This fast-growing REIT is rewarding investors with big dividend growth, which might be tempting to income investors looking for a way to jump into the marijuana sector. However, most should think carefully about that choice.

A solid pot stock

The first thing to understand about Innovative Industrial Properties is that it is, in fact, a wonderful way to invest in the pot industry. Since it doesn’t actually grow marijuana, it sidesteps the still material legal and regulatory issues involved in the space. Moreover, it is providing an important resource to the industry — cash to help fund growth.

Essentially, Innovative Industrial buys growing facilities from marijuana growers who instantly rent the property back under long-term leases. That allows the grower to keep using the property and provides it with cash that it can put toward expanding its business (or, perhaps, to reduce leverage). Innovative Industrial, meanwhile, expands its portfolio and gets a new long-term lease. It’s a win-win scenario that allows Innovative Industrial to grow along with the industry.

Furthermore, for those who might still be a little concerned about the legal issues surrounding marijuana, Innovative Industrial provides a bit of a backstop. Not only does it sidestep legal issues by being a landlord, but it theoretically could repurpose the properties it owns and lease them to companies not involved with pot. A marijuana grower would probably have a much harder time repositioning itself, if it were even possible.

As a relatively new REIT with a unique niche, Innovative has been growing like a weed. To put a number on that, it ended 2018 with around a dozen properties, and by mid-2019, it had 22. It has become a vital source of capital to the some of the biggest names in the industry.

Now add in the income the REIT legally has to direct toward shareholders and Innovative starts to look enticing for dividend investors interested in the marijuana space, a fast-growing sector not exactly known for income. Innovative’s swiftly expanding portfolio has also led to incredible dividend growth, with the most recent increase coming in at a massive 33%. If you are looking for a relatively safe way to invest in the marijuana industry while also generating some income, Innovative is a great option.

More than one fly in the ointment

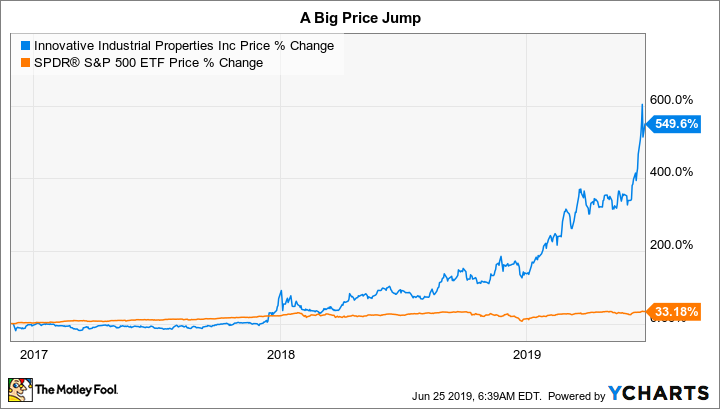

That said, income investors should think carefully before making a buy call here. For starters, even after rapid dividend growth, the yield is a miserly 1.8% (you could easily get that much by investing in an S&P 500 index ETF). Like the marijuana growers that Innovative Industrial counts as tenants, the REIT’s shares have been bid up by Wall Street’s hype machine. To put a number on that, the stock is up more than 500% since its late 2017 IPO. It has clearly gotten caught up in the marijuana investing craze. While its business has physical assets to backstop it, that doesn’t mean it will be able to live up to the currently high expectations built into the price of virtually all marijuana-related stocks.

IIPR DATA BY YCHARTS.

As for the safety provided by the property portfolio, there are some issues to consider. For example, grow houses are very specific structures. Repurposing a grow house would require a time consuming and potentially expensive overhaul of a property. Innovative could replace a tenant with another grower, of course, but that only works if the industry doesn’t get sidelined in some way. In other words, if the marijuana sector as a whole falters for some reason, Innovative’s business will likely take at least a temporary hit, if not more. It is, then, a safer way to play the marijuana sector, but far from a “safe” real estate investment.

The next issue to keep in mind is that Innovative is still a relatively tiny REIT. Even after the massive run-up in price and swift portfolio growth, it sports just a $1.2 billion market cap and a portfolio of roughly 22 highly targeted assets. REIT industry giant Realty Income has a $22.6 billion market cap and a diversified portfolio of around 6,000 properties. Innovative Industrial is growing fast, aided by its small size, but don’t overlook the risk associated with investing in a tiny, highly focused property owner. Trouble with one property or lessee could have a material impact on its financial results.

To the REIT’s credit, it has so far managed to expand the portfolio with just modest use of leverage. That ups the safety quotient here. But Innovative has increasingly been using debt to fund its acquisitions. So, what is now a strength still needs to be monitored closely as management executes its business plans. It is unlikely that low leverage will remain a point of differentiation for very long. And if management gets caught up in the search for growth, leverage could easily turn into a net negative.

This is not an income stock

At the end of the day, Innovative Industrial Properties is a very interesting marijuana stock. But it is not a great income stock, even with the massive dividend growth numbers it has put up. The yield is too low, the stock has risen alarmingly fast, and the still-modest portfolio is highly focused on a niche asset class that has little history behind it. Income investors should easily be able to find higher-yielding REITs with much stronger backstories. Unless you are specifically looking for exposure to the marijuana sector, Innovative Industrial Properties is probably best avoided by income investors today.

Innovative Industrial Properties Inc. (IIPR) was trading at $119.70 per share on Thursday afternoon, down $4.91 (-3.94%). Year-to-date, IIPR has gained 274.06%, versus a 9.78% rise in the benchmark S&P 500 index during the same period.

This article is brought to you courtesy of The Motley Fool.