[ad_1]

naphtalina/iStock via Getty Images

Investment Thesis

The WisdomTree LargeCap Dividend ETF (NYSEARCA:DLN) is a large-cap dividend ETF. The fund offers exposure to a basket of high-quality dividend-paying securities in the US.

Dividend ETFs are a popular source of income for investors seeking a consistent stream of cash. They are generally less volatile than the market since a dividend reflects a company’s financial soundness, and are therefore perceived by investors as less risky. On top of the good dividend that comes with it, DLN trades at a discount relative to the S&P 500 and has historically outperformed the market.

Strategy Details

The WisdomTree LargeCap Dividend ETF tracks the performance of the WisdomTree U.S. LargeCap Dividend index. The index invests in dividend-paying large-cap companies in the US equity market. This fund can be used to gain exposure to core US large-cap stocks and to provide a stable source of income.

If you want to learn more about this strategy, please click here.

Portfolio Composition

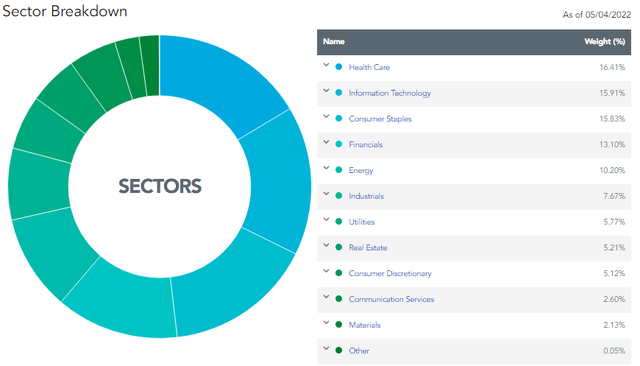

The index places a high weight on the Health Care sector (representing around 16.4% of the index), followed by Information Technology (accounting for 16%) and Consumer Staples (representing around 13% of the fund). The largest three sectors have a combined allocation of approximately 49%. In terms of geographical allocation, the fund invests only in the US.

WisdomTree

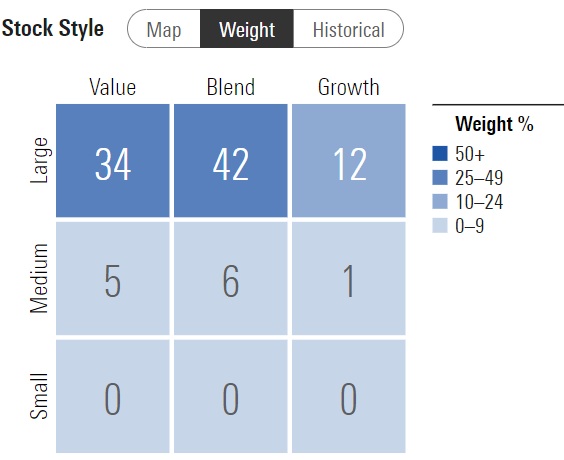

~42% of the portfolio is invested in large-cap blend issuers, characterized as large-sized companies where neither growth nor value characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $8 billion. This category accounts for over 80% of total assets. The main explanation for this is the fact that large caps are typically mature companies that have limited growth prospects and generate excess cash. They are therefore able to return a large portion of that cash back to shareholders.

Morningstar

The fund is currently invested in 295 different stocks. The top ten holdings account for ~29% of the portfolio, with no single stock weighting more than ~5%. All in all, DLN is well-diversified and has a very low level of unsystematic risk as a result.

Morningstar

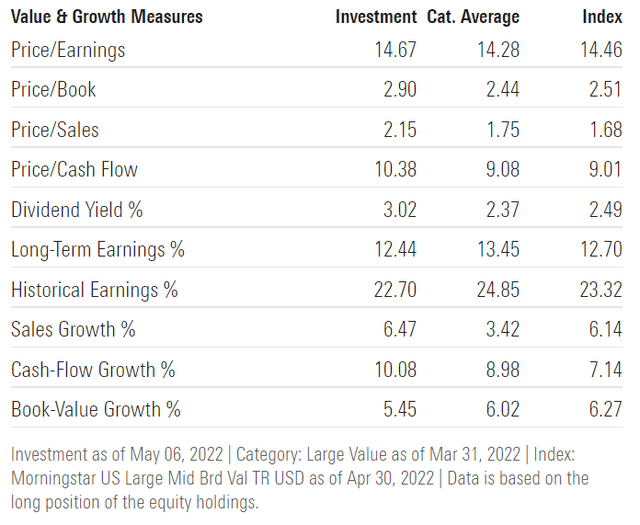

As we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Morningstar, DLN currently trades at an average price-to-book ratio of ~2.9 and at an average price-to-earnings ratio of ~14.7. This is much cheaper than what you can get on an S&P 500 ETF such as the SPDR S&P 500 Trust ETF (SPY) which trades at 18x forward earnings.

Morningstar

Is This ETF Right for Me?

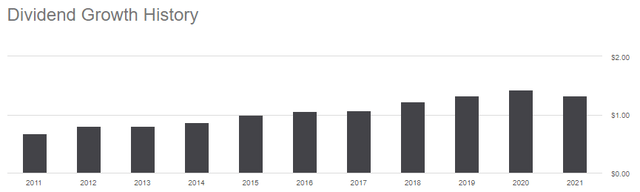

Dividend investors like DLN because it owns a basket of quality dividend-paying stocks. This is nicely reflected in the dividend history which shows a clear growth trajectory over the last decade. In 2021, DLN paid a dividend of $1.33 per share, slightly lower than the previous year. At the current share price of $62, the TTM dividend yield (excluding capital gains) stands at ~2.2%.

Seeking Alpha

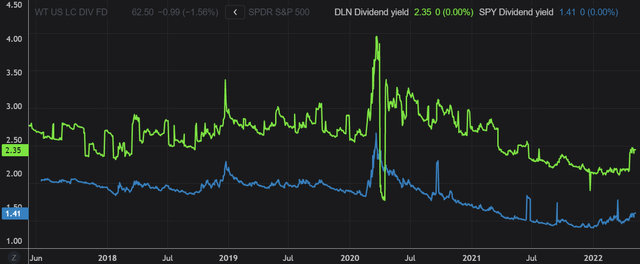

The dividend yield is another factor that favors DLN over SPY. That said, I think you should be cautious and I see how a 2% dividend yield fits investment goals. In my opinion, this yield is insufficient to compensate investors for holding long-duration assets such as stocks in the current investment environment. Investors now have an alternative in the bond market where they can get a yield exceeding 3%.

Refinitiv Eikon

I have compared below DLN’s price performance against SPY over the last 5 years to assess which one was a better investment. Over that period, SPY outperformed DLN by an ~18 percentage points margin.

Refinitiv Eikon – 5Y price return

However, if we look at the total return which takes into account dividends paid to shareholders, it is interesting to see that DLN did actually better than SPY. I think this is one of the examples which really shows the power of dividends and how important they are for investors.

To put DLN’s price performance into perspective, a $100 investment 5 years ago in this ETF would now be worth ~$150.34. This represents a compound annual growth rate of ~8.5%, excluding dividends, which is a good absolute return.

Refinitiv Eikon – 5Y total return

If we take a step back and look at the 10-year total return, the results don’t change much. DLN came on top once again, outperforming SPY since mid-2014. I like the fact that DLN provides a reliable source of income and has the potential for capital gains, which are in many countries taxed at a lower rate than dividends.

Refinitiv Eikon – 10Y total return

Key Takeaways

DLN provides exposure to a basket of high-quality dividend-paying securities in the US. The fund is well-diversified both across sectors and issuers. The strategy has a track record of providing consistent income for shareholders and outperforming the market, which makes DLN a good buy-and-hold type of investment in my opinion. On top of that, the fund trades at a discount to the S&P 500 and I believe it has a good chance of outperforming the market over the next years.

[ad_2]

Source links Google News