[ad_1]

da-kuk

This article first appeared in Trend Investing on June 20, 2022 at A$26.52; however, it has been updated for this article.

As the 2022 U.S equity bear market stabilizes (S&P 500 index is now at 3,961, down 16.88% YTD, PE is now 19.94), we take a look at iShares Core S&P/ASX 200 ETF [ASX:IOZ] (iShares MSCI Australia ETF (NYSEARCA:EWA)) (to be referred to as “IOZ” in this article).

For a background on IOZ you can read our past Trend Investing articles:

- March 2020 – The Australian Index Is On A 33% Discount Sale And A 7.76% Yield Due To The Coronavirus

- March 2022 – Australia Offers A Safe Haven For Investors During The Russia-Ukraine War

Today’s article looks at the Australian economy and outlook, the IOZ ETF, and why IOZ looks to be a 2022 beaten down bargain.

Investors are able to purchase the iShares Core S&P/ASX 200 ETF in two ways:

- iShares MSCI Australia ETF – In USD currency and designed for U.S and non-Australian investors.

- iShares Core S&P/ASX 200 ETF [ASX:IOZ] – In AUD currency and designed for Australian investors.

In this article we will refer to IOZ but the information will also mostly translate exactly across to EWA as they are the same fund, just held in a different currency. The other difference is that IOZ has a lower management fee of 0.09% compared to EWA at 0.5%pa.

Note: When looking at the Yahoo Finance charts below investors should be aware that they do not include the annual dividends of about 4-5%pa.

iShares Core S&P/ASX 200 ETF [ASX:IOZ] one year chart – IOZ price = AUD 27.35

Yahoo Finance![iShares Core S&P/ASX 200 ETF [ASX:IOZ] one year chart](https://static.seekingalpha.com/uploads/2022/7/25/37628986-16587251189474478.png)

iShares Core S&P/ASX 200 ETF [ASX:IOZ] five year chart

Yahoo Finance![iShares Core S&P/ASX 200 ETF [ASX:IOZ] five year chart](https://static.seekingalpha.com/uploads/2022/7/25/37628986-16587251517188952.png)

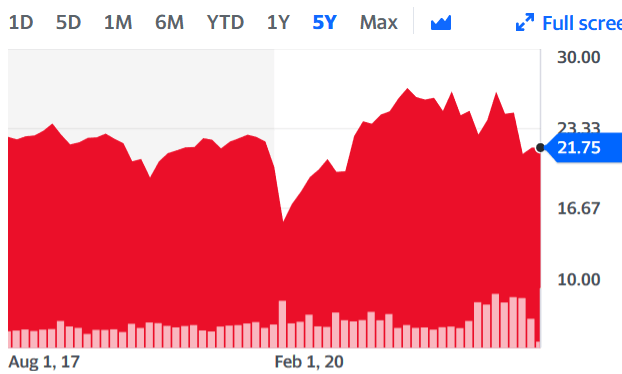

iShares MSCI Australia ETF 5 year price chart – EWA price = USD 21.75

Yahoo Finance

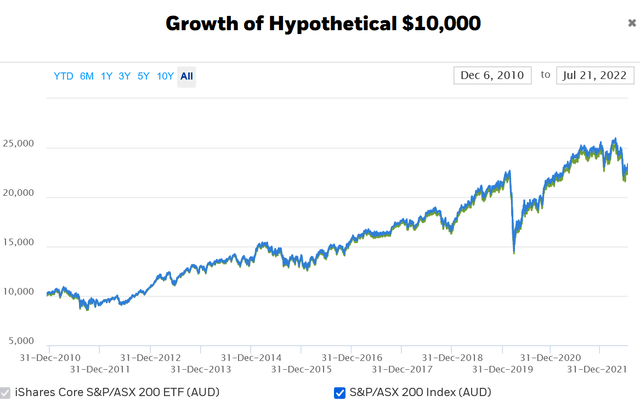

Long term IOZ chart showing the steady growth and recent price fall

iShares IOZ

The AUD is about average against the USD – Currently ~0.69 (0.6912)

CNBC

The Australian economy and outlook

We discussed the Australian economy in detail in our recent article here. To summarize briefly:

- Australia is a global leader in mining and agriculture. Iron ore dominates, but coal, natural gas and other commodities are also significant.

- Export services are also important to Australia and include international student education and tourism.

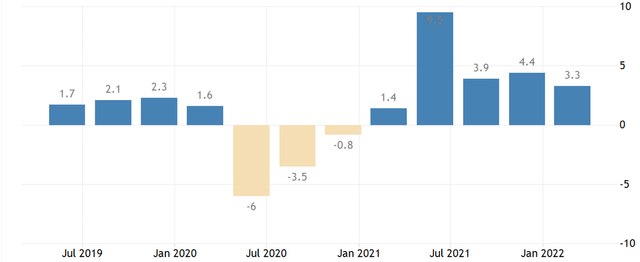

- Australia has a population of ~26.1 million and their GDP is currently 3.3% (Q1 2022 YoY growth), with an IMF 2022 GDP forecast of 4.2%pa.

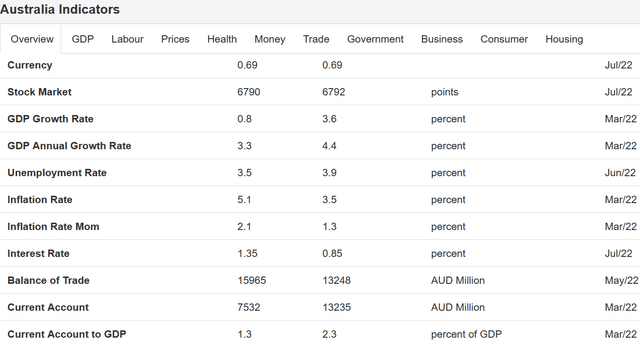

The Australian economy is in good shape with record low unemployment of 3.5% (June 2022). Inflation is running high at 5.1% in Q1, 2022. The RBA cash rate is 1.35% and set to increase again by ~0.5% several times in 2022 towards 3.0-3.6%.

Trading Economics

The outlook for the Australian economy is generally quite good, with some clouds surrounding the property sector as interest rates rise. The average Australian is well ahead on their mortgage payments, so for now only a small percentage (mostly very recent buyers) are heavily impacted by rising rates. Higher cost of living is also a concern for many.

Positives

Current high prices for many commodities is helping Australia. The economy is currently quite strong and recovering well from COVID-19. Unemployment is low and job vacancies are very high.

Negatives

High household debt and property prices. Rising rates will negatively impact the property sector, which has been a huge wealth creator for many decades. Poor relations with China is hurting some exports. The Australian economy will likely slow in 2022 as it adjusts to higher living costs and interest rates.

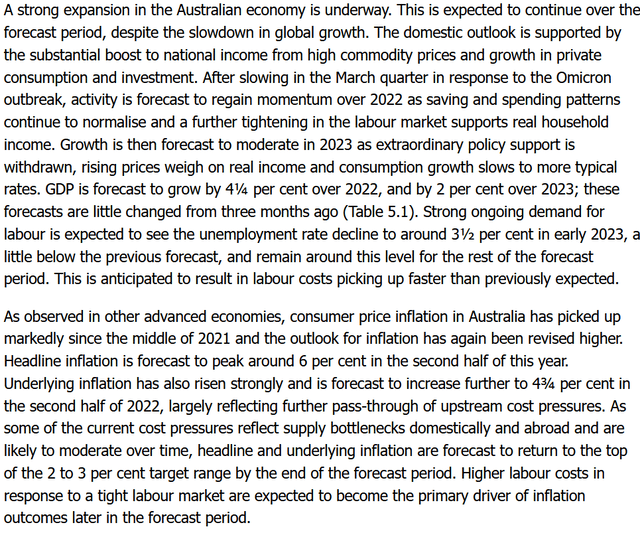

Reserve Bank of Australia Economic Outlook – May 2022

RBA

Trading Economics states:

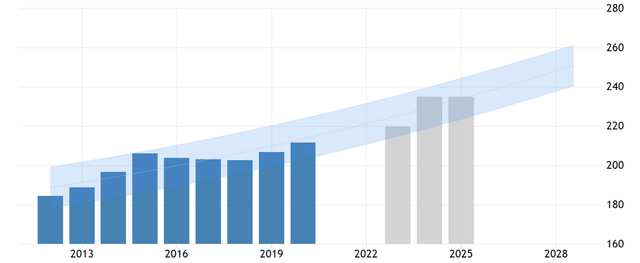

The Australia GDP annual growth rate is projected to trend around 2.8% in 2023 and 3.30% in 2024. The Australia’s economy is dominated by the service sector (65% of total GDP).

Australian GDP growth rate history the past few years shows a strong 2021-22 rebound after the 2020 COVID-19 collapse.

Trading Economics

Overall Australia should continue to benefit from strong levels of net migration, low unemployment and moderate economic growth this decade. The property sector will fall as rates rise but the retirees and savers will benefit from higher rates. Australia’s baby boomers will continue to spend and the tourists and students will continue to come to Australia for its great attractions and lifestyle.

Australia, beautiful one day, perfect the next, offers one of the best lifestyles in the world in terms of modern popular cities, good climate, and friendly people. The relatively high cost of living is the main negative.

The IOZ ETF

The IOZ ETF (or EWA) is a broad way to play the Australian top 200 shares index (ASX200). The IOZ ETF is currently comprised of 202 companies. IOZ management fee is 0.09%pa and EWA is 0.5%pa. The fund is re-balanced quarterly, and pays quarterly distributions.

The ten year total return (capital gain plus distributions) is an average of 9.04%pa.

Blackrock defines their IOZ fund stating:

The fund aims to provide investors with the performance of the S&P/ASX 200 Accumulation Index, before fees and expenses. The index is designed to measure the performance of the 200 largest Australian securities listed on the ASX.

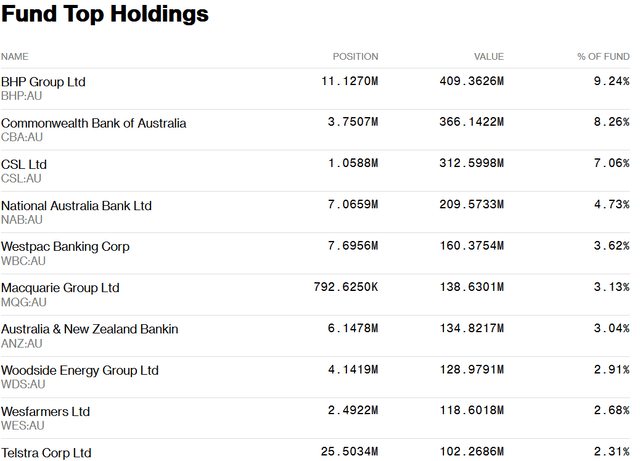

As shown below the IOZ top ten is led by BHP Group [ASX:BHP] (BHP) and the major Australian banks (CBA, NAB, WBC, ANZ). There is also some exposure to healthcare (CSL Ltd) and telecommunications (Telstra).

Top ten holdings of the IOZ ETF

Bloomberg

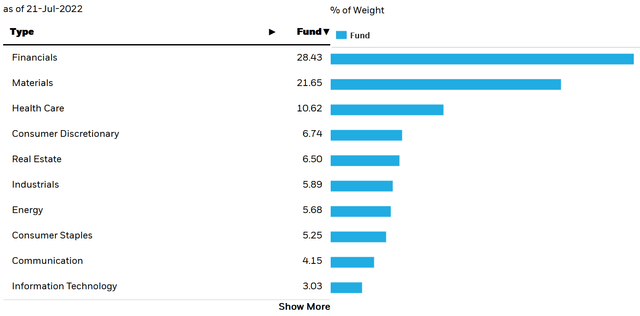

As shown below the IOZ fund is heavily exposed to two key sectors – financials (28.43%) and materials (21.65%).

IOZ Sector weightings (as of July 21, 2022)

iShares IOZ

Valuation

As of June 17, 2022, IOZ’s PE is 15.13 and dividend yield is 5.89%. The IOZ ETF is trading similar to NAV (NAV is A$27.37, fund price is A$27.35).

The IOZ ETF is trading at A$27.35 near its 52 week low of A$26.38 and well off its 52 week high of A$31.45.

Our view is that the valuation is very attractive given the moderately low PE, high yield, and strong outlook for the Australian economy this decade.

Peer comparison

Looking at the table below IOZ (Australia) has a significantly lower PE and much higher yield than USA. Canada looks great value but is quite dependent on oil prices and the yield is lower than Australia.

| Current PE | Dividend yield | |

| iShares Australia ASX200 [ASX:IOZ] | 15.13 | 5.89% |

|

iShares Core S&P 500 ETF [USA] (IVV) |

19.61 | 1.57% |

| iShares MSCI Canada (EWC) | 14.00 | 2.24% |

As shown on the chart below the Australian stock market [blue] did not have the big rise as USA [red] had; consequently it has not fallen as much either. It should be noted the chart below does not include dividends and the Australian market dividends have been higher than USA and Canada.

Comparison of past 5 year stock price gains for IOZ [blue], IVV [red], and EWC [green]

Yahoo Finance![Comparison of past 5 year stock price gains for IOZ [blue], IVV [red], and EWC [green]](https://static.seekingalpha.com/uploads/2022/7/25/37628986-16587338687247884.png)

Why IOZ looks to be a 2022 beaten down bargain

The IOZ ETF is quite low compared to normal due to the global negative market sentiment. The IOZ PE of 15.13 is low and the yield of 5.89% is good. The AUD at ~0.69 is similar to its long term average.

These suggest that the ASX200 [ASX:IOZ] is currently undervalued compared to historical averages. Of course this assumes earnings can hold up in the year ahead, which for now seems reasonable given the Australian economy is still performing well despite some challenges related to higher inflation and rising interest rates.

Looking out this decade Australia continues to offer a moderately strong outlook boosted by a well-diversified economy (somewhat reliant on mining and on China) and a growing population boosted by immigration. The location of Australia tends to also add some safety being away from other countries.

Risks

- Macro-economic risks. As slowing economy is a negative for Australia as a strong commodity exporter. Australia is quite dependent upon iron ore prices. The current iron ore price has dipped down to US$103/t.

- Current poor recent relations with China. China has banned some of Australia’s exports. To date this has not applied to iron ore, as China is currently dependent upon it. This may change in future years; however Australia can also export to other countries. The new Albanese led Government may be able to improve relations with China. China is having a property slowdown which may eventually impact Australia.

- Debt – Australia’s private debt to GDP is very high at 190% (at the end of 2021). This means many Australian consumers are vulnerable to interest rate rises, especially if they rise too fast.

- Currency risk. The stocks and IOZ fund are priced in Australian dollars. The AUD tends to be a risk-on currency and can do poorly compared to the USD during risk-off times. A key risk for investors would be if the AUD falls relative to their currency.

- Fund risks – The IOZ fund is very large and liquid and typically trades very near to NTA value, so fund risks are minimal. It is managed by Blackrock, a global leader.

- Market sentiment. If U.S stocks fall Australia typically follows.

Australia private debt to GDP is forecast to rise and is a risk for the Australian economy.

Trading Economics

Further reading

Conclusion

The iShares Australia ASX200 ETF (either IOZ or EWA) is a 2022 beaten down bargain. It is best suited to investors looking for a stable yield around 5%pa and potentially some modest capital gain each year when averaged over a decade. The ten year total return (capital gain plus distributions) is an average of 9.04%pa.

The Australian equity market outlook is reasonable with both positives and negatives, but should still do well this decade despite some near term pressure from rising interest rates and high household debt levels. Property prices are expected to fall about 15-20% in the next year or two, but this is on the back of huge rises the past few years. The Australian banks are financially sound. The 2022 GDP growth rate should be solid around 4.2%, with a fall in 2023 to about 2.3%, recovering in 2024 to 3.3%.

Valuation looks very attractive on a current PE of 15.13 and a dividend yield of 5.89%.

Risks revolve mostly around the Australian economy or currency doing poorly. The biggest risks relate to high household personal debt levels & high property prices and the impact rising rates will have on the Australian consumer. If mortgage rates were to triple (from the lows) to about 7-8% (RBA rate >5%) and property prices were to fall 30-40%+ then an Australian recession would become much more likely. For now that looks to be too extreme a fall and only a smaller chance of occurring. The other big risk is a slowing China and/or global economy and potentially dramatically falling commodity prices, notably iron ore. Please read the risks section.

We view IOZ or EWA as a buy, suitable for a 5 year+ time frame, especially if you are positive on the Australian economy and currency.

As usual all comments are welcome.

[ad_2]

Source links Google News