[ad_1]

The online world is home to many of the most powerful and dynamic companies in the market, and the opportunities for growth are particularly promising when investing in businesses operating through the internet. On the other hand, the competitive landscape is always changing, and this is an important risk factor to consider when investing in internet stocks.

Diversification can be a smart way to bet on a portfolio of rapidly growing companies while keeping the company-specific risk under control, and First Trust DJ Internet Index ETF (FDN) is a great vehicle to implement such an approach.

Growth And Fundamental Strength

FDN has a fairly concentrated portfolio, with only 9 stocks accounting for 53% of the fund’s holdings. Those highly weighted companies are Amazon (AMZN), Facebook (FB), Alphabet (GOOG) (GOOGL), PayPal (PYPL), Netflix (NFLX), Salesforce (CRM), Twitter (TWTR), eBay (EBAY), and Veeva Systems (VEEV)

Source: Seeking Alpha Essential

Source: Seeking Alpha Essential

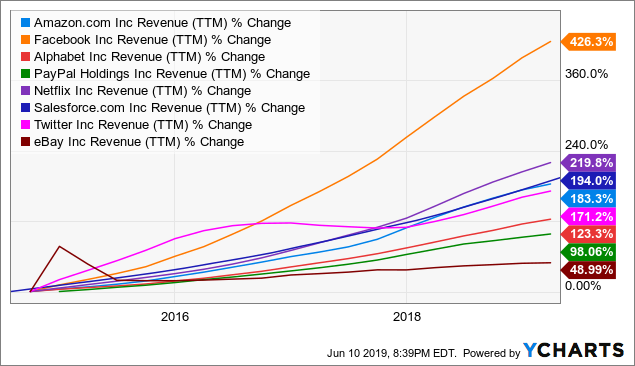

There are some nuanced differences among the companies in the portfolio, but a clear distinguishing factor is that the 9 companies are delivering vigorous growth rates over the long term. These companies are either the undisputed leaders or one of the top players in their respective markets, and they are effectively capitalizing on the massive growth opportunities provided by the internet.

Data by YCharts

Data by YCharts

The network effect is a key source of competitive strength for internet businesses. Under this dynamic, the value of the service increases as it gains size over time. In e-commerce, for example, buyers and sellers attract each other to the leading platforms such as Amazon and eBay.

The same happens in areas such as digital payments or social networks, where more users make the platform more valuable for those users. This creates a self-sustaining cycle of growth and increased user value for the leading players in these sectors.

Because of this dynamic, companies with big scale and a first-mover advantage in the online world are generally in a position of strength to continue capitalizing on the massive growth opportunities that the internet provides.

Diversification plays a major role in terms of limiting company-specific risk. For example, by owning companies such as Google, Facebook, Amazon, and Twitter, the ETF provides exposure to all of the top players in online advertising, so it keeps competitive risk under control.

Quantitative Return Drivers

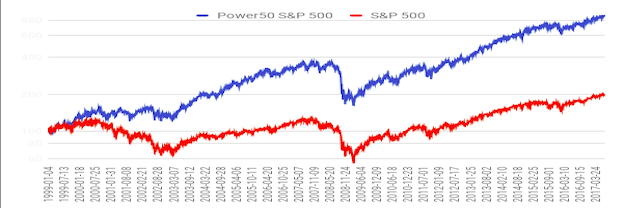

The PowerFactors system is a quantitative investing system available to members in “The Data Driven Investor.” This system basically ranks companies in a particular universe according to a combination of factors such as financial quality, valuation, fundamental momentum, and relative strength.

In plain English, the PowerFactors system is looking to buy good businesses (quality) for a reasonable price (valuation) when the company is doing well (fundamental momentum) and the stock is outperforming (relative strength).

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term.

Data from S&P Global via Portfolio123

The table below shows the aggregate PowerFactors ranking for the 9 top components in the FDN portfolio, as well as the ranking for these companies across the different quantitative factors.

All of these names are above 80, meaning in the top 20% of the US market based on the PowerFactors score. Even better, 8 out of 9 are in the best 10% of the market according to the PowerFactors ranking.

| Ticker | PowerFactors | Quality | Value | F Momentum | R Strength |

| VEEV | 99.68 | 99.16 | 74.04 | 99.45 | 98.89 |

| EBAY | 99.04 | 96.26 | 95.19 | 86.99 | 81.92 |

| FB | 98.81 | 99.59 | 86.88 | 92.92 | 77.57 |

| TWTR | 97.64 | 96.59 | 74.34 | 98.36 | 76.53 |

| CRM | 96.87 | 91.71 | 90.67 | 77.78 | 79.17 |

| PYPL | 96.07 | 93.94 | 77.42 | 67.54 | 95.08 |

| GOOGL | 93.53 | 95.01 | 85.34 | 89.68 | 52.15 |

| AMZN | 93.3 | 93.88 | 82.01 | 68.33 | 77.17 |

| NFLX | 82.92 | 87.99 | 70.28 | 59.03 | 71.47 |

Data from S&P Global via Portfolio123

Looking at the top components in FDN from a quantitative perspective, there are strong reasons to be bullish on First Trust DJ Internet Index ETF over the middle term.

Risk Considerations And Conclusion

FDN is highly oriented towards growth stocks, and these kinds of companies tend to carry above-average volatility. Beta for the ETF over the past 24 months is 1.33, so FDN should be expected to fall harder than the broad market in times when risk appetite is declining, and market prices are moving in the wrong direction.

The market is also expecting vigorous growth from many of the companies in the FDN portfolio, and this is already incorporated into valuations. For companies that fail to meet those growth expectations, current prices don’t provide much of a downside buffer.

From a fundamental perspective, regulatory risk is a major risk factor in the short term. Success attracts regulatory pressure, and companies such as Google, Facebook, and Amazon are facing increasing scrutiny recently.

Chances are that this short-term uncertainty hurting big tech companies will turn out to be a buying opportunity for investors. As long as the fundamentals remain strong, the probabilities are that top-quality companies will continue delivering solid returns in spite of increased regulatory oversight. Nevertheless, this is still a relevant risk factor to keep in mind when evaluating a position in FDN.

Those risks being acknowledged, FND provides exposure to a portfolio of top-quality growth stocks with attractive potential over the years ahead. Personally, I would rather handpick several of those stocks and buy them as individual holdings for a more concentrated bet. This approach carries both higher risk and superior potential for gains versus investing in FDN

On the other hand, for investors who want to increase exposure to high-quality growth stocks in technology through a diversified vehicle, First Trust DJ Internet Index ETF looks like a solid alternative to consider.

Statistical research has proven that stocks and ETFs showing certain quantitative attributes tend to outperform the market over the long term. A subscription to The Data Driven Investor provides you access to profitable screeners and live portfolios based on these effective and time-proven return drivers. Forget about opinions and speculation, investing decisions based on cold hard quantitative data can provide you superior returns with lower risk. Click here to get your free trial now.

Disclosure: I am/we are long AMZN, FB, GOOGL, PYPL, CRM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News