Black_Kira/iStock via Getty Images

This article first appeared in Trend Investing on May 13, 2022 when BATT was US$13.24, but has been updated for this article.

2022 Bear Market Bargains Series – Amplify Lithium & Battery Technology ETF (NYSEARCA:BATT)

Amplify Lithium & Battery Technology ETF – Price = USD 14.98

Yahoo Finance

The Amplify Lithium & Battery Technology ETF (to be referred to as “BATT”) is a broad way to play the battery and electric vehicle (“EV”) boom which is expected this decade. The ETF is currently comprised of 90 global companies. The expense ratio is 0.59%pa.

Past performance right now is looking somewhat poor (negative 11.88% one year return), however we are measuring at a time when markets have fallen heavily.

Amplify defines their BATT fund stating:

BATT is a portfolio of companies generating significant revenue from the development, production and use of lithium battery technology, including: 1) battery storage solutions, 2) battery metals & materials, and 3) electric vehicles. BATT seeks investment results that correspond generally to the EQM Lithium & Battery Technology Index.

Note: You can read more on the EQM Lithium & Battery Technology Index (BATTIDX) here. The ETF re-balances quarterly.

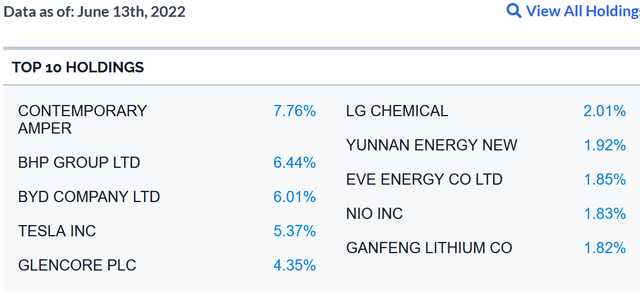

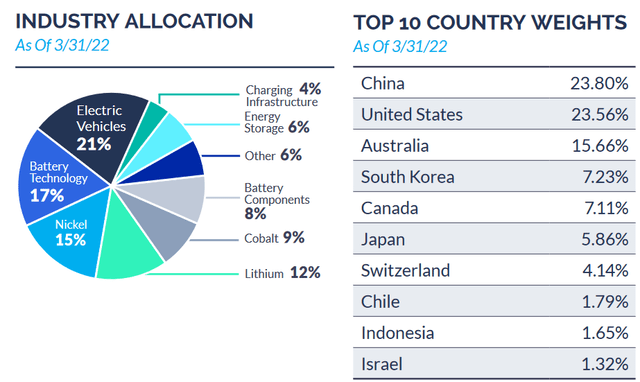

As shown below EV and battery companies have large weightings, but there is also significant exposure to EV metals (nickel, lithium, cobalt) producers. China, USA, and Australia are the top three countries for the companies location (headquarters) as of March 31, 2022.

Top ten holdings of the BATT ETF

Amplify

BATT Sector and country weightings (as of March 31, 2022)

Amplify fact sheet

Valuation

BATT’s current P/E is 21.08. Dividend yield is 2.79%.

As of May 12, 2022 the fund is trading on a 0.96% NTA discount.

Our view is that the valuation is attractive given the growth outlook for the EV related sector is very strong (see section below).

Peer comparison

Looking at the table below BATT has a much lower PE and much higher dividend yield than its peer Global X Lithium & Battery Tech ETF (LIT).

| Current PE | Dividend yield | |

| BATT | 21.08 | 2.79% |

| LIT | 27.8 | 0.25% |

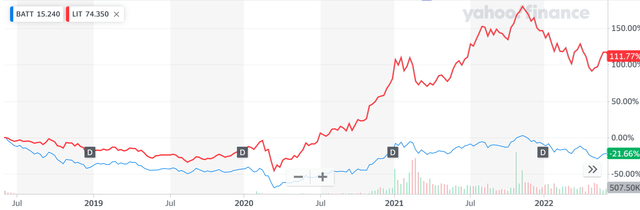

As shown below, LIT does have a better recent performance history, probably due to having greater exposure to lithium miners. The LIT top ten holdings are here.

Price chart comparison of BATT and LIT

Yahoo Finance

Comments on the BATT ETF

The BATT ETF offers a simple and easy way to get broad exposure to the larger and key companies of the EV sector – EVs, batteries, EV battery metal miners, etc. The returns should therefore be less volatile than, say, owning an individual stock and the risk and potential reward will typically both be somewhat lower.

The EV sector companies look set to potentially have a great decade boosted by the tailwind of surging EV sales. If this eventuates, then the BATT ETF should potentially have a strong decade ahead.

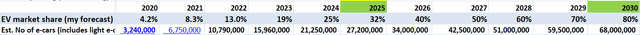

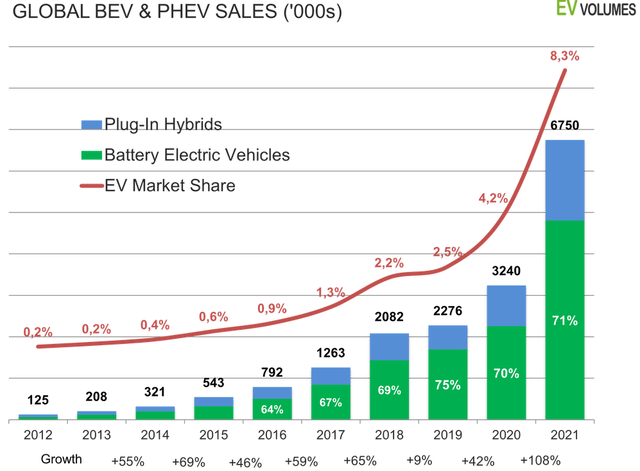

Electric car sales grew 108% in 2021 and in our view are likely to grow by ~50%pa each year this decade. 2021 global electric car sales reached 8.3% market share and ~6.75m sales. Current electric car global market share is only 11% YTD.

Trend Investing forecast is for 2025 sales to reach 32% (27.2m electric cars) and 2030 sales to reach 80% (68m electric cars)

Trend Investing

Global electric car sales reached 8.3% market share and 6.75m sales in 2021, up 108% on 2020

EV Volumes

Tesla Model 3 – Many electric car models are sold out one or more years in advance due to enormous demand and constrained supply

Trend Investing personal pic

Risks

- Global, China, Europe, USA slowdown resulting in less EV sales, therefore less demand for batteries and EV battery metals.

- Battery metals (nickel, lithium, cobalt) prices falling may negatively impact the sector of the fund invested into EV metal mining stocks.

- Excess competition, supply chain risks, technology change.

- ETF risks – Amplify management of the fund. The ETF could trade below its net tangible assets (“NTA”) value.

- Sovereign risk – Generally low for the BATT fund. USA, Australia, South Korea, Canada, Japan is low risk. Moderate risk with China exposure. Also some of the EV metal miners have ‘mines’ in higher risk countries.

- Stock market risks – Market sentiment. Liquidity looks to be ok. There has been past talk of Chinese ADRs being de-listed by 2024. Recent news gives some hope for a solution. Many of the stocks in the BATT fund are the Hong Kong or China listings, so the exposure is only small (NIO, etc.).

Note: Generally the risk of buying into a diversified fund is much lower than buying into a single stock. There is still, however, the risk that the whole sector (EV/battery/EV battery miners) does poorly, or the whole stock market does poorly.

Further reading

Conclusion

The BATT ETF is a 2022 beaten-down bargain. The ETF is trading at US$14.98, not far from its 52 week low of US$12.90 and well of its 52 week high of US$20.78.

Valuation looks attractive on a current PE of 21.08 and dividend yield of 2.79%, especially given the tremendous growth outlook for the EV related sector.

Risks revolve mostly around the sector performing poorly due to poor EV sales and hence less demand for batteries and EV metals. Some China companies exposure adds risk. Please read the risks section.

We view BATT as a buy, suitable for a 5 year plus time frame, especially if you are positive on the outlook for EV growth this decade. Safer to buy in stages in case we see further falls due to the current very poor market sentiment.

As usual, all comments are welcome.