[ad_1]

ETF Overview

Vanguard Dividend Appreciation Index Fund ETF (VIG) focuses on profitable large cap dividend growth stocks in the United States with a history of raising their dividends. The fund replicates the NASDAQ U.S. Dividend Achievers Select Index. For reader’s information, the index holds U.S. stocks that have grown their dividend for 10 consecutive years. VIG’s holding is a bit different that it excludes REITs and limited partnerships. VIG also applies profitability screen to reduces exposure to weak fundamental stocks. VIG has an expense ratio of only 0.08%. This is one of the lowest among other similar passive funds.

Fund Holdings

VIG’s portfolio currently includes 185 stocks. The fund has a rule that not a single stock would represent over 4% of its portfolio. There will also be quarterly rebalancing to ensure all stocks are below 4% of its total portfolio. The table below shows the top 10 holdings of VIG. These 10 largest holdings represent about 34% of the fund’s total net assets. As can be seen from the table below, these companies are large-cap U.S. stocks with a history of growing their dividend payments. In addition, these are companies that have economic moats. This means that they have a competitive advantage over their peers based on either economies of scale, network effects, or pricing power.

|

Rank |

Holdings |

Economic Moat |

|

1 |

Procter & Gamble Co. (PG) |

Yes |

|

2 |

Visa Inc. (V) |

Yes |

|

3 |

Microsoft Corp. (MSFT) |

Yes |

|

4 |

Johnson & Johnson (JNJ) |

Yes |

|

5 |

Walmart Inc. (WMT) |

Yes |

|

6 |

Comcast Corp. (CMCSA) |

Yes |

|

7 |

McDonald’s Corp. (MCD) |

Yes |

|

8 |

Abbott Laboratories (ABT) |

Yes |

|

9 |

Medtronic plc (MDT) |

Yes |

|

10 |

Union Pacific Corp. (UNP) |

Yes |

Source: Created by author

Growth Analysis

Stringent Stock Selection Criteria based on 10 consecutive years of dividend growth

In order for a stock to be selected and included in the fund’s portfolio, it must have at least 10 consecutive years of dividend growth. If for some reasons a company stops increasing its dividend, it will be excluded in VIG’s portfolio of stocks. It will take at least 10 years before a stock is able to be included in VIG’s portfolio if it misses a dividend increase. The selection criteria is beneficial as companies that are able to increase dividends for 10 plus years are usually companies that are able to consistently grow their top and bottom lines even during an economic recession.

Forward looking approach to screen out stocks with declining profitability

A dividend cut is the worst nightmare for dividend income investors. Fortunately, VIG screens out companies that might not be able to sustain their dividend growth in advance. The fund screens the profitability of the companies in its portfolio to see if things change (e.g. negative cash flow or net income growth). This preventative approach will screen out companies that might be in the verge of cutting their dividends.

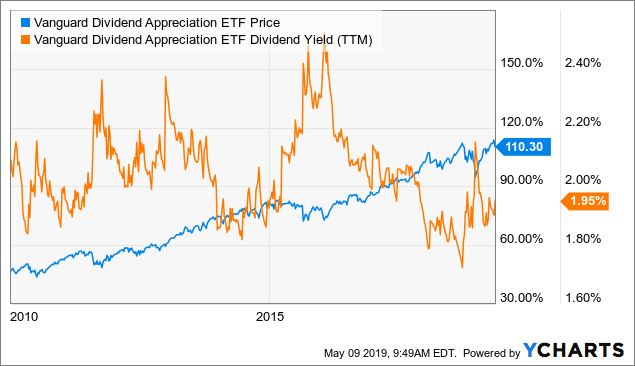

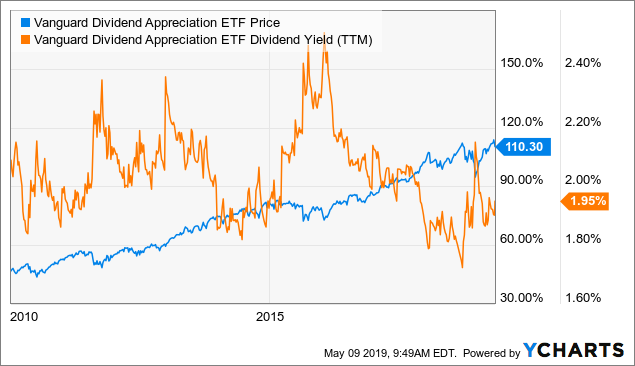

A combination of dividend growth and capital appreciation

Investors should not expect high yield from VIG as the fund is primarily focused on dividend growth stocks. Dividend growth stock typically will have better growth outlook than high dividend yield stocks. As a result, investors can expect both dividend growth and capital appreciation from VIG. The strategy to focus on dividend growth stock also helps to reduce exposure to companies that have weak growth fundamentals. Since stocks with weak growth outlook tend to trade at a lower valuation, the yields of these stocks are typically higher than dividend growth stocks. Therefore, the strategy to focus on dividend growth stocks helps to reduce the exposure to weak fundamental stocks. Investors can click the link to read an in depth discussion on higher dividend stocks vs dividend growth stocks. In terms of dividend yield, VIG’s trailing 12-month dividend yield of 1.95% is towards the low end of its 10 year yield range.

Data by YCharts

Macroeconomic Risks

While nearly 100% of the stocks that VIG holds trade in the United States, investors should also keep in mind that most of these companies have sizable businesses internationally. Therefore, investors should also pay attention to global macroeconomic trends. The uncertainty surrounding the trade tensions between China and the United States may have the potential to derail the global economy. This will definitely affect the share price of the companies in VIG’s portfolio.

Investor Takeaway

For investors that wants a combination of dividend growth and capital appreciation, VIG is a fine choice. VIG’s expense ratio is low. In addition, the fund’s stock selection criteria include both backward-looking and forward-looking conditions. This ensures that companies with strong business fundamentals are selected. Aside from macroeconomic risks that investors need to consider, we think VIG is a good long-term investment choice for investors.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Disclosure: I am/we are long CMCSA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News