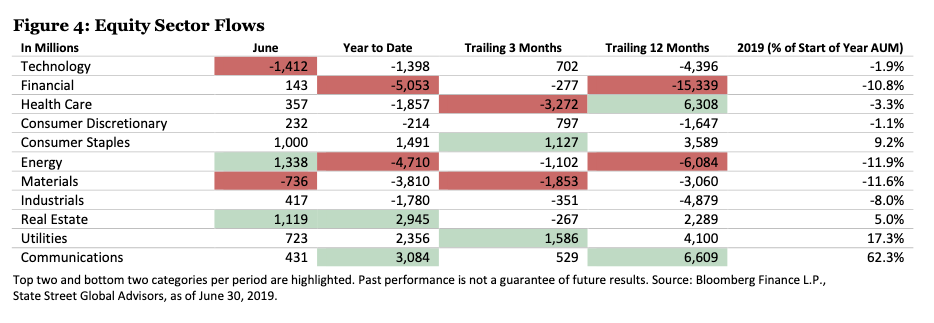

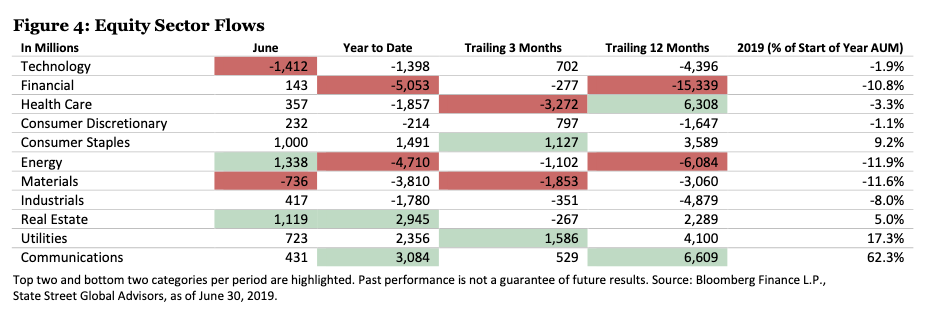

Based on the latest report on exchange-traded fund (ETF) flow data from State Street Global Advisors, the technology sector took a temporary dive in inflows during the month of June, but that could be short-lived. Among the potential gainers in the tech sector, communication services is the one to watch.

“Looking ahead, Communication Services is a sector to watch. Bellwether names reside in the segment and earnings season is upon us,” wrote Matthew Bartolini, CFA Head of SPDR Americas Research State Street Global Advisors, in the report. “Last season, the sector saw the second-highest magnitude of earnings beats, and it is only one of the three sectors that have witnessed more upgrades relative to downgrades to their full-year 2019 earnings estimatesvias of late. Based on our method of using continuous flow momentum (as described below), there is also positive sentiment from a flow perspective.”

Communication ETFs to Consider

Earlier this year, Direxion bolstered its lineup of exchange-traded funds (ETFs) by adding two ETFs to complete its synchronization with the Global Industry Classification Standard (GICS®) sector changes implemented by S&P Dow Jones in September 2018.

In particular, these new ETFs offer traders exposure to the newly expanded and renamed Communication Services Select Sector Index via leveraged and inverse products.

“There has been pent-up demand by investors to be able to take advantage of improved definition of the type of securities that are relevant in today’s markets,” David Mazza, Managing Director and Head of Product at Direxion “The launch of the first ever leverage products in this space give traders the advantage to amplify that exposure on a daily basis for those looking for leveraged and inverse exposure.”

| Fund | Symbol | CUSIP | Benchmark | Gross Expense

Ratio |

Net Expense Ratio* |

| Direxion Daily Communication Services Index Bull 3X Shares | TAWK | 25460E497 | Communication Services Select Sector Index | 1.11% | 1.10% |

| Direxion Daily Communication Services Index Bear 3X Shares | MUTE | 25460E489 | Communication Services Select Sector Index | 1.08% | 1.07% |

The Communication Services sector now reflects today’s modern means of facilitating communications and delivering information, broadened to include not just telecom titans such as AT&T, but major internet and IT industry players such as Netflix and Facebook. The new composition means the sector will offer potentially more growth-oriented exposure than the old value-oriented telecommunication services sector, as well as become more cyclical than defensive.

“The new Communication Services sector reflects what communications means in the 21st century, transforming what was once a defensive area of the market into one that is global, cyclical and growth-oriented,” said Mazza. “TAWK and MUTE allow traders to take bold positions on the next evolution of media and communications.”

Like all leveraged and inverse ETFs, these Direxion products are intended only for investors with an in-depth understanding of the risks associated with seeking leveraged and inverse investment results, and who plan to actively monitor and manage their positions. There is no guarantee that the Funds will meet their objective.

For more market trends, visit ETF Trends.