[ad_1]

Maks_Lab/iStock via Getty Images

For the period December 31, 2021 to March 31, 2022 (the “Period”), the Global X Emerging Markets Bond ETF (the “Fund”) sub-advised by Mirae Asset Global Investments (USA) LLC posted a loss of 6.87% (including distributions paid to unitholders). This performance compares to a loss of 9.93% for the Fund’s benchmark, the JP Morgan EMBI Global Core Index (the “Index”) during the same period.

The Index tracks liquid, U.S.-dollar emerging market (EM) fixed and floating-rate debt instruments issued by sovereign and quasi-sovereign entities.

The performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance data current to the most recent month or quarter-end, please click here. Total expense ratio: 0.39%.

Cumulative return is the aggregate amount that an investment has gained or lost over time.

General Market Review

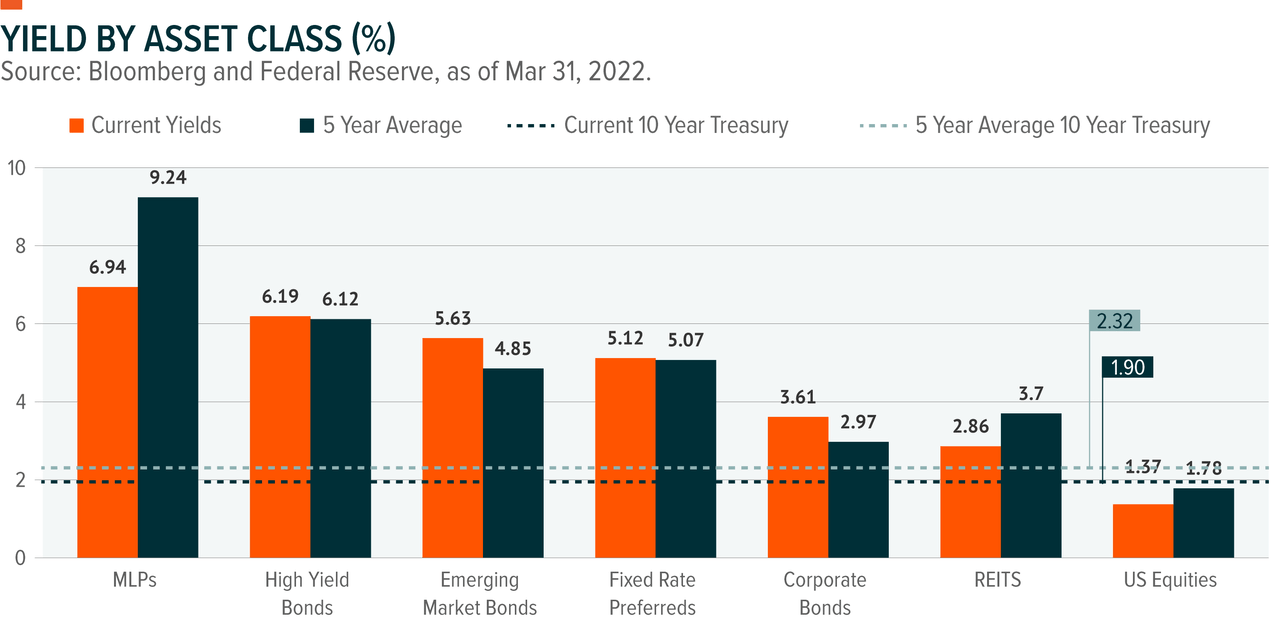

Heading into 2022, the macro backdrop for risk-assets was already facing challenges from the expected slowdown in global growth, due to the resurgence of the Omicron variant and persistent inflationary dynamics. Further headwinds arose in the first quarter, with the threat of tighter monetary policy and escalating geopolitical tensions. At the beginning of the year, the market expected the U.S. Federal Reserve (FED) to hike interest rates three times in 2022.1 This was considered aggressive at the time, given that the Fed was still expanding its balance sheet and growth rates were declining. However, the policy path quickly evolved as fears of persistent inflation began rising. With full support from the Biden administration, the Fed became very hawkish and led the market to price in more than 10 interest rate hikes for 2022, implying multiple Federal Open Market Committee (FOMC) meetings with 50 basis point hikes.2 Consequently, U.S. 10-year Treasury rates rose more than 83 basis points to 2.33%.3

In the first quarter of 2022, Russia’s full-scale invasion of Ukraine put further pressure on risk assets as well as inflation dynamics. Even though Russia makes up only 2.5% of the global GDP, the outsized influence of Russia on key global commodity export markets, such as oil (11%), gas (17%), wheat (11%), and nickel (7%), created anxiety among market participants.4 Russian-related sanctions and self-imposed sanctions by business communities further disrupted the global supply chain. Consequently, global energy and agricultural prices rose sharply, further pressuring inflation expectations. However, Russia did not cut off its natural gas flows to European markets, a move markets initially feared would be part of Russia’s counter measures against the West’s severe sanctions. Nevertheless, geopolitical tensions centered around the Russia-Ukraine war increased pressure on the global growth trajectory, while elevating the inflation outlook for the rest of 2022. One interesting observation by global central banks, post Russia-Ukraine escalation, was that central banks appeared to prioritize policy focus around stemming inflation as opposed to boosting growth.

A macro development that received less media attention was China’s major policy pivot in mid-March. Contributions to China’s deteriorating domestic growth momentum include (1) the regulatory crackdowns in Chinese technology sectors, (2) the liquidity crunch experienced by real estate property developers, and (3) the risk of large-scale lockdowns in major cities due to surging COVID-19 cases. These finally forced the Chinese government to announce a major policy pivot when China’s Financial Stability and Development Committee (FSDC) signaled State-Owned Enterprises, including major Chinese banks, to support growth initiatives. Consequently, Chinese financial asset markets and assets sensitive to China’s growth impulse rebounded as the risk of China’s hard landing declined.

For EM investors, Q1 2022 was an even more challenging environment as they had to recognize the losses from exposures to Russia in their portfolios. The swift countermeasures by the West in the form of economic and financial sanctions, including the coordinated efforts to freeze the foreign reserves of Central Bank of Russia, risked forcing Russia to default on foreign debt obligations. Furthermore, index providers’ decision to exclude Russia from widely followed bond and equity indices forced passive investors to crystalize losses at inopportune market timing. That being said, EM investors quickly differentiated winners and losers from the geopolitical crisis as the cost of the war was going to be unevenly distributed between commodity exporters and commodity importers. The terms of trade shock effects from higher commodity prices will likely show up in EM countries’ trade and budget balances in the coming quarters.

EM credit markets faced multiple headwinds coming from (1) the sell-off in U.S. Treasuries triggered by the tightening monetary policy and (2) the credit spread widening driven by a deteriorating outlook from a growth slowdown and losses from Russian assets. Interestingly, EM credit markets were much more resilient than anticipated at the onset of Russia’s invasion, as the EM credit sector, excluding Russian assets, performed similarly to Developed Market credit markets during the Period. One likely explanation of the EM resilience could be that the surging commodity prices were a net positive factor for the majority of EM issuers.

Portfolio Review

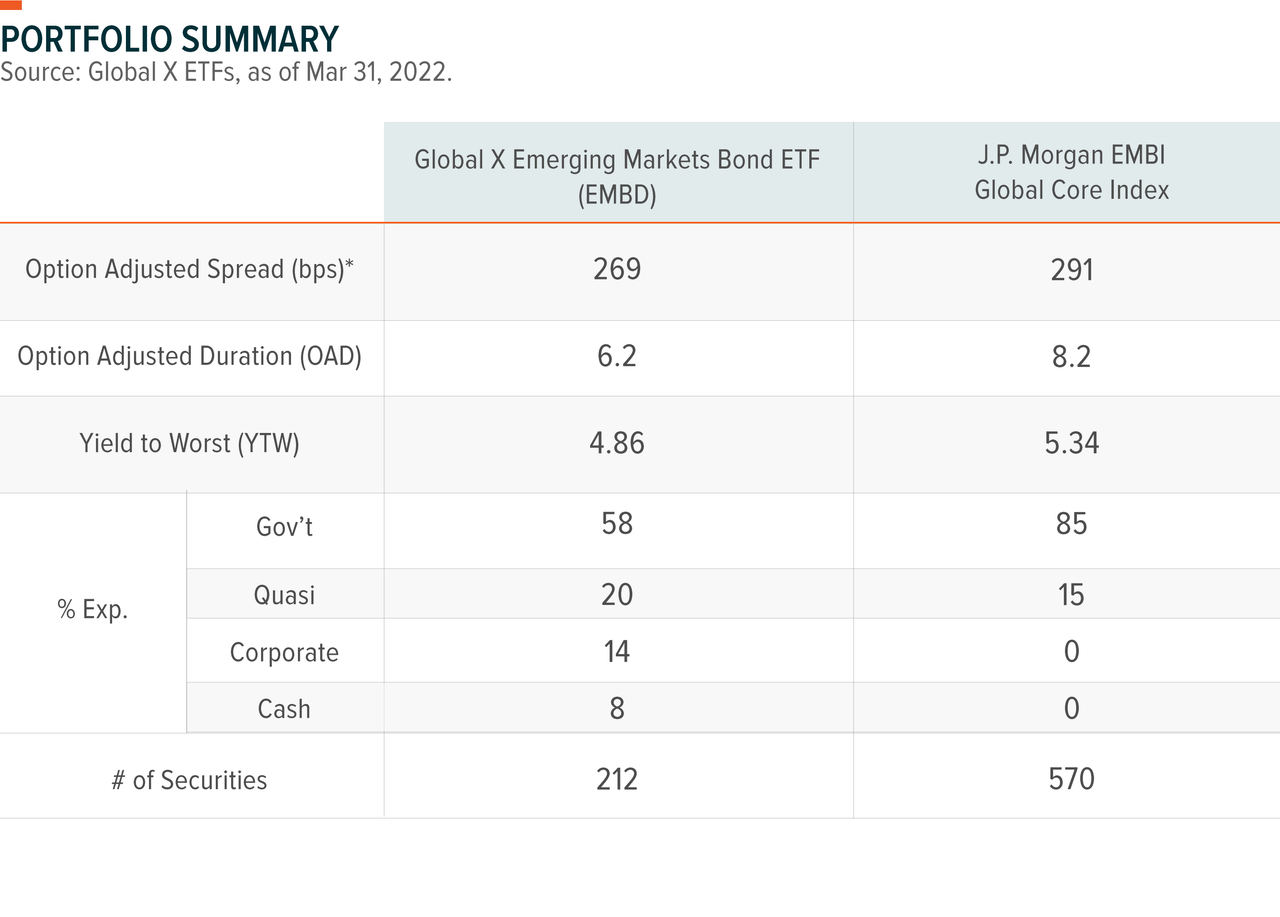

During the Period, the Fund outperformed the Index by 306 basis points. The Fund’s lower duration relative to the Index and country selections positively contributed to performance (+108 and +232 basis points, respectively). However, the Fund’s security selection was a detractor (-34 basis points).5

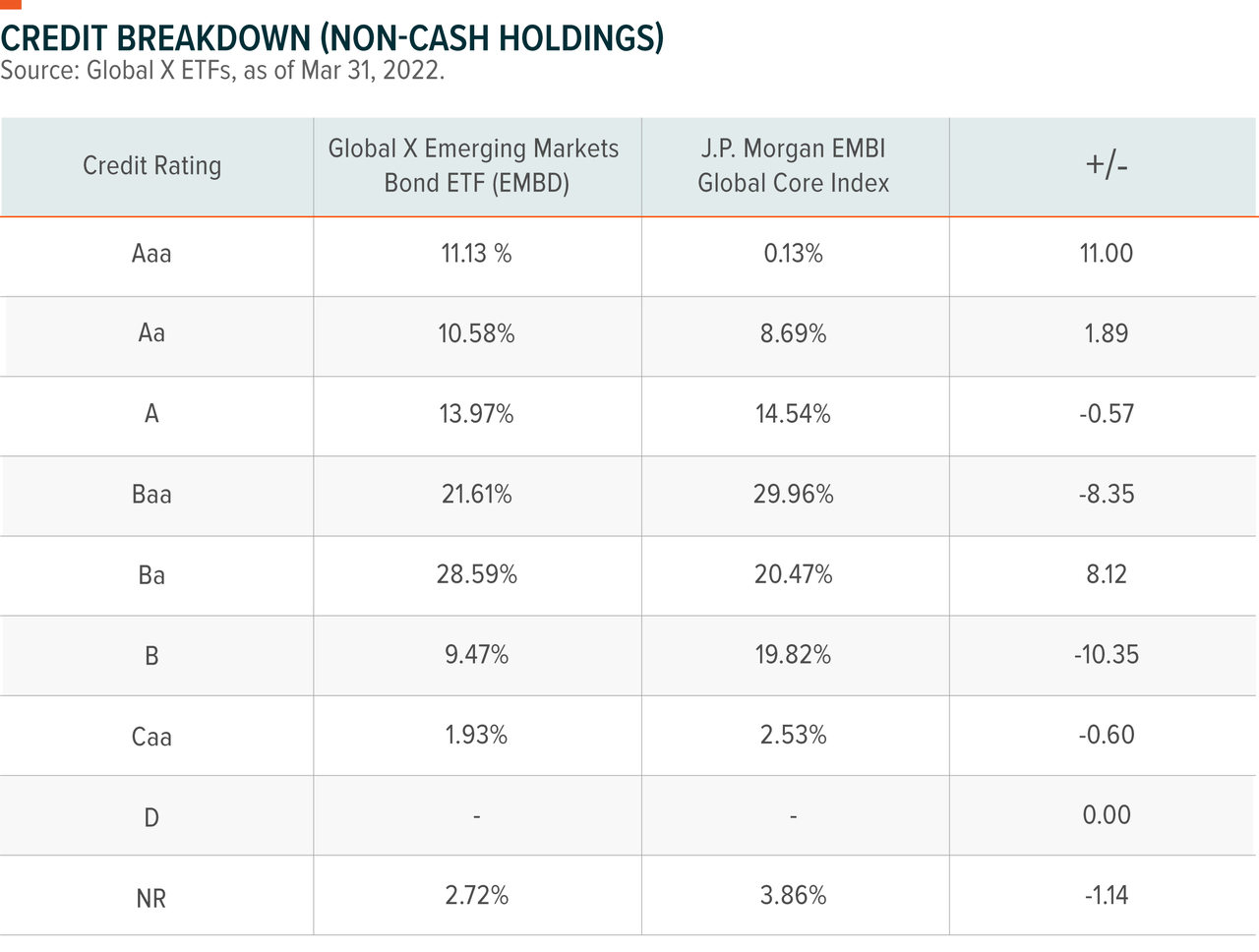

Heading into the first quarter, we maintained our underweight duration exposure as we expected global bond yields to move higher in the first half of the year while credit spreads were expected to remain elevated. Thus, our decision to overweight high-yielding assets over the investment-grade sector, given that there were more spread buffers to absorb in high-yield sovereign bonds, positively impacted the Fund’s performance.

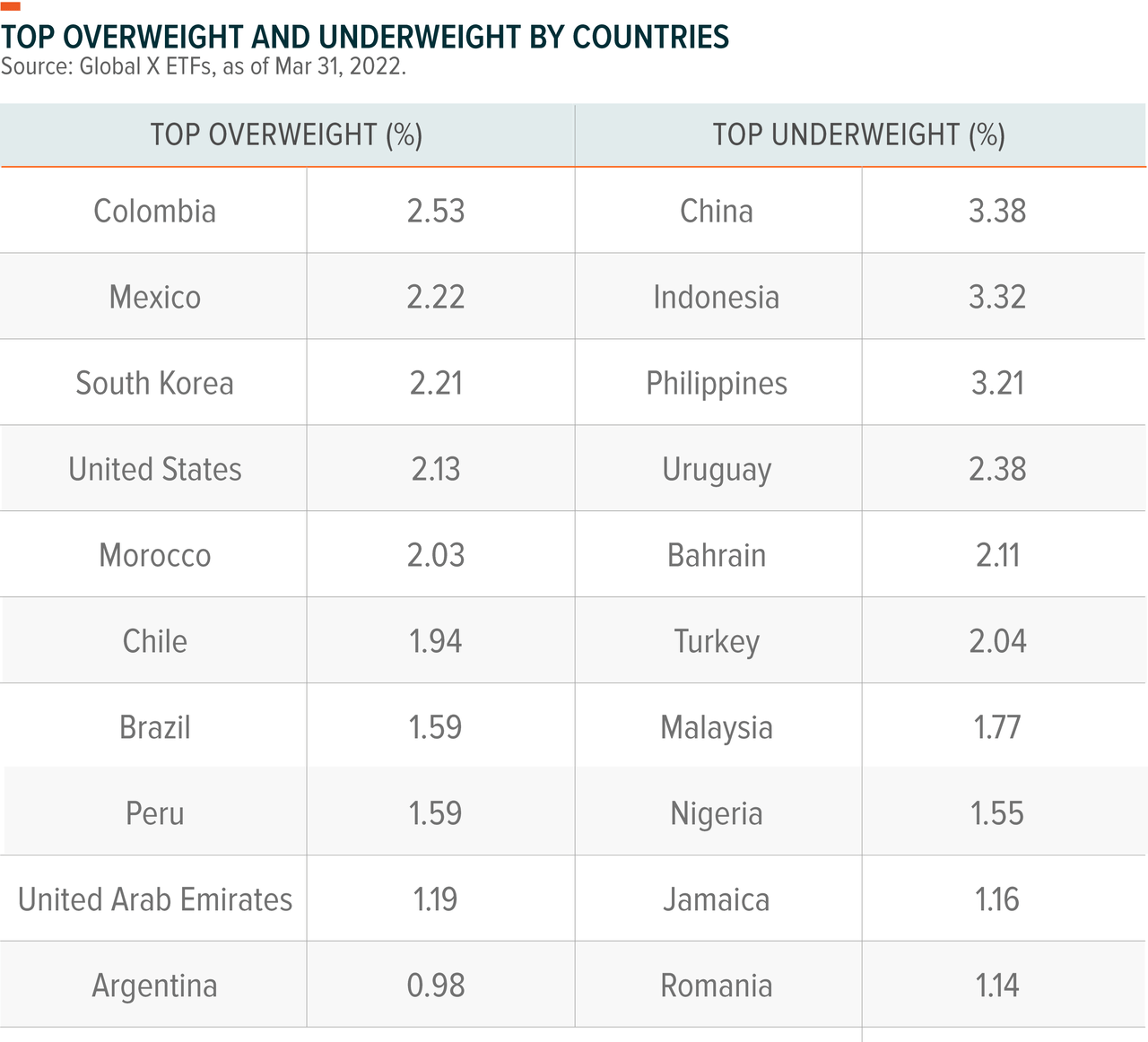

The largest positive contribution derived from our underweights in Russia and Ukraine, which added to performance by 256 and 17 basis points, respectively.6 We maintained our underweight position in Russia as the credit spreads were not sufficiently attractive relative to the ongoing headline risks of the military build-up. As the war broke out, we maintained our underweight positions in Russia and sold our remaining Russian exposures when the Euroclear settlement firm unblocked the settlement process of Russian securities. As for our Ukraine exposure, we headed into Q1 2022 with market neutral exposure as Ukraine bonds sold off aggressively in Q4 2021 in line with other bonds that have high volatility. However, we reduced our Ukrainian exposure as headline risks related to Russia’s invasion increased.

On the other hand, the Fund’s underweight in Turkey detracted from performance. Given that Turkey’s external positions were vulnerable to tightening U.S. monetary policy and to higher commodity prices as a major oil and agricultural goods importer, we maintained underweight positions in Turkey. Furthermore, our overweight positions in Colombia, Brazil, and Morocco were further detractors from performance. Colombia lagged as the market remained cautious of election risks. Our security selection detracted from performance due to the Fund’s exposure to a South African technology holding company, Nasper, which had investment exposure to China’s leading platform (Tencent). The regulatory crackdown on the Chinese technology sector elevated the perceived credit risks of the issuer.

During the Period, we reduced our exposure to higher yielding African issuers, as we believed that the negative shock to EM risk appetite will make it difficult for these issuers to raise capital from the new issue market, which may raise refinancing risks.

Outlook & Strategy

Key investment themes heading into Q2 2022 are: (1) the market’s pricing of the Fed’s aggressive quantitative tightening (QT) path, (2) the repercussion of global commodity prices on the growth and inflation mix, (3) the risk of an elongated pandemic lockdown versus delivering on pro-growth commitment by the Chinese policymakers, and (4) geopolitical escalation.

At the time of writing, the 10-year U.S. Treasury has continued to rise due to expectations of a more hawkish path for U.S. monetary policy. However, the recent sell-off in U.S. rates was not driven by the Fed’s policy rate path, which is already pricing in 250bp in 2022 and another 75bp in 2023, but by the market’s pricing of the Fed’s aggressive QT path. The Fed’s QT plan is more aggressive than many in the market had anticipated, not only in terms of the speed at which maximum cap should be reached, but also in terms of the size of the maximum cap with potential for Mortgage-Backed Securities sale. We expect the rise in rate volatility to dampen the general risk asset sentiments.

Secondly, the longer the Russia-Ukraine conflict continues, the more likely global commodity prices may remain elevated, further deteriorating the growth-inflation mix. The market already shifted the expectation of global inflation fading from Q1 2022 to the latter half of the year. With global central banks already prioritizing inflation risks over growth slowdown risks in their policy focus, global growth momentum will likely deteriorate further in Q2 2022.

Thirdly, the big uncertainty for global growth momentum is whether China will be able to quickly overcome the slowdown brought about by COVID-19 lockdown measures. We note that China’s credit impulse, namely the monthly change of flows in new credit, was trending higher prior to the lockdown measures. We believe this reflects how China’s government wanted to stimulate growth before the Communist Party National Congress gathers in the Fall to announce President Xi’s third term as party chief. Similar to what we have seen in Europe and in the United States, we expect China’s growth activity to quickly recover as the Omicron variant appears less concerning to authorities than prior variants. Furthermore, we expect authorities in China to provide more fiscal support to offset COVID-19 lockdown losses and to support EM asset risk appetite.

Lastly, there remains a risk that the Russia-Ukraine geopolitical crisis could expand to a broader European event by inadvertently dragging one of the NATO members into the conflict. With all of the top-down macro risks mentioned above, we believe one positive catalyst for EM markets heading into Q2 2022 is that investors have likely incorporated these risks in their portfolios.

Given that the risk-reward mix appears tilted more towards downside risks than upside potential, we plan to position the portfolio more defensively in terms of duration and credit risks relative to the Index. However, we plan to use the weaknesses in the credit markets triggered by the market’s overly aggressive assumptions of the Fed’s policy stance to add to duration risks. We feel that the sell-off in U.S. Treasury markets are excessive, given that the current level already reflects expectations for more than 10 interest rate hikes in 2022, in addition to the aggressive QT path.

From a credit risk perspective, we plan to move up the credit quality spectrum by adding high-quality issuers while reducing lower quality and high-beta exposures. We find the investment grade corporate sector attractive from a risk-reward perspective as they may provide better protection from downside growth risks given that their credit fundamentals remain solid. Our regional allocation mix favors Latin America over Asia and the Middle East as higher commodity prices and hawkish regional EM central banks could potentially provide safeguards against tightening U.S. monetary policy. From a country allocation perspective, we believe credit differentiation driven by sovereigns with healthy external balance sheets will be the central theme for EM assets as the Fed withdraws liquidity support from the system.

Credit Ratings noted are by Fitch, Moody’s, and Standard & Poor’s. Ratings are measured on a scale that generally ranges from Aaa (highest) to D (lowest). If more than one of these rating agencies rated the security, then an average of the ratings was taken to decide to security’s rating.

Related ETFs

EMBD: The Global X Emerging Markets Bond ETF (EM is an actively managed fund sub-advised by Mirae Asset Global Investments (USA) LLC that seeks a high level of total return, consisting of both income and capital appreciation, by investing in emerging market debt. EMBD primarily invests in emerging market debt securities denominated in U.S. dollars, however, the Fund may also invest in those denominated in applicable local foreign currencies. Securities may include fixed-rate and floating-rate debt instruments issued by sovereign, quasi-sovereign, and corporate entities from emerging market countries.

EMBD’s portfolio managers incorporate both top-down macro views consistent with the firm’s Investment Committee and bottom-up fundamental research to evaluate the investment attractiveness of select countries and companies that are believed to offer superior risk-adjusted returns. The portfolio managers determine country allocation primarily based on economic indicators, industry structure, terms of trade, political environment and geopolitical issues. In addition, the portfolio managers conduct relative valuation analysis on sovereign and corporate issues to tactically identify potential opportunities to enhance the Fund’s risk-adjusted returns. The portfolio managers may dynamically adjust the top-down and bottom-up strategies of the Fund to better reflect market developments.

Footnotes

- Graffeo, E. & Ferro, J. (2021, December 27). Stocks’ rally will likely survive the Fed’s first hike, Crossmark says.

- Bloomberg L.P. (n.d.). [WIRP function, 10.47 hikes priced in at time of writing] [Data set]. Retrieved April 21, 2022 from Global X Bloomberg terminal.

- McCormick, L. (2022, March 31). Investors brace for QT’s ‘profound effect’ on cost of liquidity.

- Statista Research Department. (2022, April 6). Russia’s share in global production 2020, by commodity.

- Analysis provided by Mirae Asset, as of March 31, 2022.

- Ibid.

DEFINITIONS

Beta: Beta is a quantitative measure of volatility, also known as systematic risk, of a security or securities versus the market as a whole.

Duration: Is a measure of the sensitivity of the price of a fixed-income investment to a change in interest rates. Duration is expressed in years.

Investing involves risk, including the possible loss of principal. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. High yield bonds involve greater risks of default or downgrade and are more volatile than investment grade securities, due to the speculative nature of their investments. EMBD is actively managed, which could increase its transaction costs (thereby lowering its performance) and could increase the amount of taxes you owe by generating short-term gains, which may be taxed at a higher rate. EMBD is non-diversified.

As an actively managed Fund, EMBD does not seek to replicate a specified index and is subject to increased credit and default risk, where there is an inability or unwillingness by the issuer of a fixed income security to meet its financial obligations, debt extension risk, where an issuer may exercise its right to pay principal on an obligation later than expected, as well as interest rate/maturity risk, where the value of the Fund’s fixed income assets will decline because of rising interest rates.

EMBD may invest in securities denominated in foreign currencies. Because the Fund’s NAV is determined in U.S. dollars, the EMBD’s NAV could decline if currencies of the underlying securities depreciate against the U.S. dollar or if there are delays or limits on repatriation of such currencies. Currency exchange rates can be very volatile and can change quickly and unpredictably.

Carefully consider the Fund’s investment objectives, risks, and charges and expenses before investing. This and other information can be found in the Fund’s summary or full prospectuses, which may be obtained by calling 1.888.493.8631, or by visiting globalxetfs.com. Please read the prospectus carefully before investing.

EMBD’s benchmark index is the JPMorgan EMBI Global Core Index, which is a broad, diverse U.S. dollar denominated emerging markets debt benchmark that tracks the total return of actively traded debt instruments in emerging market countries. Indices are unmanaged and do not include the effect of fees, expenses or sales charges. One cannot invest directly in an index.

This information contains a manager’s opinion, is not intended to be individual or personalized investment or tax advice, and should not be used for trading purposes.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. The market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share, and do not represent the returns you would receive if you traded shares at other times. NAVs are calculated using prices as of 4:00 PM Eastern Time.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC or Mirae Asset Global Investments. Global X Funds are not sponsored, endorsed, issued, sold or promoted by JPMorgan, nor does JPMorgan make any representations regarding the advisability of investing in the Global X Funds. Neither SIDCO, Global X nor Mirae Asset Global Investments are affiliated with JPMorgan.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

[ad_2]

Source links Google News