[ad_1]

Main Thesis

The purpose of this article is to evaluate the Vanguard Utilities ETF (VPU) as an investment option at its current market price. I recommended this investment back in early March, despite concerns that the sector appeared overvalued. I saw market conditions that were generally favorable for the Utilities sector, and that has indeed played out in the short-term. With defensive, high-yielding positions outperforming, especially on days when the market is declining, it remains important to consider this asset class for the remainder of 2019.

There are a few reasons to stay bullish. One, interest rates remain flat, and there is even a strong probability of a cut by year-end, which was unthinkable a year ago. Two, housing activity remains solid, with new housing starts rising again in April. Three, dividend growth for VPU is accelerating, which is helping keep the income stream attractive going forward. However, the recent strength is also telling me to be cautious, as funds like VPU are getting increasingly more expensive as investors pay up for defensive exposure. Furthermore, if trade disputes subside, or economic growth accelerates, VPU would likely get hurt as investors rotate back into discretionary positions.

Therefore, while I remain optimistic on VPU as a whole, I would advocate for cautious optimism as these levels.

Background

First, a little about VPU. The fund’s stated objective is “to track the performance of a benchmark index that measures the investment return of stocks in the utilities sector” and it is managed by Vanguard. Currently, the fund trades at $133.17/share and yields 2.94% annually, based on its current price and last four distributions. I covered VPU for the first time in early March, when I recommended the fund. This turned out to be a very timely call, as VPU has returned roughly 5.5%, after accounting for the Q1 dividend. While this might not sound wildly impressive, consider that the S&P 500 is only up about 1.8% in during that same time period, with a lot more volatility. Given this strong, short-term move, I wanted to reassess VPU to see if it is still worth buying today, and I will discuss the merits of doing so in detail below.

Exhibiting Strength

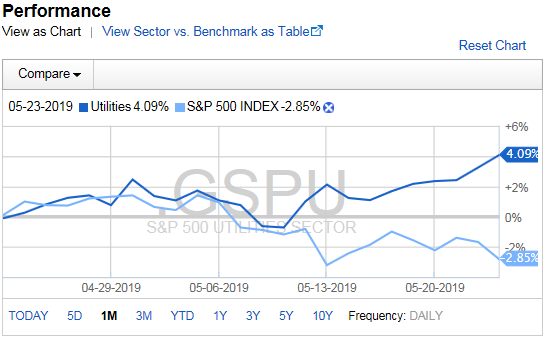

As I mentioned above, the Utilities sector is one of the few sectors exhibiting quite a bit of strength, even with recent market volatility. In fact, over the past month, the sector has markedly out-performed the S&P 500, as illustrated in the graph below:

Source: Fidelity

Source: Fidelity

What is striking about this chart is that it is showing the trend accelerate in the near-term, which is quite impressive considering the performance of the sector over the past year. While many were viewing the sector as overbought or overvalued, it was clear there was still room for it to run.

Now the challenge is determining if the potential for further upside is present, and I will discuss a few key points for and against below.

Interest Rate Outlook More Dovish Than Ever

A key reason for my recommendation of VPU the last time around was the interest rate outlook. I noted how Utility stocks often trade in opposite directions of interest rates, and the fact that the Fed appeared to be pausing further rate hikes this year led me to believe the sector was ripe to move higher. This has turned out to be the right call in the short-term, but investors have got to be wondering if the sector can continue to move higher from here.

While a valid concern, a development in the interest rate outlook since March continues to favor this sector, as the outlook has gotten even more dovish as the year has gone on. Specifically, the market has taken the “patient” verbiage in recent Fed statements to mean now rate hikes are off the table. The recent Fed statement, which came out on May 1st, continued to use this terminology, which is listed below:

In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal funds rate may be appropriate to support these outcomes.

Source: Federal Reserve

In truth, this is not much of a shift in Fed thinking, and seems to be in line with the tone they have portrayed for most of the year. However, investors have interpreted this as having quite dovish intentions, and that thinking has accelerated with the escalation of the ongoing trade dispute between the U.S. and China.

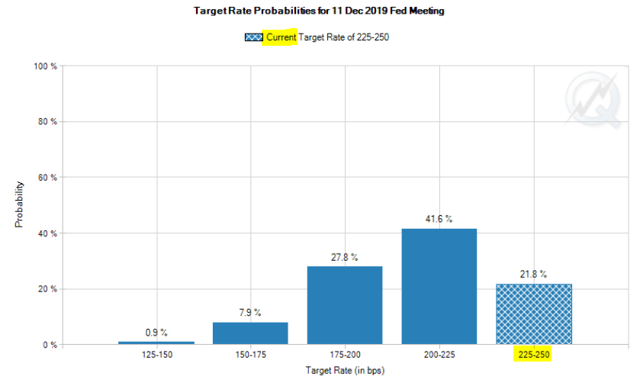

Specifically, when I discussed the outlook back in March, investors were not anticipating any interest rate hikes in 2019, but expected interest rates to end the year at current levels. Now, despite no clear intention from the Fed to cut interest rates, the market is pricing in that possibility. In fact, according to data compiled by CME Group, which tracks the futures market for investor sentiment on interest rates, there is currently a better chance of two interest rate cuts by year-end, compared with rates staying neutral, as illustrated in the chart below:

Source: CME Group

Source: CME Group

My overall takeaway here is this: I do not expect two rate cuts by year-end, and, in fact, I will be very surprised if we even see one. However, this is a remarkable change in sentiment. The current market outlook is extremely dovish, and that is good news for the Utilities sector. While the sector could reverse quickly if this outlook shifts, with all the clouds on the horizon right now – from slowing growth to trade battles – I see this outlook remaining static in the short-term. Therefore, I see this outlook as a tailwind for VPU going forward from here.

Dividend Growth – Strong

Another positive aspect of VPU is the fund’s dividend, which is not surprising because the Utilities sector is known for producing above-average yields. While the yield has come down over the past year as the share price has risen, the fund still yields just under 3%, which remains attractive given our current climate.

Aside from the 3% yield, what really gets me interested in the fund is the dividend growth, which is helping the yield remain attractive, even with share price gains. Specifically, VPU paid its Q1 distribution back in March, which clocked in an impressive year-over-year growth rate. Not only was it high in isolation, but it was markedly higher growth than the previous quarter, as the chart below illustrates:

| Q1 2018 Dividend | Q1 2019 Dividend | YOY Growth |

| $.84/share | $.95/share | 13.1% |

| Q4 2017 Dividend | Q4 2018 Dividend | YOY Growth |

| $.94/share | $1.02/share | 8.5% |

Source: Vanguard (with calculations by Author)

My takeaway here is roundly positive. A 13% growth rate is a great start to the year, by pretty much any standard, but it is especially attractive considering this is an acceleration of Q4 growth. Many investors anticipated dividend growth to slow in 2019, as the impact from corporate tax cuts wore off. VPU appears to be bucking that assumption, for now, and provides another reason income-oriented investors should find this fund attractive.

Housing Starts – Still Growing

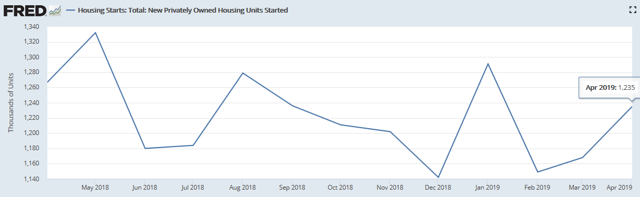

A final positive point on the Utilities sector relates to housing starts. Back in March I mentioned how there had been a sharp increase in starts in January, rebounding off what was a weak end to 2018. I saw this as a tailwind for electricity demand and prices, and listed it as a reason to buy in to the Utilities sector.

Again, looking back, this is another attribute that benefited VPU in the short-term. Fortunately, this trend has continued based on the March and April numbers, which are listed out below:

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

While February saw a sharp decline, March and April both saw upticks, which is signaling a positive trend going in to the summer season. My takeaway here is cautiously positive for the sector overall, as the figures are increasing but still below the highs from last year. However, the fact that we are seeing residential building is positive for the economy overall, and especially the Utilities sector, signaling another positive metric for VPU.

Price To Own – Not Cheap

Now the bad news. While I reiterate that I am generally positive on the sector overall, I do believe investors need to be cautious here. No sector goes up forever, and investors may want to begin thinking of buying in on pullbacks, as opposed to buying without exception. A primary reason for this is the growing expense of owning the sector, highlighted by VPU’s price-to-earnings ratio. With a P/E just under 24, VPU is noticeably more expensive than the broader market. For comparison, the S&P 500 has a current P/E just over 21, which makes VPU about 12% more expensive than buying a diverse fund such as the SPDR S&P 500 ETF Trust (SPY). While this is a fairly simple metric, it highlights the fact that investors have been aware of the positive aspects of the Utilities sector for quite some time, so buying in now is not a value play by any stretch of imagination. Valuation is always something to consider and, in this case, it is telling investors to be cautious.

Trade Hopes Could Derail Defensive Strategy

Another point to consider is that the market is currently favoring defensive positions, largely due to the tensions between the U.S. and China. I will start by saying I remain cautious here as well, as both sides seem unwilling to give much leeway in terms of what they want to see happen. I expect this dispute to extend through 2020, increasing market volatility along the way.

However, it is important to recognize that the market is reacting quite swiftly, in both directions, based on trade sentiment. If progress continues, and if a resolution appears likely, I would expect the move back to riskier assets to be aggressive, and that presents a risk to the Utilities sector. Today’s market action (5/24) is a good example. After a rough week, President Trump gave a speech to reporters late Thursday indicating he expects the U.S.-China trade dispute to end “swiftly”. This sent markets higher in late trading on 5/23 and helped push the DOW Jones Index (DJI) up about 100 points on 5/24 (at time of writing).

My point here is that the market has been getting defensive as volatility increased, to the point where many investors are likely looking for a chance to get back in to more discretionary sectors. With Utilities trading at high multiples, any progress on the trade front could cause a rotation. Depending on an individual investor’s personal outlook on how trade talks will develop from here, this is something to be keenly aware of.

Bottom-line

The Utilities sector was a strong performer in 2018, and I continued to recommend it as 2019 got underway, even though funds like VPU were looking pricey. In hindsight, this was a correct call, as the sector has offered positive returns, even on many days when the broader market has declined. Fortunately, many of the same conditions that encouraged me to recommend VPU back in March remain in place. Specifically, housing starts continue to increase, interest rates are flat, and dividend growth is strong. However, investors do need to be cautious here, as buying this defensive positioning is getting increasingly expensive, and that puts new positions at risk of capital losses. Furthermore, if we see positive developments in terms of economic growth, inflation, or trade resolutions, investors will likely be taking some defensive chips off the table and buying in to riskier assets. With that in mind, I remain optimistic on VPU at the moment, but caution investors to be selective about new entry points at this time.

Disclosure: I am/we are long SPY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News