[ad_1]

Dilok Klaisataporn

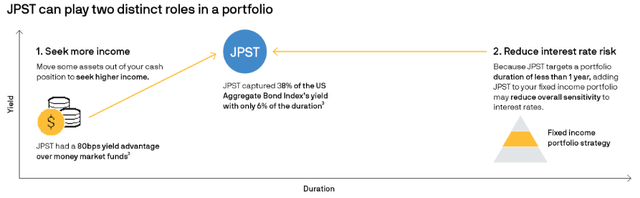

The Federal Reserve has been raising interest rates to control inflation. Investors of longer term bond funds had duration risk bite them in their account value. Today, we will revisit an ETF that is towards the other end of the spectrum, a fund holding USD-denominated debt securities with an effective duration of one year or less. Did its nimbleness vis a vis its duration help in recent times?

The Fund

JPMorgan Ultra-Short Income ETF (BATS:JPST) aims to “deliver current income while seeking to maintain a low volatility of principal”.

JPST

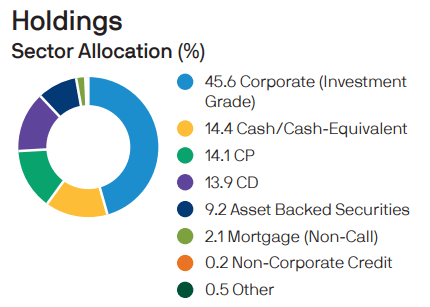

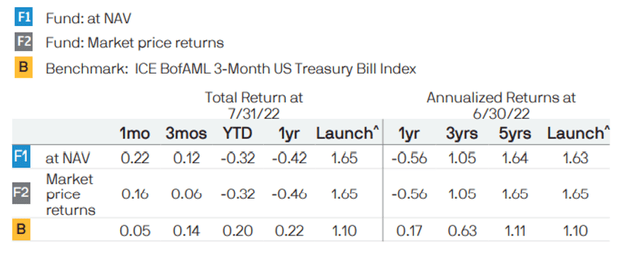

This $20 billion ETF manages it credit risk by putting money into investment-grade fixed and floating-rate corporate and structured debt.

Fund Factsheet July 31, 2022

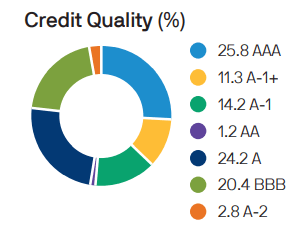

The objective of this ETF is to have at least 80% of its assets in investment grade [IG] holdings. The most recent data shows that JPST met and exceeded that goal quite comfortably. Similar to what we saw in our coverage of this fund in 2021, the continue to have a higher concentration of holdings at the top and bottom ends of the IG grade with relatively fewer holdings in the middle.

Fund Factsheet July 31, 2022

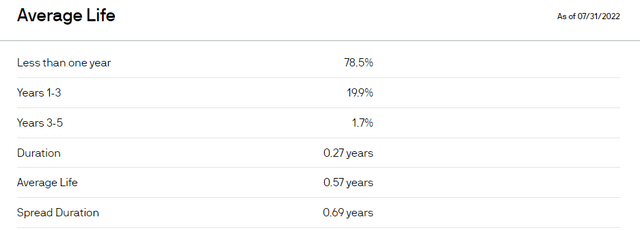

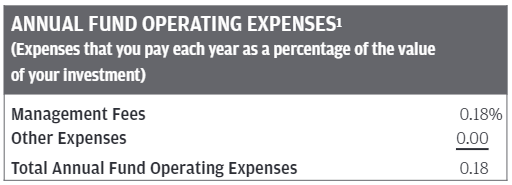

As indicated by its name, JPST minimizes it duration risk by aiming to maintain an overall duration of a year or less under normal market circumstances. It has the discretion to exceed this duration in periods of higher volatility in rates and spreads. Saying that the fund met this objective would be an understatement as per the most recent data.

JPST

The fees for this ETF are a nominal 0.18 percent which certainly does not impact its performance at any material level.

Prospectus

Earnings and Distributions

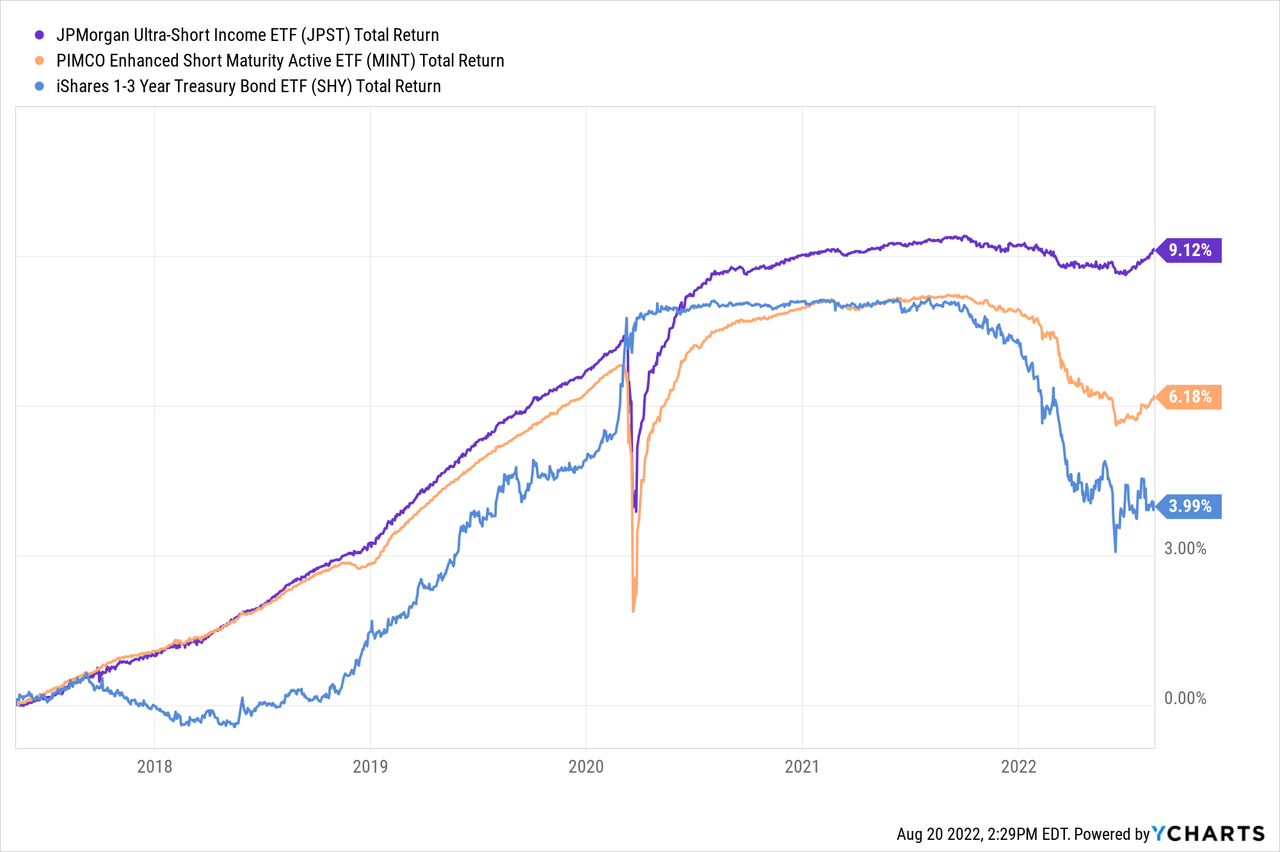

The average yield as of July 31 was 3.11 percent, with the 30 day sec yield coming in around 2.50 percent.

Fund Factsheet July 31. 2022

With the rise in interest rates, expectedly we are seeing a rise in the yield numbers, both in earnings and what is paid out to the investors.

JPST

In comparison, the last time we wrote on this ETF, both the earnings and the distributions were well below 1 percent. With another hike baked into the mix for September, the yield on SEC Yield on JPST should move past 3 percent in the next few months.

Performance

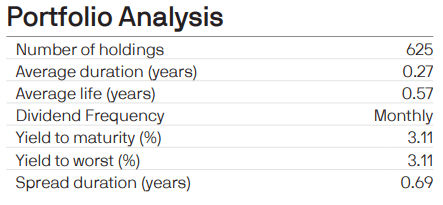

Serving as a cash alternative to its investors, it has not disappointed since inception in 2017. The ETF out performed comparable cash alternatives such as PIMCO Enhanced Short Maturity Active ETF (MINT) and iShares 1-3 Year Treasury Bond ETF (SHY) during this time.

It has even beaten its benchmark for majority of its existence despite the lack of fees for the benchmark index.

JPST

Verdict & Alternatives

Back in June 2021, cash alternatives were hard to come by and we did not think JPST worthy for the miniscule yield it generated then, its nimbleness notwithstanding.

In the current market, there are no great alternatives for cash. We had previously highlighted one where you could make far more. But today even those kinds of bargains are hard to find. Investors’ best bet here may be to hold cash as cash or accept the luster free returns. Outside that, investors holding cash to buy quality stocks, can sell cash secured puts to earn far more as we routinely do. But that method might not work for everyone as many hold cash for other reasons and not just to buy stocks on sale. (Source: JPST: They Work Hard For Your Money)

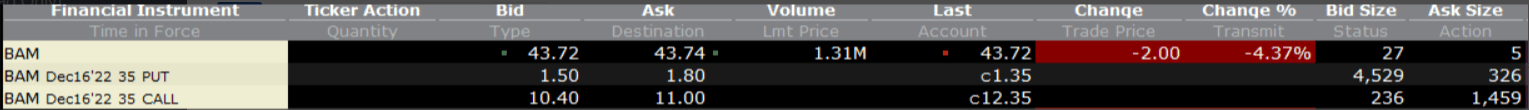

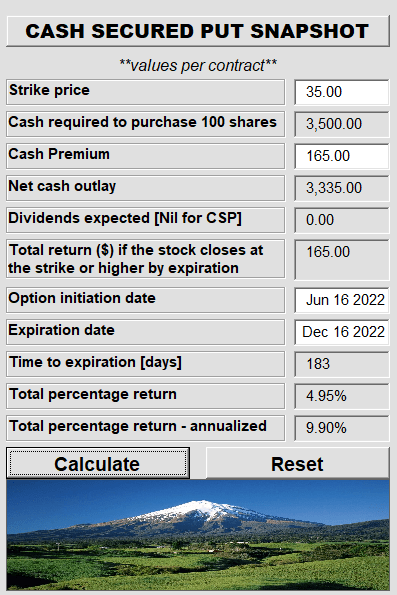

IB Jun 16, 2022 Conservative Income Portfolio

That (almost) 10% yield was quite sweet and as we see, BAM is nowhere in the $35 zone. These pay a lot more but you have to deploy these carefully and after big declines. As long as you do that, your odds of beating JPST increase substantially.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

[ad_2]

Source links Google News