asset companies are going to be seeing high leverage negative pressures on their returns LTM, and with a 30% weighting in the portfolio and the possibility of continued risk-off sentiment, the quality parts of the portfolio will struggle to keep the current multiple sensible. On top of that, the expense ratios are quite high at 0.71% due to the peculiarities of this ETF, earnings yield gets eroded there too.

It comes down to the fact that BLOK is quite an aggressive ETF, and there’s a lot of crypto exposure here which introduces its now iconic volatility. With the economic environment being difficult, we’d stay away.

[ad_2]

Source links Google News